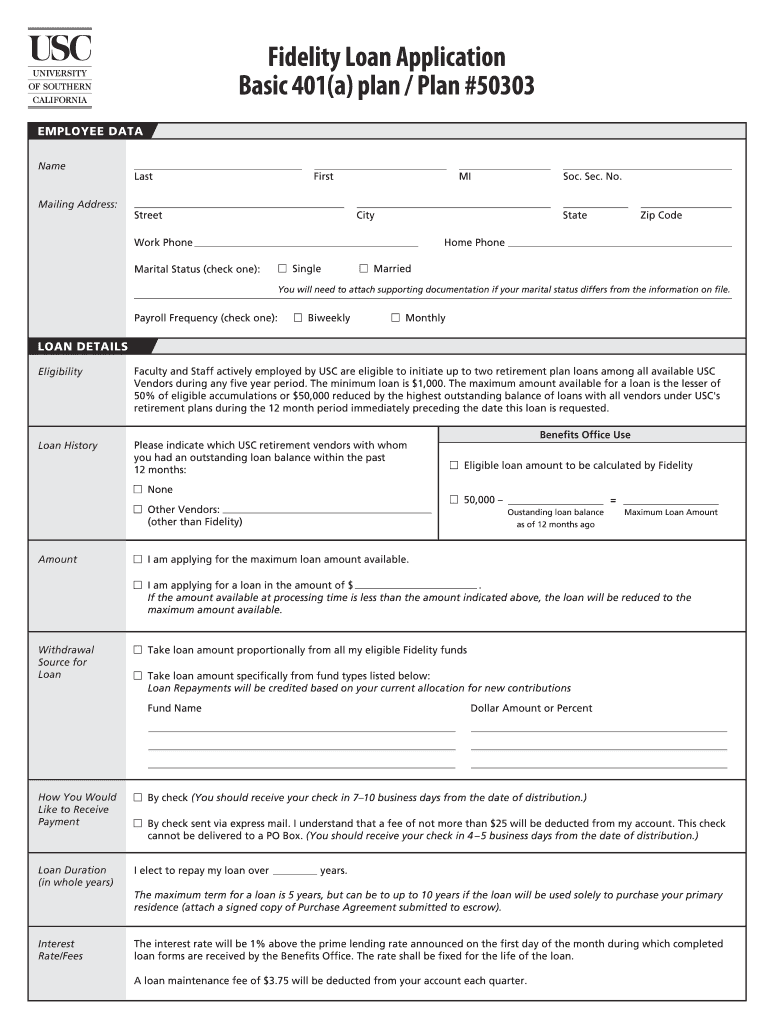

USC Fidelity Loan Application Basic 401a free printable template

Get, Create, Make and Sign usc fidelity loan

How to edit usc fidelity loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out usc fidelity loan

How to fill out USC Fidelity Loan Application Basic 401(a) plan

Who needs USC Fidelity Loan Application Basic 401(a) plan?

Instructions and Help about usc fidelity loan

Many students visit our Lobby every day, but the truth of the matter is there's an easier way the staff here at USC have worked very hard to save you time by making the federal application process available online let me show you how you see this if you have not done so already please do so as soon as possible if you have applied for financial aid and your award letter includes the Federal Direct stack of thumb please follow these easy steps the first step is to submit the online Federal Direct Stafford loan request form by logging into you my financial aid documents account the form is located in the document library tab be sure to indicate the amount you wish to borrow once the financial aid office has processed your loan and notified the Department of Education you'll receive an email confirmation please allow at least five business days to receive that confirmation the second step is to sign your master promissory note also known as your MPN to sign your MPN visit studentloansgov you will need your personal identification number also known as your PIN which was used to complete your FAFSA if you have forgotten your PIN you can retrieve it at studentloansgov you will be able to sign your MPN after the financial aid office has processed your loan a reminder email will be sent by the Department of Education if you are a first-time undergraduate or graduate borrower here at USC you must complete online entrance counseling at studentloansgov first-time borrowers at USC are also asked to attend an in-person entrance counseling session these sessions will be held during Welcome Week please visit our financial aid website at the beginning of August to view the schedule now you know the secret to save time apply for all your Federal Direct Stafford loans online for more information please this is the long section of our website find on you

People Also Ask about

Can you borrow from your 401 A?

How long does it take to get 401k loan from Fidelity?

Can I borrow from my 401k right now?

How long till I can borrow from my 401k?

Can I borrow against my Fidelity retirement account?

Can you borrow money from a 401k?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the usc fidelity loan in Gmail?

How do I fill out the usc fidelity loan form on my smartphone?

How can I fill out usc fidelity loan on an iOS device?

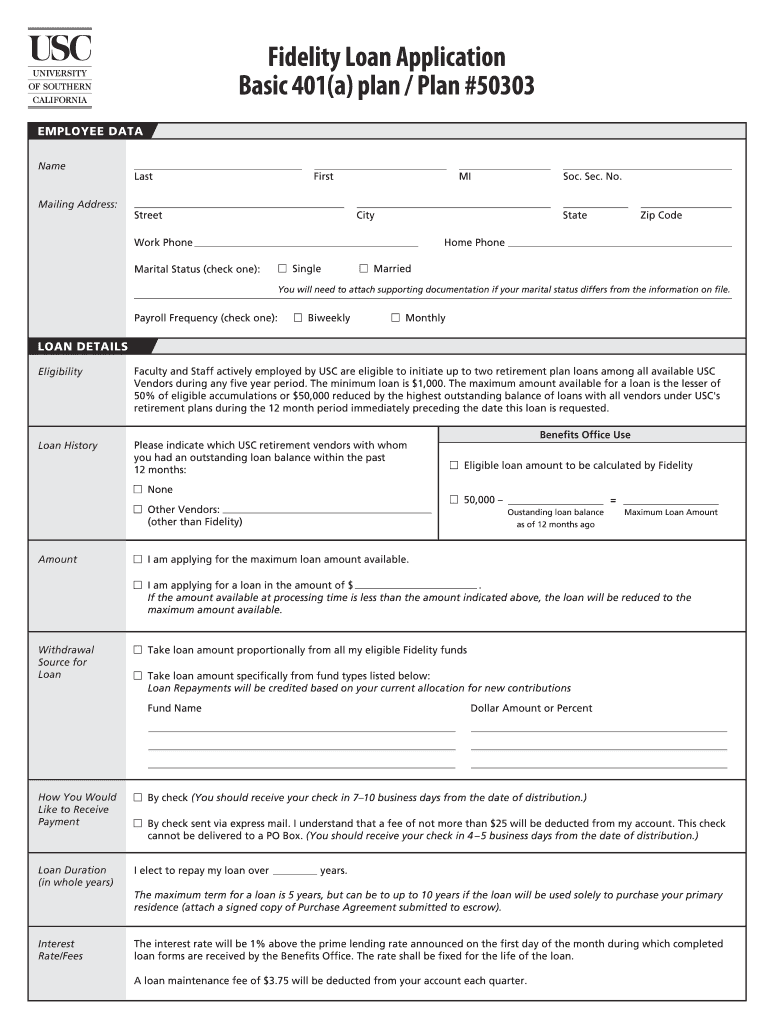

What is USC Fidelity Loan Application Basic 401(a) plan?

Who is required to file USC Fidelity Loan Application Basic 401(a) plan?

How to fill out USC Fidelity Loan Application Basic 401(a) plan?

What is the purpose of USC Fidelity Loan Application Basic 401(a) plan?

What information must be reported on USC Fidelity Loan Application Basic 401(a) plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.