Get the free PayTrainAPA - American Payroll Association

Show details

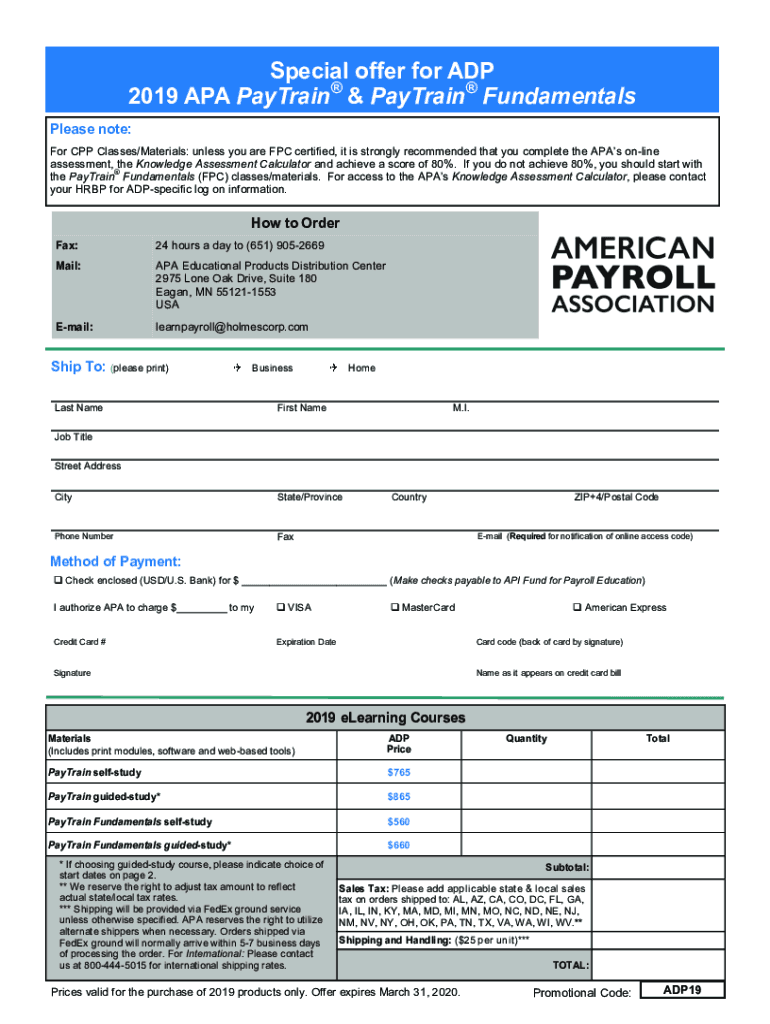

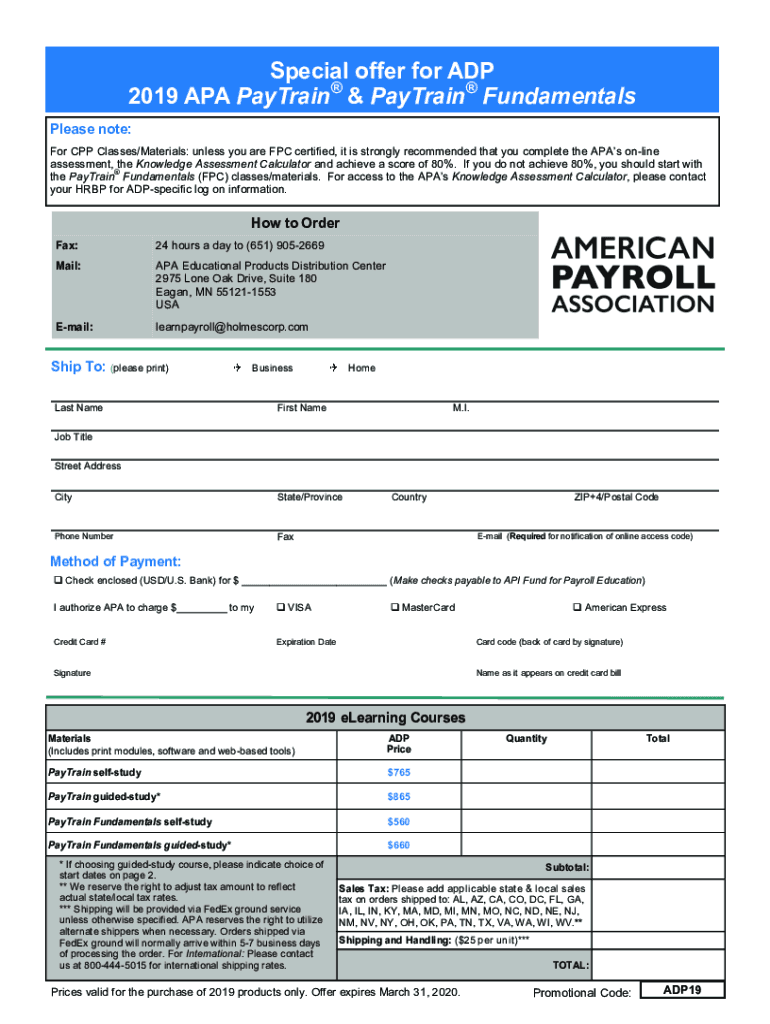

Special offer for ADP 2019 APA Pastries & Pastries Fundamentals Please note: For CPP Classes/Materials: unless you are FPC certified, it is strongly recommended that you complete the APA online assessment,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign paytrainapa - american payroll

Edit your paytrainapa - american payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paytrainapa - american payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing paytrainapa - american payroll online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit paytrainapa - american payroll. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out paytrainapa - american payroll

How to fill out paytrainapa - american payroll

01

To fill out paytrainapa - american payroll, follow these steps:

02

Gather all the necessary employee information, such as employee name, Social Security Number, address, and tax withholding information.

03

Calculate each employee's gross wages for the pay period.

04

Subtract any pre-tax deductions, such as retirement contributions or health insurance premiums, from the gross wages to get the taxable wages.

05

Calculate the applicable federal, state, and local taxes based on the taxable wages and the employee's withholding allowances.

06

Subtract the total taxes from the taxable wages to get the net pay for each employee.

07

Record the net pay and any additional deductions for each employee in the payroll software or on the payroll register.

08

Generate and distribute pay stubs to employees, detailing their gross wages, deductions, taxes, and net pay.

09

Finally, submit the payroll information, including taxes withheld, to the appropriate tax authorities and make any necessary payments.

Who needs paytrainapa - american payroll?

01

Paytrainapa - american payroll is needed by companies or organizations that have employees and need to process their payroll accurately and efficiently.

02

It is especially useful for businesses that have a large number of employees or complex pay structures, as it automates many of the calculations and eliminates manual errors.

03

Paytrainapa - american payroll ensures that employees are paid correctly and on time, while also helping businesses comply with tax regulations and reporting requirements.

04

In summary, any business, big or small, that wants an efficient and accurate payroll processing system can benefit from using paytrainapa - american payroll.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit paytrainapa - american payroll from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including paytrainapa - american payroll. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send paytrainapa - american payroll for eSignature?

Once your paytrainapa - american payroll is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete paytrainapa - american payroll online?

With pdfFiller, you may easily complete and sign paytrainapa - american payroll online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is paytrainapa - american payroll?

Paytrain APA - American Payroll is a comprehensive training program and certification offered by the American Payroll Association, aimed at providing payroll professionals with the necessary skills and knowledge to effectively manage payroll processes and compliance.

Who is required to file paytrainapa - american payroll?

Payroll professionals and employers who are responsible for managing payroll processes and ensuring compliance with federal, state, and local payroll regulations are required to file for Paytrain APA certification.

How to fill out paytrainapa - american payroll?

To fill out the Paytrain APA application, candidates must complete the necessary forms provided by the American Payroll Association, include supporting documentation such as proof of experience, and submit the application along with the required fees.

What is the purpose of paytrainapa - american payroll?

The purpose of Paytrain APA - American Payroll is to enhance the knowledge and skills of payroll practitioners, ensuring they are equipped to handle payroll functions efficiently, comply with regulations, and contribute to the overall success of their organizations.

What information must be reported on paytrainapa - american payroll?

Information that must be reported includes the applicant's educational background, work experience in payroll, relevant certifications, and any additional professional training related to payroll management.

Fill out your paytrainapa - american payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Paytrainapa - American Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.