Get the free RELEVANT LIFE PLAN TRUST DEED - legalandgeneral.com

Show details

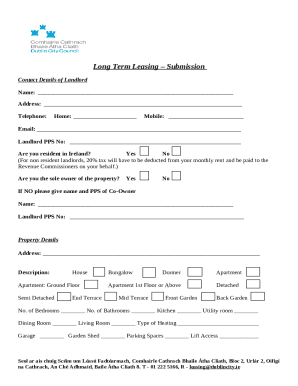

RELEVANT LIFE POLICY NOMINATION FORM Important notes The form is only suitable for use with Royal London Relevant Life Plans that have been placed in a Royal London, Scottish Provident or Bright Grey

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign relevant life plan trust

Edit your relevant life plan trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your relevant life plan trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing relevant life plan trust online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit relevant life plan trust. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out relevant life plan trust

How to fill out relevant life plan trust

01

To fill out a relevant life plan trust, follow these steps:

02

Start by gathering all the necessary information such as personal details of the trust settlor (individual who is creating the trust), beneficiaries, and trustees.

03

Determine the specific assets or property that will be held in the trust.

04

Carefully read and understand the terms and conditions of the relevant life plan trust document.

05

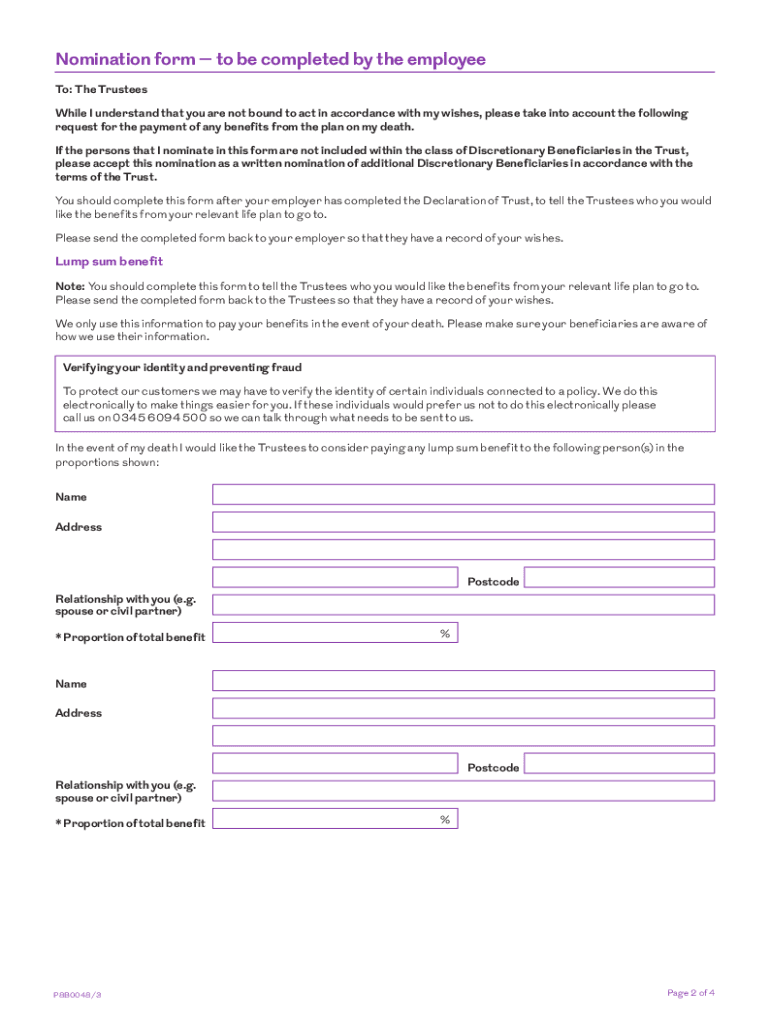

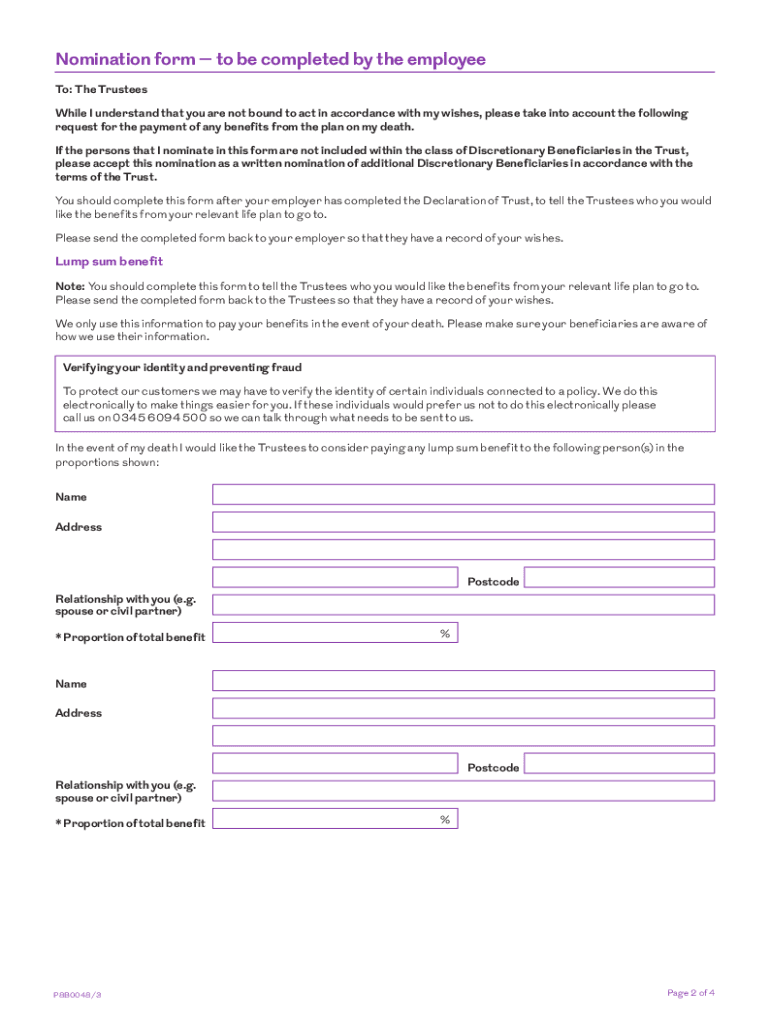

Fill in the provided fields with the required information. This may include the names and contact details of the beneficiaries, trustees, and any additional information required by the trust document.

06

Clearly define the powers and responsibilities of the trustees.

07

Specify any conditions or restrictions on the distribution of assets from the trust.

08

Review the completed relevant life plan trust document thoroughly to ensure accuracy and completeness.

09

Obtain legal advice if needed to ensure compliance with relevant laws and regulations.

10

Execute the relevant life plan trust document by signing it along with all other parties involved, such as trustees and witnesses.

11

Keep a copy of the executed relevant life plan trust document in a safe and accessible location.

Who needs relevant life plan trust?

01

The relevant life plan trust is typically beneficial for individuals who wish to provide financial protection and benefits to their loved ones in the event of their death, particularly for high-earning individuals or business owners. It can be suitable for:

02

- A company director who wants to provide a death-in-service benefit to their family or dependents

03

- Self-employed individuals who want to ensure financial security for their loved ones in case of death

04

- Individuals with substantial assets or estates who want to protect and control their assets for the benefit of their chosen beneficiaries

05

- Business owners who want to provide financial security for their employees' families through a death-in-service benefit

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete relevant life plan trust online?

pdfFiller makes it easy to finish and sign relevant life plan trust online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I edit relevant life plan trust on an iOS device?

Use the pdfFiller mobile app to create, edit, and share relevant life plan trust from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete relevant life plan trust on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your relevant life plan trust, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is relevant life plan trust?

A relevant life plan trust is a type of life insurance policy set up by an employer for the benefit of an employee, which provides a tax-efficient way of providing a life insurance benefit to the employee's beneficiaries.

Who is required to file relevant life plan trust?

Employers who set up a relevant life plan trust for their employees are required to file the necessary documentation with HM Revenue and Customs (HMRC) to ensure compliance with tax regulations.

How to fill out relevant life plan trust?

Filling out a relevant life plan trust typically involves completing the trust declaration form provided by the insurance company, detailing the trustees, beneficiaries, and coverage amount, while ensuring it is signed by all parties involved.

What is the purpose of relevant life plan trust?

The purpose of a relevant life plan trust is to provide financial security for the families and dependents of employees by ensuring a payout in the event of the employee's death, while offering tax advantages for both the employer and employee.

What information must be reported on relevant life plan trust?

Information that must be reported includes details of the policyholder, beneficiaries, the insured person, the amount of cover, and any changes to the trust or beneficiaries over time.

Fill out your relevant life plan trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Relevant Life Plan Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.