Get the free Center for Charitable Estate Planning - harding.edu

Show details

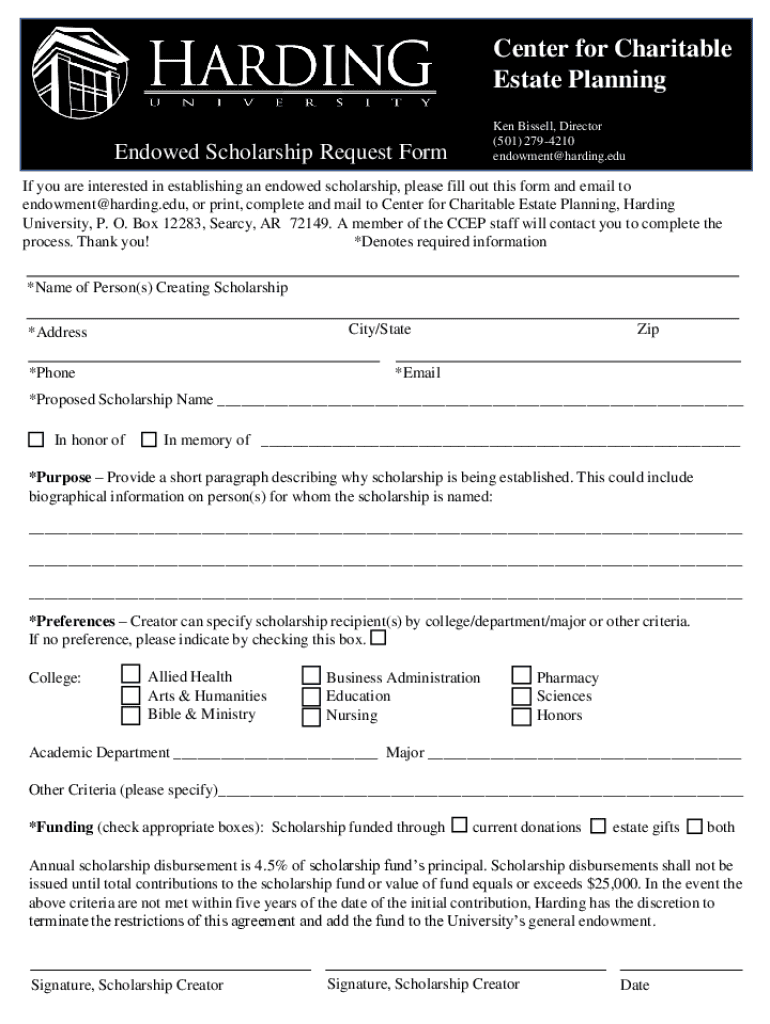

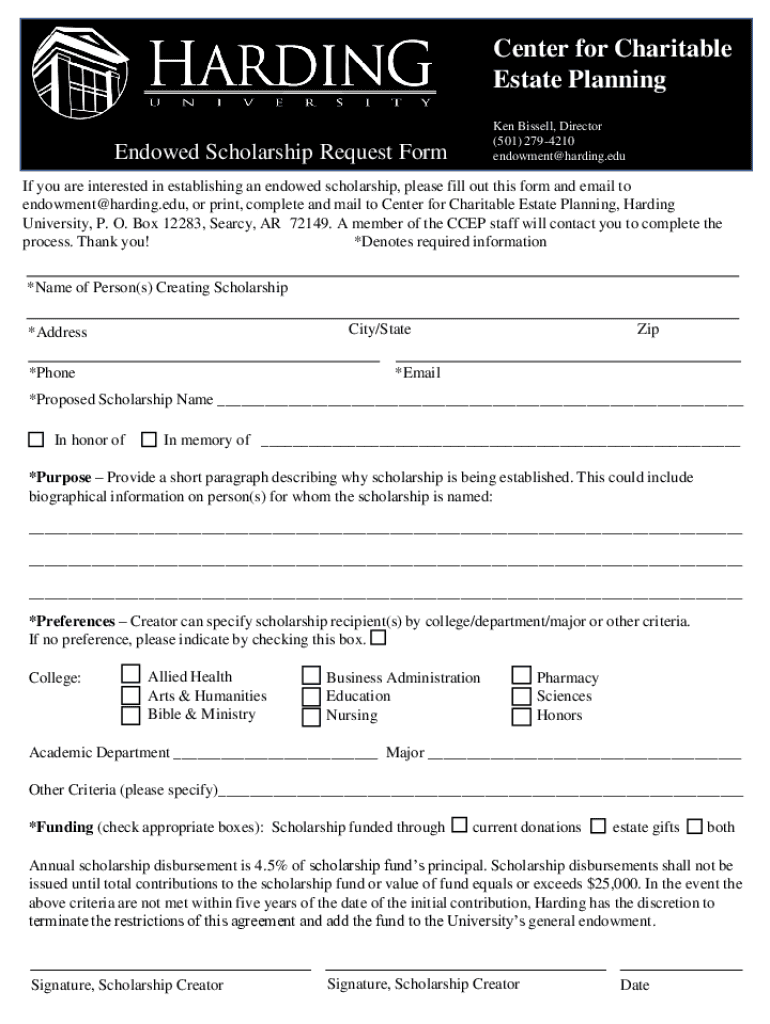

Center for Charitable Estate Planning Ken Bissell, Director (501) 2794210 endowment@harding.eduEndowed Scholarship Request Formic you are interested in establishing an endowed scholarship, please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign center for charitable estate

Edit your center for charitable estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your center for charitable estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit center for charitable estate online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit center for charitable estate. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out center for charitable estate

How to fill out center for charitable estate

01

Begin by gathering all necessary information and documents related to the estate.

02

Determine the purpose and goals of the charitable center to be filled out.

03

Conduct thorough research to identify the suitable charitable organizations or causes that align with the estate's objectives.

04

Contact the chosen charitable organization and inquire about their application process for establishing a center for charitable estate.

05

Obtain the required application forms and carefully fill them out, ensuring accuracy and completeness.

06

Provide all necessary supporting documentation as per the requirements stated by the charitable organization.

07

Review the filled-out forms and documents before submission to ensure everything is in order.

08

Submit the completed application along with all supporting materials to the designated authority or department of the chosen charitable organization.

09

Wait for the charitable organization to review the application and conduct any necessary evaluations.

10

Follow up with the organization to inquire about the status of the application and address any additional requirements or inquiries they may have.

11

Upon approval, work closely with the charitable organization to establish and manage the center for charitable estate.

12

Continuously monitor and evaluate the activities and impact of the center to ensure it aligns with the initial objectives and goals set by the estate.

Who needs center for charitable estate?

01

Individuals or families who have a significant estate and wish to establish a long-term charitable initiative.

02

Philanthropists who aim to invest their wealth in impactful charitable causes and leave a lasting legacy.

03

Donors who want to support and contribute to specific charitable organizations or causes.

04

Estate planners and advisors who assist clients in structuring and administering their estates in a philanthropic manner.

05

Non-profit organizations seeking to expand their impact and reach by collaborating with estates to establish centers for charitable estate.

06

Communities and societies that can benefit from the support and services provided by charitable centers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete center for charitable estate online?

pdfFiller has made filling out and eSigning center for charitable estate easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for signing my center for charitable estate in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your center for charitable estate and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out the center for charitable estate form on my smartphone?

Use the pdfFiller mobile app to complete and sign center for charitable estate on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is center for charitable estate?

The Center for Charitable Estate is an organization that provides resources and guidance for individuals and families looking to create charitable bequests or establish estate plans with charitable intent.

Who is required to file center for charitable estate?

Individuals or entities that plan to include charitable donations in their estate planning, and those managing estates that include charitable provisions are required to file with the Center for Charitable Estate.

How to fill out center for charitable estate?

To fill out the Center for Charitable Estate forms, one must gather all relevant financial documents, detail the charitable contributions planned or made, and complete the necessary forms provided by the Center, following their guidelines.

What is the purpose of center for charitable estate?

The purpose of the Center for Charitable Estate is to promote charitable giving through estate planning, ensuring that individuals can support charitable organizations and causes after their passing.

What information must be reported on center for charitable estate?

Information that must be reported includes details about the estate, the value of assets, specific charitable contributions, and the intended beneficiaries.

Fill out your center for charitable estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Center For Charitable Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.