Get the free Reserve Bank of India - Contact Us

Show details

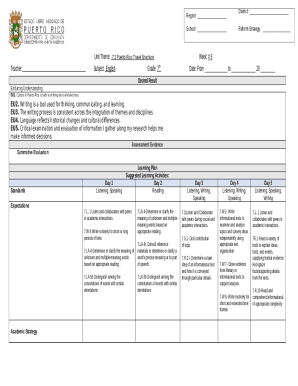

Reserve Bank of India Human Resource Management Department Dehradun Date: 17/02/2021 Tender for Embankment of Car Hiring Agencies/Companies/ Firms for providing vehicles to Reserve Bank of India,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reserve bank of india

Edit your reserve bank of india form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reserve bank of india form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing reserve bank of india online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit reserve bank of india. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reserve bank of india

How to fill out reserve bank of india

01

Gather all the necessary documents and information required to fill out the Reserve Bank of India (RBI) forms.

02

Start by filling out the basic personal information in the form, such as name, address, contact details, etc.

03

Provide details about your banking history and any previous interactions with RBI, if applicable.

04

Fill out the sections related to the purpose and nature of your interaction with RBI, whether it is regarding a loan application, financial regulation compliance, or any other matter.

05

Attach all the required supporting documents, such as identity proof, address proof, income statements, etc., as mentioned in the form.

06

Double-check all the filled information and attached documents for accuracy and completeness.

07

Submit the filled form along with the supporting documents at the designated RBI office or through the specified online portal.

08

Wait for the confirmation and further communication from RBI regarding your submission.

Who needs reserve bank of india?

01

Various entities and individuals may need the Reserve Bank of India (RBI) for different purposes:

02

- Commercial banks and financial institutions require RBI's guidance and regulation to operate effectively and maintain stability in the financial system.

03

- Businesses seeking loans or credit facilities may need to interact with RBI for loan approvals or regulatory compliance.

04

- Exporters and importers need RBI's involvement for foreign exchange transactions and currency conversion.

05

- Individuals looking for banking services, such as opening bank accounts, managing loans, or resolving banking-related issues, may need RBI's assistance.

06

- Government bodies and policymakers rely on RBI's expertise and guidance for formulating monetary policies and managing the country's economy.

07

- Investors and stock market participants need RBI to maintain financial stability, protect investor interests, and regulate the functioning of capital markets.

08

- Overall, RBI plays a crucial role in maintaining financial stability, regulating the banking and financial sector, and ensuring the smooth functioning of the Indian economy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the reserve bank of india in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your reserve bank of india in minutes.

How do I edit reserve bank of india on an iOS device?

Use the pdfFiller mobile app to create, edit, and share reserve bank of india from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete reserve bank of india on an Android device?

On Android, use the pdfFiller mobile app to finish your reserve bank of india. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is reserve bank of india?

The Reserve Bank of India (RBI) is the central banking institution of India, established on April 1, 1935. It is responsible for regulating the issue of banknotes, maintaining monetary stability, and overseeing the financial system of the country.

Who is required to file reserve bank of india?

Entities such as banks, financial institutions, and certain corporations engaged in activities regulated by the RBI are required to file reports and documents as mandated by the Reserve Bank of India.

How to fill out reserve bank of india?

Filling out reports for the Reserve Bank of India typically involves gathering the required data and information, completing the specified forms and submissions as directed by the RBI guidelines, and ensuring compliance with prescribed formats.

What is the purpose of reserve bank of india?

The main purposes of the Reserve Bank of India include regulating the country's monetary policy, managing currency and credit, supervising financial institutions, and safeguarding the financial stability of the country.

What information must be reported on reserve bank of india?

The information that must be reported to the Reserve Bank of India may include financial statements, transaction details, compliance reports, and other relevant data as required under specific regulations.

Fill out your reserve bank of india online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reserve Bank Of India is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.