Get the free Business Banking Trade and Lending Solution Application form.cdr

Show details

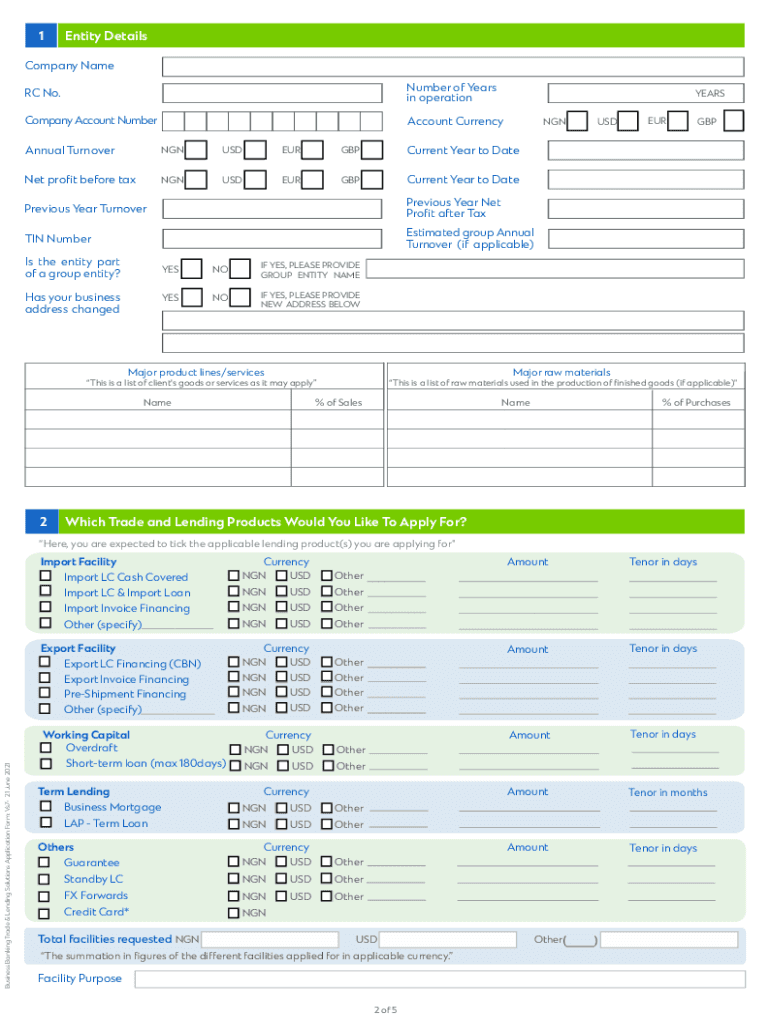

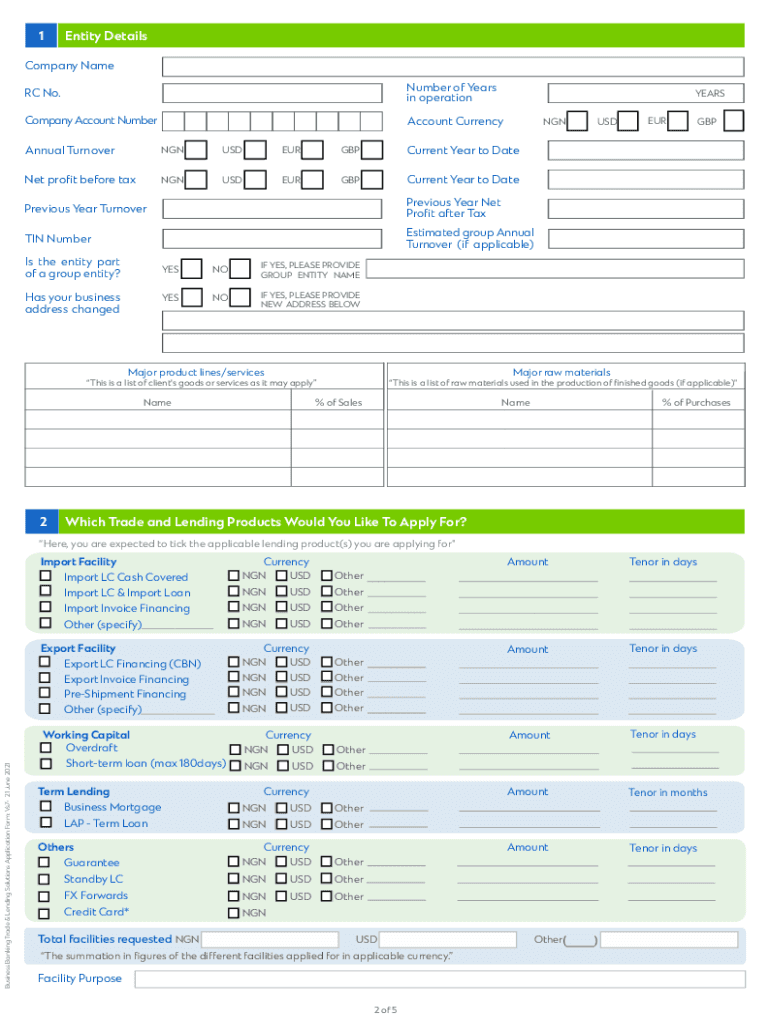

Business Banking Trade & Lending Solutions Applicant on Form: Vs7 21 June 2021BUSINESS BANKING TRADE AND LENDING SOLUTIONS APPLICATION FORMsc.com/nghere for good1Entity DetailsCompany Name RC No.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business banking trade and

Edit your business banking trade and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business banking trade and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business banking trade and online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business banking trade and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business banking trade and

How to fill out business banking trade and

01

To fill out a business banking trade, follow these steps:

02

Gather all necessary information: You will need to provide details about your business, such as its name, address, and contact information.

03

Determine the type of business account: Decide whether you need a checking account, savings account, or both.

04

Research available options: Look into different banks and financial institutions that offer business banking trade services, and compare their features and fees.

05

Visit the bank: Schedule an appointment or visit the bank's website to start the application process.

06

Complete the application form: Fill out the required fields accurately, providing all necessary details about your business and preferences.

07

Submit supporting documents: Depending on the bank's requirements, you may need to provide documents such as proof of identification, business licenses, and financial statements.

08

Review and agree to terms and conditions: Carefully read the terms and conditions of the bank's business banking trade services and ensure you understand them before proceeding.

09

Fund your account: Deposit the initial amount required by the bank to activate your business banking trade account.

10

Set up online banking: If available, take advantage of the bank's online banking platform to manage your business finances conveniently.

11

Familiarize yourself with the trade features: Learn how to make deposits, withdraw funds, transfer money, and utilize any trade-related services provided by the bank.

12

Maintain accurate records: Keep track of all business banking trade transactions and statements to effectively manage your finances and for tax purposes.

Who needs business banking trade and?

01

Business banking trade is useful for various individuals and entities, including:

02

- Small businesses: Business banking trade helps small businesses manage financial transactions, access trade-related services, and build creditworthiness.

03

- Medium and large corporations: These organizations often require robust trade solutions to handle large volumes of transactions and manage multiple accounts.

04

- Entrepreneurs and startups: Establishing a business banking trade account from the start can help with organizing finances and separating personal and business funds.

05

- International businesses: Companies engaged in international trade can benefit from specialized trade services, such as foreign exchange and trade financing.

06

- Professionals and freelancers: Individuals operating as independent professionals or freelancers can utilize business banking trade to manage their finances, invoice clients, and receive payments.

07

- Non-profit organizations: Non-profit organizations need financial management tools and trade services to effectively handle donations, grants, and expenses.

08

- Associations and clubs: Trade accounts can assist associations and clubs in managing membership fees, event revenues, and other financial activities.

09

- Sole proprietors: Business banking trade accounts can provide sole proprietors with a convenient way to handle their business transactions separate from personal finances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the business banking trade and electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your business banking trade and in seconds.

How do I fill out the business banking trade and form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign business banking trade and. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How can I fill out business banking trade and on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your business banking trade and by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is business banking trade and?

Business banking trade refers to the banking services and products that cater specifically to the needs of businesses, including loans, credit, and cash management.

Who is required to file business banking trade and?

Businesses engaged in trade or commerce are generally required to file business banking trade and, especially those involved in international trade.

How to fill out business banking trade and?

To fill out business banking trade and, gather all necessary information about your business transactions, ensure proper reporting of financial data, and follow the specific guidelines provided by the relevant banking authority.

What is the purpose of business banking trade and?

The purpose of business banking trade and is to monitor and regulate trade transactions, prevent money laundering, and ensure compliance with financial laws.

What information must be reported on business banking trade and?

Information such as transaction details, business identification, financial data, and compliance documents must be reported on business banking trade and.

Fill out your business banking trade and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Banking Trade And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.