Get the free HTSG: A professional tax and accounting firm in ...

Show details

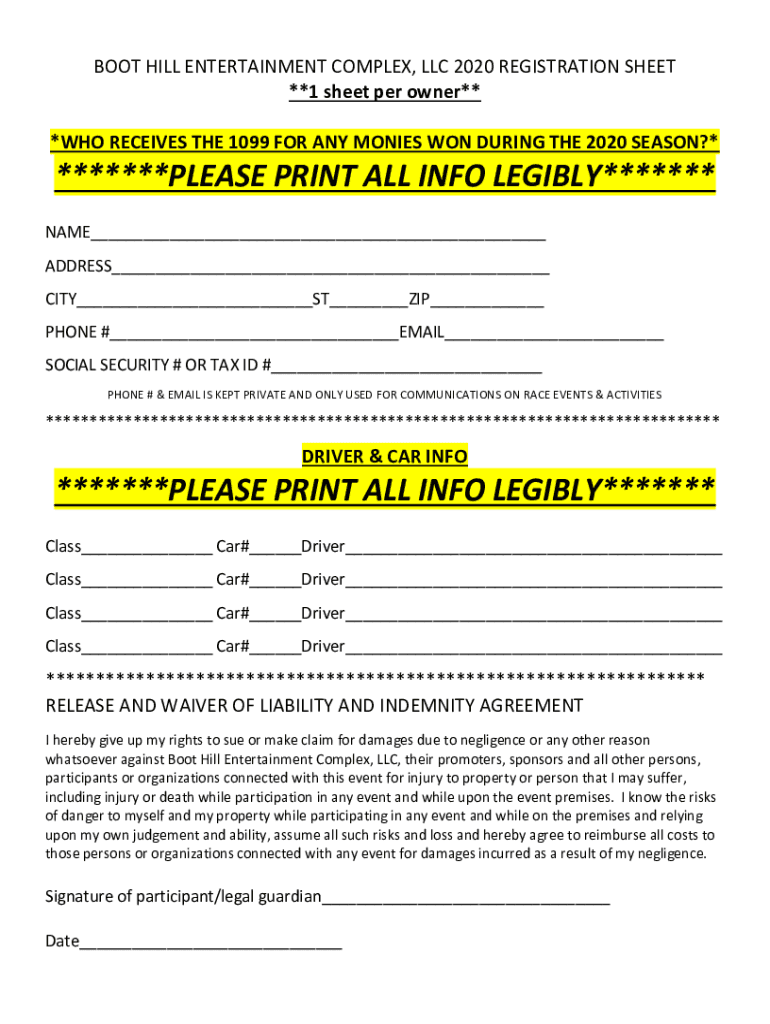

BOOT HILL ENTERTAINMENT COMPLEX, LLC 2020 REGISTRATION SHEET **1 sheet per owner** *WHO RECEIVES THE 1099 FOR ANY MONIES WON DURING THE 2020 SEASON?********PLEASE PRINT ALL INFO LEGIBLY******* NAME

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign htsg a professional tax

Edit your htsg a professional tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your htsg a professional tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing htsg a professional tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit htsg a professional tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out htsg a professional tax

How to fill out htsg a professional tax

01

To fill out a professional tax form (HTSG), follow these steps:

02

Start by gathering all the necessary information and documents required for filling out the form, such as your employment details, income sources, and any deductions or exemptions you may be eligible for.

03

Enter your personal information accurately, including your full name, social security number, and contact details.

04

Provide details about your employment, including the name and address of your employer, your job title, and your employment duration.

05

Report your total income from professional sources, such as salaries, wages, or business profits. Make sure to include any additional income you may have earned from freelance work or consulting.

06

Deduct any eligible expenses you incurred while performing your professional duties, such as work-related travel expenses, professional development courses, or necessary equipment or supplies.

07

Calculate the tax due on your professional income based on the applicable tax rate and any deductions or exemptions you are entitled to.

08

Complete any additional sections or schedules required by the tax authority to provide further details or clarify specific aspects of your professional tax return.

09

Review your completed form for accuracy and make any necessary corrections or adjustments before submitting.

10

Sign and date the form to certify its authenticity and completeness.

11

Submit the filled-out form along with any supporting documents to the relevant tax authority by the specified deadline.

12

Keep a copy of the filled-out form and supporting documents for your records.

Who needs htsg a professional tax?

01

HTSG (Professional Tax) is required by individuals who earn income through professional services, including but not limited to:

02

- Self-employed individuals

03

- Freelancers

04

- Independent contractors

05

- Consultants

06

- Doctors

07

- Lawyers

08

- Accountants

09

- Architects

10

- Engineers

11

This tax is specific to those individuals who provide professional expertise or services as their main source of income.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete htsg a professional tax online?

pdfFiller has made it easy to fill out and sign htsg a professional tax. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in htsg a professional tax?

The editing procedure is simple with pdfFiller. Open your htsg a professional tax in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I fill out htsg a professional tax on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your htsg a professional tax. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is htsg a professional tax?

HTSG a professional tax is a tax levied on individuals engaged in professions, trades, or occupations. It is typically imposed by local government authorities and is used to generate revenue for the community.

Who is required to file htsg a professional tax?

Individuals engaged in professional activities, such as doctors, lawyers, and engineers, are generally required to file HTSG a professional tax. The specific requirements may vary based on local regulations.

How to fill out htsg a professional tax?

To fill out HTSG a professional tax, individuals must obtain the appropriate tax form from their local tax authority, provide personal and professional details, report income, and calculate the tax owed according to the set rates.

What is the purpose of htsg a professional tax?

The purpose of HTSG a professional tax is to generate funds for local government services and infrastructure, and to ensure that individuals benefitting from local amenities contribute to public finances.

What information must be reported on htsg a professional tax?

Individuals must report their name, address, profession, income from the profession, and any deductions applicable when filing HTSG a professional tax.

Fill out your htsg a professional tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Htsg A Professional Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.