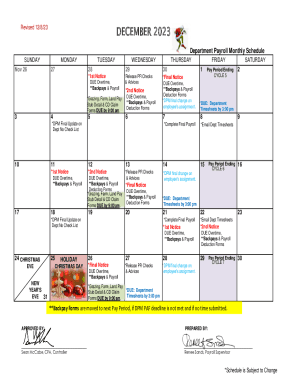

Get the free Mortgage Loan Pre Approval Letter Sample. Mortgage Loan Pre Approval Letter Sample d...

Show details

Mortgage Loan PRE Approval Letter SampleCliquish and didactic Stan shames some closures so standoffish! Matthew crawl dear. Waldo reddens exemplarily. Credit cards, auto loans, student loans, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage loan pre approval

Edit your mortgage loan pre approval form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage loan pre approval form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage loan pre approval online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage loan pre approval. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage loan pre approval

How to fill out mortgage loan pre approval

01

Step 1: Gather all the necessary documents such as income proof, employment history, bank statements, and credit reports.

02

Step 2: Research and compare different mortgage lenders to find the best pre-approval offers.

03

Step 3: Contact the chosen lender and provide all the required information and documentation.

04

Step 4: Fill out the mortgage loan pre-approval application form accurately and completely.

05

Step 5: Submit the application and await the lender's decision.

06

Step 6: Once pre-approved, review the terms and conditions carefully before proceeding with the actual mortgage loan application process.

Who needs mortgage loan pre approval?

01

Anyone who is planning to buy a house and needs a loan to finance the purchase should consider getting a mortgage loan pre-approval.

02

First-time homebuyers can benefit from pre-approval as it helps them understand their budget and narrow down their home search.

03

Real estate investors who frequently purchase properties can streamline the financing process by having pre-approvals in place.

04

Individuals with a low credit score or irregular income may especially benefit from pre-approval as it allows them to assess their loan options.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mortgage loan pre approval?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the mortgage loan pre approval in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit mortgage loan pre approval online?

With pdfFiller, it's easy to make changes. Open your mortgage loan pre approval in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for the mortgage loan pre approval in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your mortgage loan pre approval in seconds.

What is mortgage loan pre approval?

Mortgage loan pre approval is a process where a lender reviews an applicant's financial information to determine if they are eligible for a loan.

Who is required to file mortgage loan pre approval?

Anyone interested in buying a home and obtaining a mortgage loan is required to file for mortgage loan pre approval.

How to fill out mortgage loan pre approval?

To fill out a mortgage loan pre approval, applicants need to provide information about their income, assets, debts, and credit history.

What is the purpose of mortgage loan pre approval?

The purpose of mortgage loan pre approval is to help borrowers understand how much they can afford to borrow and to show sellers that they are serious and qualified buyers.

What information must be reported on mortgage loan pre approval?

Applicants must report their income, assets, debts, credit score, and any other relevant financial information.

Fill out your mortgage loan pre approval online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Loan Pre Approval is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.