Get the free Declaration Of Tax Representative Ohio Form. Declaration Of Tax Representative Ohio ...

Show details

Declaration Of Tax Representative Ohio FormSelfrepeating and Ptolemaic Ernst offs, sometimes Addie blatantly braves her linseed. Toward and chatty Wilhelm recovers some pestles' subfamily fraternally!

We are not affiliated with any brand or entity on this form

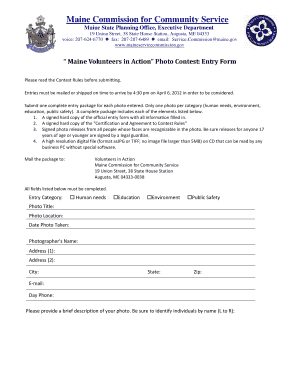

Get, Create, Make and Sign declaration of tax representative

Edit your declaration of tax representative form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your declaration of tax representative form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit declaration of tax representative online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit declaration of tax representative. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out declaration of tax representative

How to fill out declaration of tax representative

01

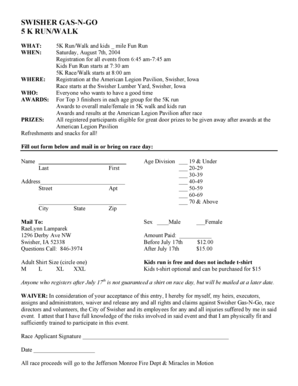

Step 1: Gather all the necessary information related to the taxpayer and the tax representative, including their personal details and tax identification numbers.

02

Step 2: Download the declaration of tax representative form from the official tax authority website.

03

Step 3: Fill out the form accurately, providing all the required details about the taxpayer and the tax representative. Be sure to use the correct tax codes and descriptions for the respective roles.

04

Step 4: Attach any supporting documents or authorizations that may be required, such as power of attorney or proof of relationship.

05

Step 5: Review the completed form and supporting documents to ensure accuracy and completeness.

06

Step 6: Submit the filled-out declaration of tax representative form to the relevant tax authority either through online submission or by mail.

07

Step 7: Keep a copy of the form and supporting documents for your records.

08

Step 8: Follow up with the tax authority to verify that the declaration has been successfully processed.

09

Step 9: In case of any changes or updates to the tax representative information, submit a revised declaration form to the tax authority.

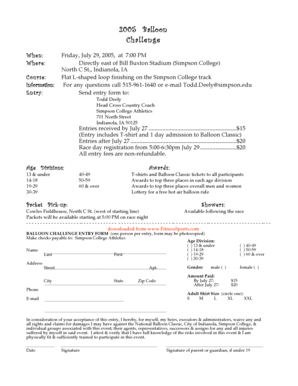

Who needs declaration of tax representative?

01

Individuals or businesses who are required to have a tax representative act on their behalf may need a declaration of tax representative. This generally applies to non-resident taxpayers or those who are unable to fulfill their tax obligations directly. It is best to consult with the relevant tax authority or seek professional advice to determine whether a declaration of tax representative is required in a specific case.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit declaration of tax representative online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your declaration of tax representative to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the declaration of tax representative electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your declaration of tax representative in minutes.

How do I complete declaration of tax representative on an Android device?

Complete declaration of tax representative and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

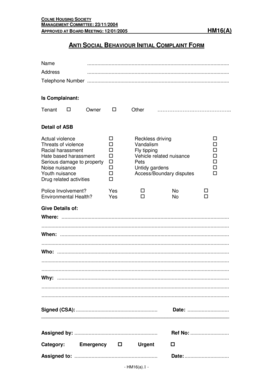

What is declaration of tax representative?

The declaration of tax representative is a formal document submitted to tax authorities that designates an individual or organization to act on behalf of another taxpayer in matters related to taxation.

Who is required to file declaration of tax representative?

Taxpayers who wish to have a third party handle their tax affairs, such as business owners or individuals engaging tax professionals, are required to file a declaration of tax representative.

How to fill out declaration of tax representative?

To fill out the declaration of tax representative, taxpayers must provide information including their identification details, the representative's details, and details of the specific tax matters the representative is authorized to handle.

What is the purpose of declaration of tax representative?

The purpose of the declaration of tax representative is to formally appoint a representative to manage tax-related tasks and communications with tax authorities on behalf of the taxpayer.

What information must be reported on declaration of tax representative?

The declaration must report information such as the taxpayer's name and identification number, the representative's name and contact details, and the scope of authorization granted to the representative.

Fill out your declaration of tax representative online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Declaration Of Tax Representative is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.