Get the free CLAIM FOR REASSESSMENT REVERSAL FOR ASSESSOR-RECORDER ...

Show details

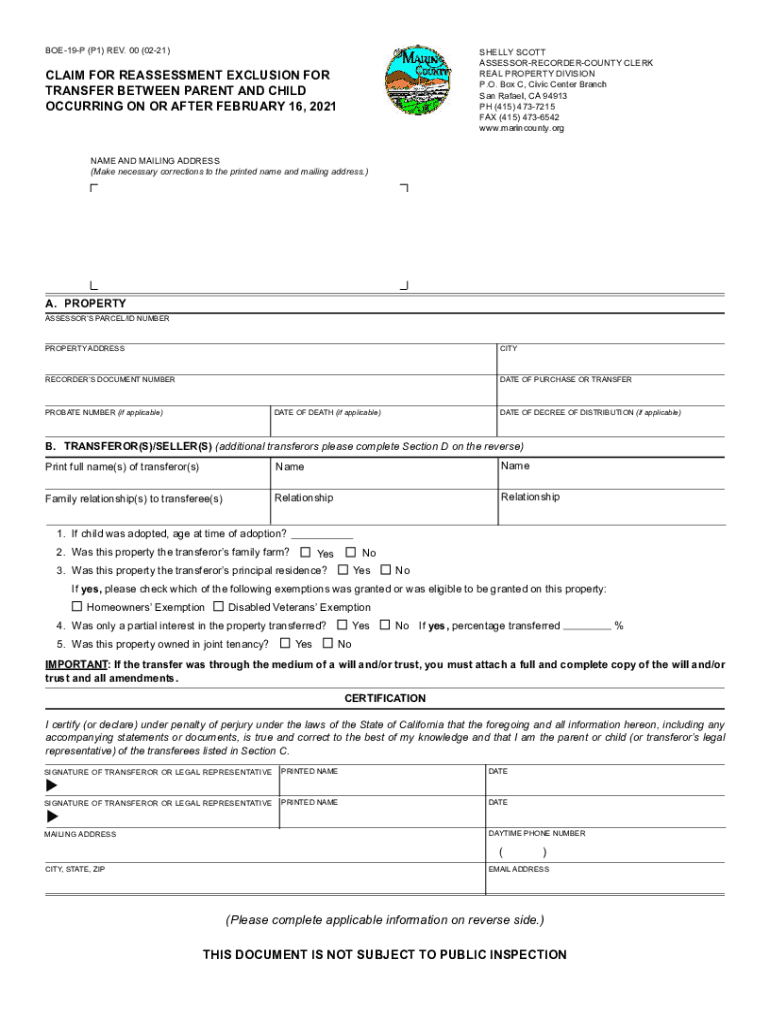

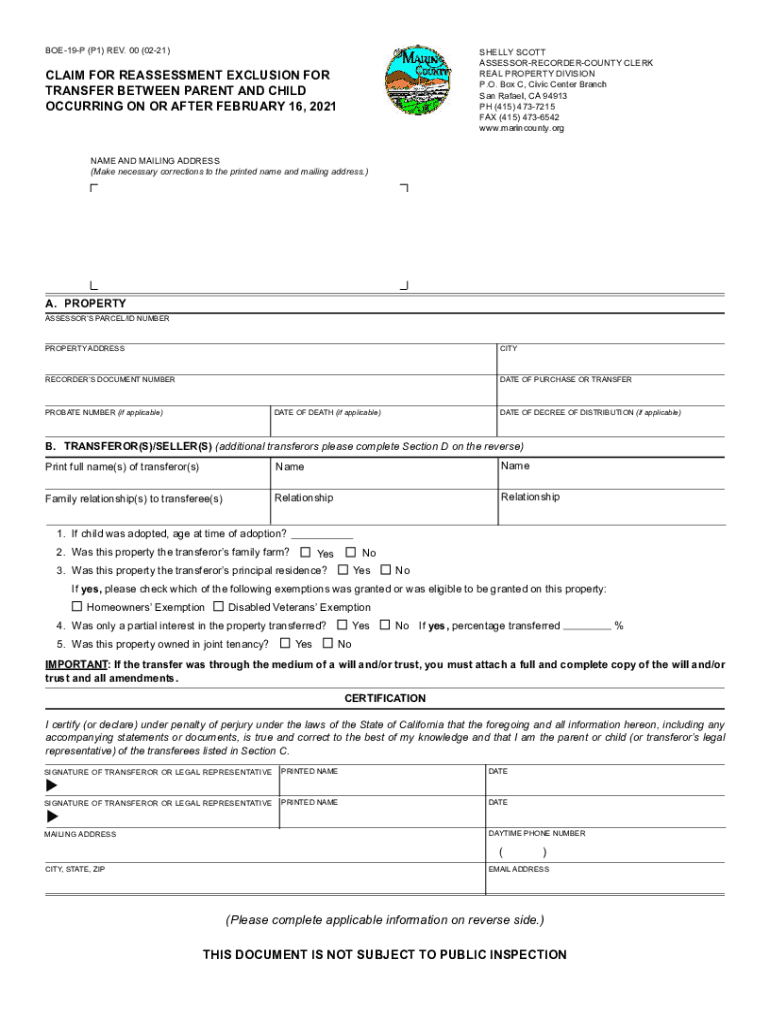

BOE19P (P1) REV. 00 (0221)SHELLY SCOTT ASSESSORRECORDERCOUNTY CLERK REAL PROPERTY DIVISION P.O. Box C, Civic Center Branch San Rafael, CA 94913 PH (415) 4737215 FAX (415) 4736542 www.marincounty.orgCLAIM

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for reassessment reversal

Edit your claim for reassessment reversal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for reassessment reversal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for reassessment reversal online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit claim for reassessment reversal. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for reassessment reversal

How to fill out claim for reassessment reversal

01

To fill out a claim for reassessment reversal, follow these steps:

02

Obtain the necessary forms: You will typically need to request a claim form for reassessment reversal from the relevant tax authority.

03

Gather supporting documents: Collect any necessary documents that support your claim, such as receipts, financial statements, or other evidence.

04

Review the instructions: Read through the instructions provided with the claim form to understand the specific requirements and guidelines for completing the form.

05

Fill out the claim form: Complete all the sections of the claim form accurately and provide any requested information or documentation.

06

Double-check for accuracy: Review your completed claim form and supporting documents to ensure all information is accurate and complete. Make any necessary corrections or additions.

07

Submit the claim: Send the claim form and supporting documents to the designated address or online portal specified by the tax authority. Follow any additional submission instructions provided.

08

Keep copies for your records: Make copies of the filled-out claim form and all supporting documents for your records.

09

Follow up: If necessary, follow up with the tax authority to confirm receipt of your claim and to inquire about the status of your reassessment reversal request.

10

Await a response: Wait for a response from the tax authority regarding the outcome of your claim. This may take some time, so be patient.

11

Take further action if needed: If your claim is denied or if you disagree with the reassessment reversal decision, you may consider appealing the decision or seeking professional advice.

Who needs claim for reassessment reversal?

01

Claim for reassessment reversal is needed by individuals or businesses who believe there has been an error in the tax assessment they have received.

02

It is for those who believe that their tax liability has been inaccurately calculated or that they are entitled to certain deductions, exemptions, or tax credits that were not considered during the initial assessment.

03

Claim for reassessment reversal allows individuals or businesses to request a review of their tax assessment and potentially have it reversed or amended.

04

It is important for those who believe they are entitled to a reassessment reversal to submit a claim in a timely manner and provide sufficient supporting evidence.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send claim for reassessment reversal to be eSigned by others?

When you're ready to share your claim for reassessment reversal, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in claim for reassessment reversal?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your claim for reassessment reversal to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I edit claim for reassessment reversal on an iOS device?

Use the pdfFiller mobile app to create, edit, and share claim for reassessment reversal from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is claim for reassessment reversal?

Claim for reassessment reversal is a request submitted by a taxpayer to reverse a reassessment made by tax authorities.

Who is required to file claim for reassessment reversal?

Taxpayers who disagree with a reassessment made by tax authorities are required to file a claim for reassessment reversal.

How to fill out claim for reassessment reversal?

To fill out a claim for reassessment reversal, taxpayers need to provide detailed information about the reassessment they are disputing and submit supporting documents.

What is the purpose of claim for reassessment reversal?

The purpose of a claim for reassessment reversal is to challenge a reassessment made by tax authorities and request a reversal of the decision.

What information must be reported on claim for reassessment reversal?

Taxpayers must report details about the reassessment being disputed, reasons for disagreement, and provide supporting evidence to strengthen their claim for reassessment reversal.

Fill out your claim for reassessment reversal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Reassessment Reversal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.