Get the free BUSINESS LOAN APPLICATION - St. Mary's Bank

Show details

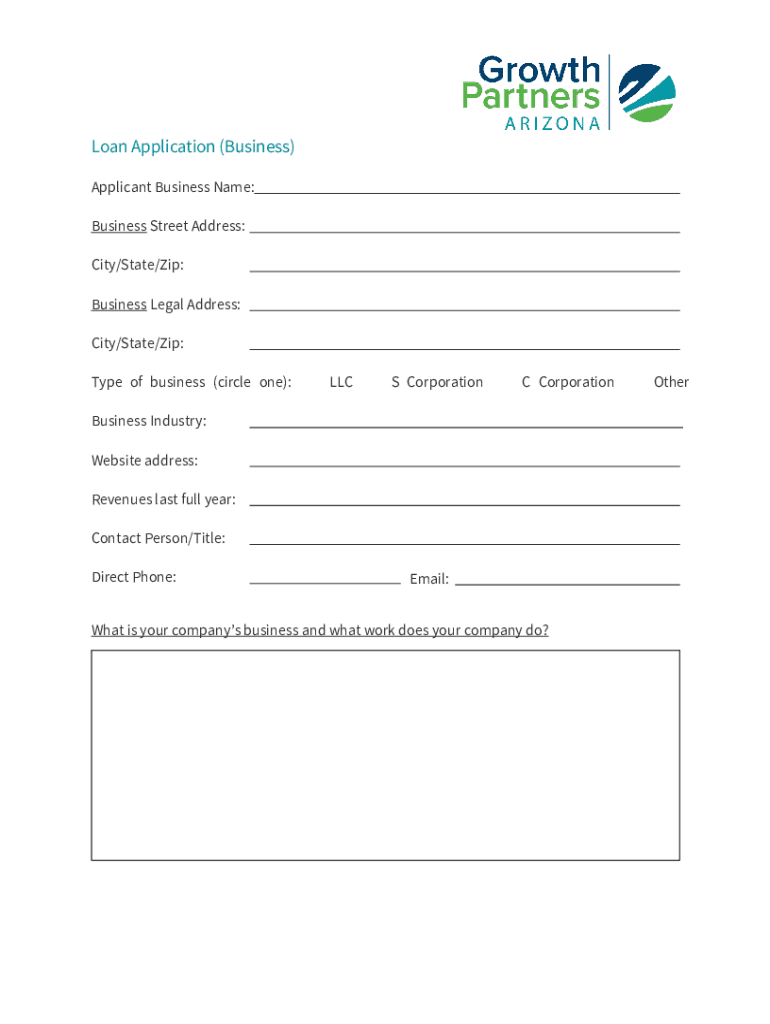

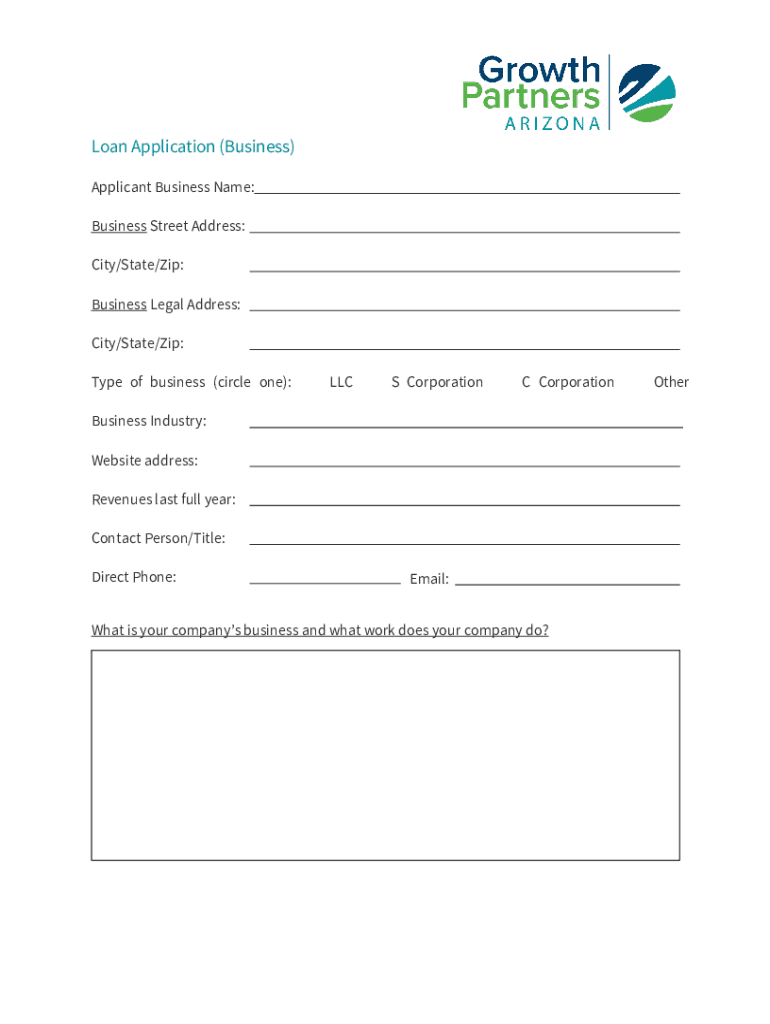

Loan Application (Business) Applicant Business Name: Business Street Address: City/State/Zip: Business Legal Address: City/State/Zip: Type of business (circle one):LCS Corporation CorporationBusiness

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business loan application

Edit your business loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business loan application online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business loan application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business loan application

How to fill out business loan application

01

Gather all the necessary documents and information such as financial statements, tax returns, business plan, and personal identification.

02

Research and choose a suitable lender or financial institution that offers business loans.

03

Review the loan application form and understand all the requirements and questions.

04

Fill out the application form accurately and completely, providing all the requested information.

05

Attach all the required documents and supporting materials along with the application form.

06

Double-check all the information and documents to ensure accuracy and completeness.

07

Submit the filled-out application form and supporting documents to the lender or financial institution through the designated method, such as online submission or in-person delivery.

08

Follow up with the lender or financial institution to ensure that the application is being processed and to address any additional information or documentation requests.

09

Wait for the lender's decision on the business loan application, which may include approval, rejection, or request for further information.

10

If approved, carefully review the loan terms and conditions, including interest rates, repayment terms, and any associated fees.

11

Sign and agree to the loan agreement if satisfied with the terms and conditions.

12

Utilize the business loan funds for the intended purpose and make timely repayments according to the agreed-upon schedule.

Who needs business loan application?

01

Anyone who operates or intends to start a business and requires financial assistance can benefit from a business loan application.

02

Entrepreneurs or small business owners who need funding for startup costs, equipment purchases, expansion plans, or working capital may need a business loan application.

03

Established businesses seeking to invest in new projects, undertake strategic initiatives, or manage cash flow fluctuations may also require a business loan application.

04

Individuals looking to acquire an existing business or franchise may need to complete a business loan application to obtain the necessary financing.

05

Ultimately, anyone who wishes to borrow money for business-related purposes can benefit from going through the process of filling out a business loan application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business loan application in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your business loan application and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get business loan application?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific business loan application and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit business loan application on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign business loan application right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is business loan application?

A business loan application is a formal request for financial assistance from a lending institution to support the growth or operation of a business.

Who is required to file business loan application?

Any individual or organization seeking financial assistance for their business is required to file a business loan application.

How to fill out business loan application?

To fill out a business loan application, you will need to provide detailed information about your business, financial statements, business plan, and personal financial information.

What is the purpose of business loan application?

The purpose of a business loan application is to provide the lender with necessary information to assess the creditworthiness of the business and make a decision on whether to approve the loan.

What information must be reported on business loan application?

Information such as business financial statements, tax returns, business plan, personal financial statements, and any other relevant documentation required by the lender must be reported on a business loan application.

Fill out your business loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.