Get the free Finance Topics - Accounting Services - Purdue University

Show details

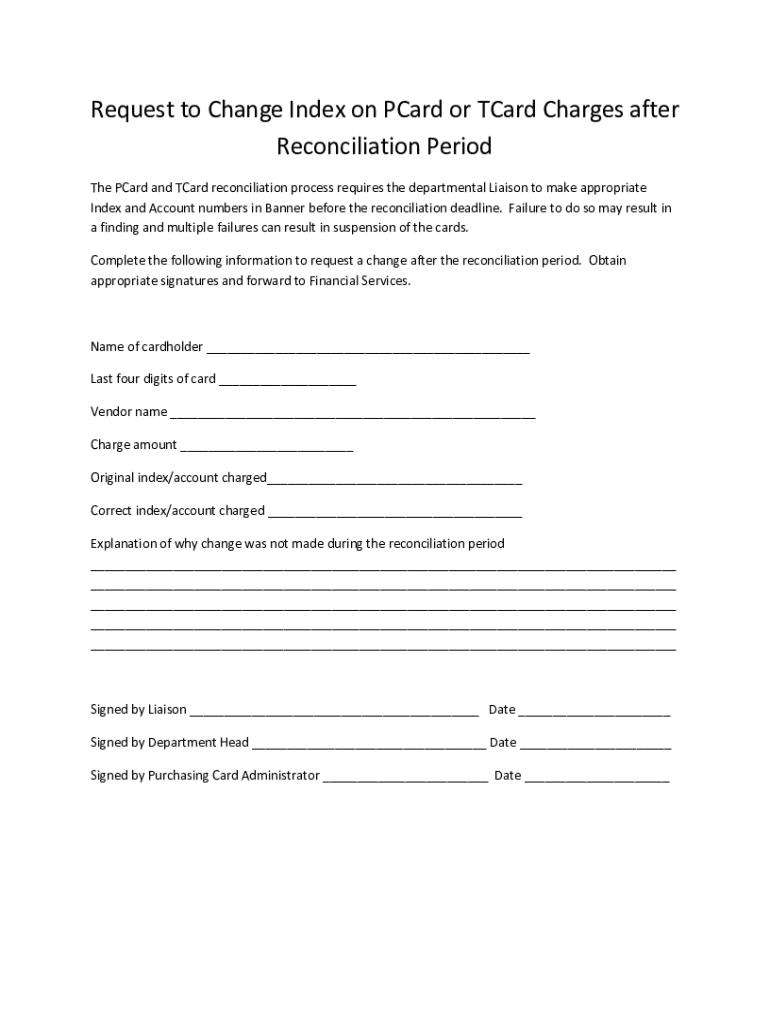

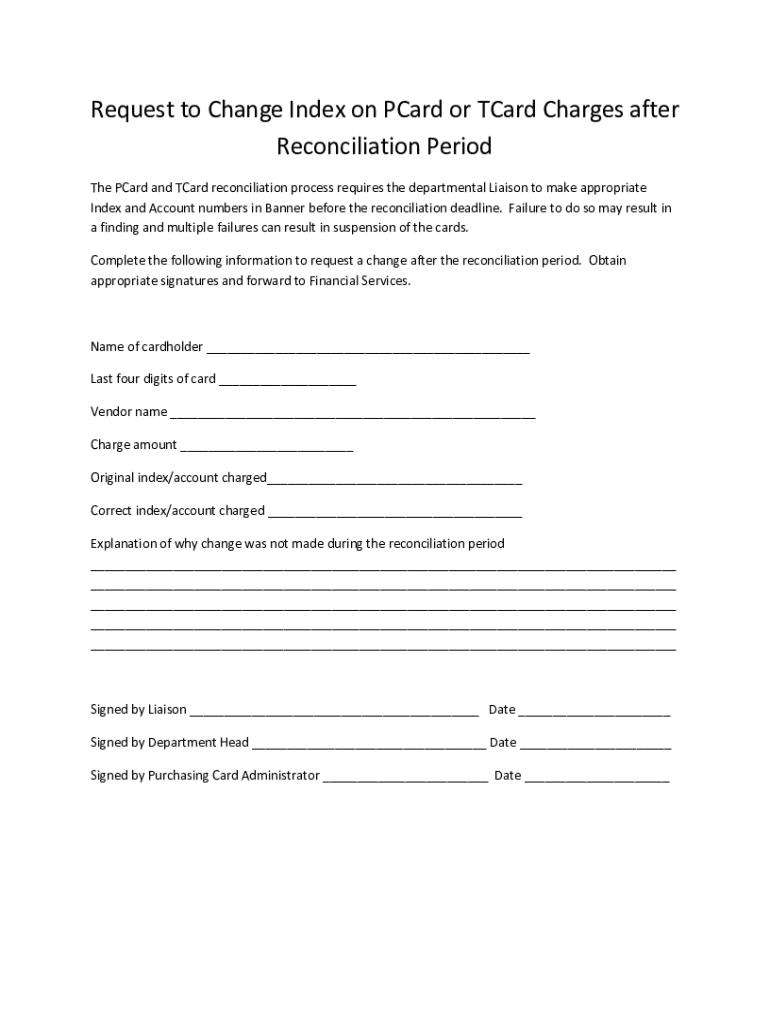

Request to Change Index on Card or Card Charges after Reconciliation Period The Card and Card reconciliation process requires the departmental Liaison to make appropriate Index and Account numbers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign finance topics - accounting

Edit your finance topics - accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your finance topics - accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit finance topics - accounting online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit finance topics - accounting. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out finance topics - accounting

How to fill out finance topics - accounting

01

Start by gathering all the necessary financial documents related to accounting, such as income statements, balance sheets, and cash flow statements.

02

Understand the basic principles of accounting, including concepts like debits and credits, assets and liabilities, and revenue and expenses.

03

Prepare a chart of accounts, which is a categorized list of all the accounts used in the accounting system.

04

Record all financial transactions accurately and in a timely manner using appropriate accounting software or manual methods.

05

Reconcile bank statements and other financial records regularly to identify any discrepancies or errors.

06

Generate financial reports, such as income statements and financial ratios, to analyze the financial performance of a business.

07

Prepare and file tax returns based on the financial information and accounting records.

08

Keep track of any changes in accounting standards or regulations to ensure compliance and updated financial reporting.

09

Seek professional advice or consult with a qualified accountant if needed for complex or specialized accounting topics.

10

Regularly review and assess the financial health of the business to make informed decisions and plan for the future.

Who needs finance topics - accounting?

01

Small business owners who want to track their financial performance and make informed decisions about their finances.

02

Accounting professionals or students who require knowledge and skills in finance topics - accounting for their careers or studies.

03

Investors and stakeholders who want to evaluate the financial health and stability of a company before making investment decisions.

04

Financial analysts or consultants who provide financial advisory services to clients and need a strong foundation in accounting concepts.

05

Government agencies and regulatory bodies who require accurate financial information for monitoring and oversight purposes.

06

Nonprofit organizations or charities that need to maintain financial records and reports for transparency and accountability.

07

Individuals who want to improve their personal financial management skills and understand their own financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send finance topics - accounting for eSignature?

Once you are ready to share your finance topics - accounting, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for the finance topics - accounting in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your finance topics - accounting and you'll be done in minutes.

Can I create an eSignature for the finance topics - accounting in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your finance topics - accounting and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is finance topics - accounting?

Finance topics in accounting refer to the principles, practices, and regulations that govern the recording, classification, and reporting of financial transactions. This includes the preparation of financial statements, bookkeeping, and compliance with tax laws.

Who is required to file finance topics - accounting?

Individuals and entities that are required to file finance topics in accounting typically include businesses, freelancers, non-profit organizations, and anyone earning income that is subject to taxation.

How to fill out finance topics - accounting?

To fill out finance topics in accounting, one should gather all relevant financial documents, such as income statements, receipts, and bank statements. Then, categorize expenses and income, complete the necessary forms accurately, and ensure that all information is entered clearly and verified.

What is the purpose of finance topics - accounting?

The purpose of finance topics in accounting is to provide a framework for reporting and analyzing financial performance, ensuring transparency, aiding decision-making, and complying with legal and regulatory requirements.

What information must be reported on finance topics - accounting?

Information that must be reported includes revenue, expenses, assets, liabilities, equity, and any relevant financial disclosures that provide insight into the entity's financial health.

Fill out your finance topics - accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Finance Topics - Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.