Get the free Final Accounting For Probate Court Sample O65UBY - services cookcountyclerkofcourt

Show details

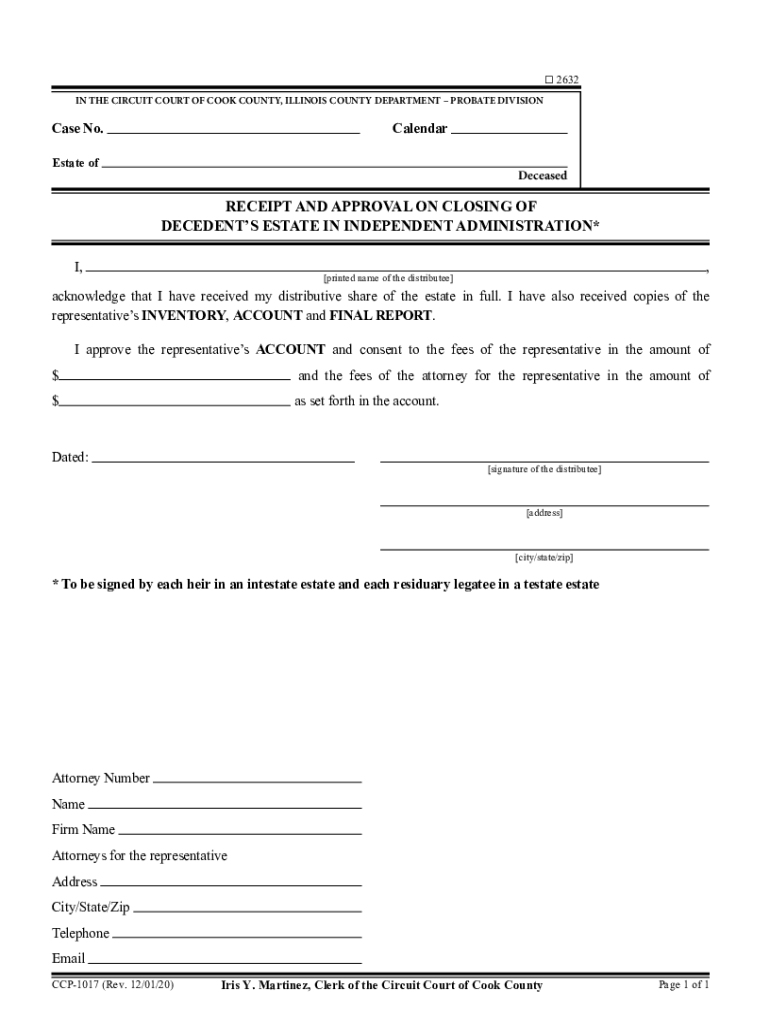

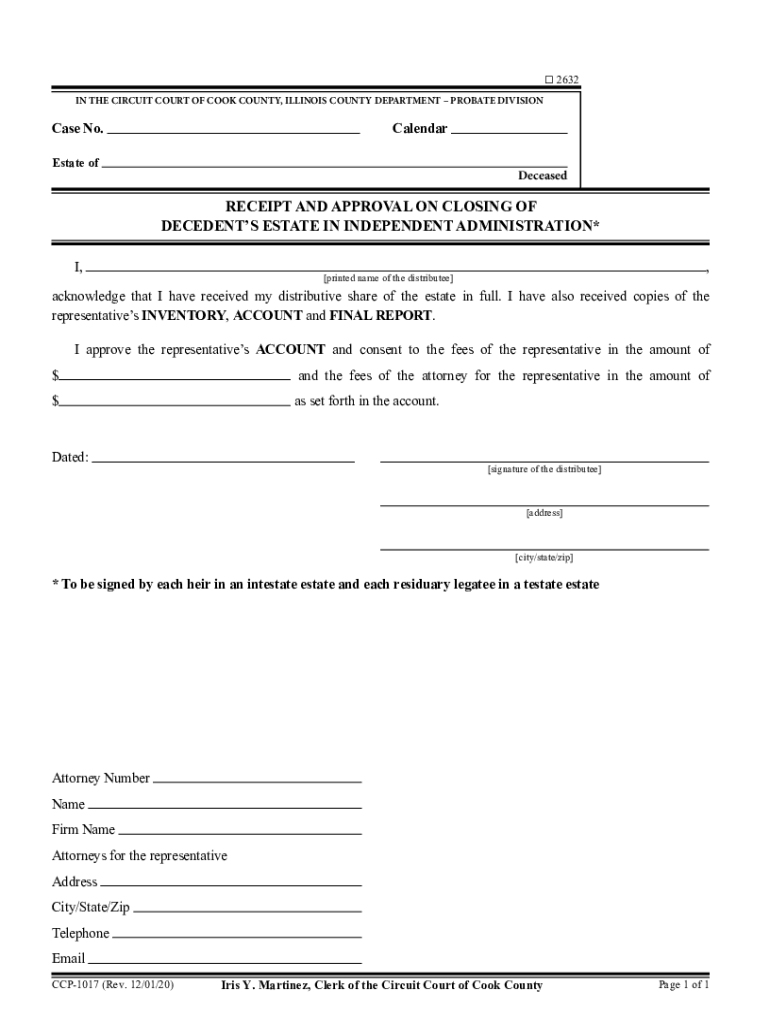

2632 IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENT PROBATE DIVISION Case No. CalendarEstate ofDeceasedRECEIPT AND APPROVAL ON CLOSING OF DECEDENTS ESTATE IN INDEPENDENT ADMINISTRATION×I,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign final accounting for probate

Edit your final accounting for probate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your final accounting for probate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing final accounting for probate online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit final accounting for probate. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out final accounting for probate

How to fill out final accounting for probate

01

To fill out the final accounting for probate, follow these steps:

02

Gather all necessary financial documents, including bank statements, investment statements, and any outstanding debts or liabilities.

03

Make a list of all assets included in the probate estate, such as real estate, vehicles, and personal belongings.

04

Calculate the total value of the probate estate by adding up all assets and subtracting any outstanding debts or liabilities.

05

Prepare an inventory of all assets and their corresponding values.

06

Detail all expenses incurred during the probate process, such as court fees, attorney fees, and any other administrative costs.

07

Subtract the total expenses from the total value of the probate estate to determine the net value.

08

Create a final accounting document that includes the following information:

09

- Opening and closing balances of the estate

10

- A breakdown of all assets and their values

11

- Details of all expenses and their amounts

12

- The net value of the estate

13

- Any distributions made to beneficiaries

14

- The remaining balance of the estate

15

Review and double-check all calculations and information for accuracy.

16

File the final accounting with the probate court and provide copies to all interested parties.

17

Keep detailed records of the final accounting for future reference and potential audits.

18

Note: It is advisable to seek assistance from a qualified attorney or accountant familiar with probate laws and procedures to ensure accuracy and compliance.

19

Always consult the specific laws and regulations of your jurisdiction regarding the requirements for filling out a final accounting for probate.

Who needs final accounting for probate?

01

Anyone who is the personal representative or executor of a probate estate needs to prepare a final accounting. The final accounting serves as a comprehensive report of the assets, debts, expenses, distributions, and net value of the estate. It is required by the probate court to provide transparency and accountability to interested parties, such as beneficiaries and creditors. Additionally, beneficiaries of the estate may also request a copy of the final accounting to ensure proper distribution of assets according to the will or applicable laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my final accounting for probate directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your final accounting for probate as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Where do I find final accounting for probate?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific final accounting for probate and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in final accounting for probate?

The editing procedure is simple with pdfFiller. Open your final accounting for probate in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is final accounting for probate?

Final accounting for probate is a detailed report of all financial transactions related to the estate of a deceased individual.

Who is required to file final accounting for probate?

The executor or personal representative of the estate is required to file the final accounting for probate.

How to fill out final accounting for probate?

Final accounting for probate is typically filled out with the assistance of an attorney or accounting professional who specializes in probate matters.

What is the purpose of final accounting for probate?

The purpose of final accounting for probate is to provide a clear and accurate record of all financial transactions related to the estate in order to ensure that assets are distributed correctly to beneficiaries.

What information must be reported on final accounting for probate?

Final accounting for probate must include details of all income, expenses, distributions, and any other financial transactions related to the estate.

Fill out your final accounting for probate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Final Accounting For Probate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.