Get the free MY TOTAL GIFT TO A&T IS - HomeNorth Carolina A&T State ...

Show details

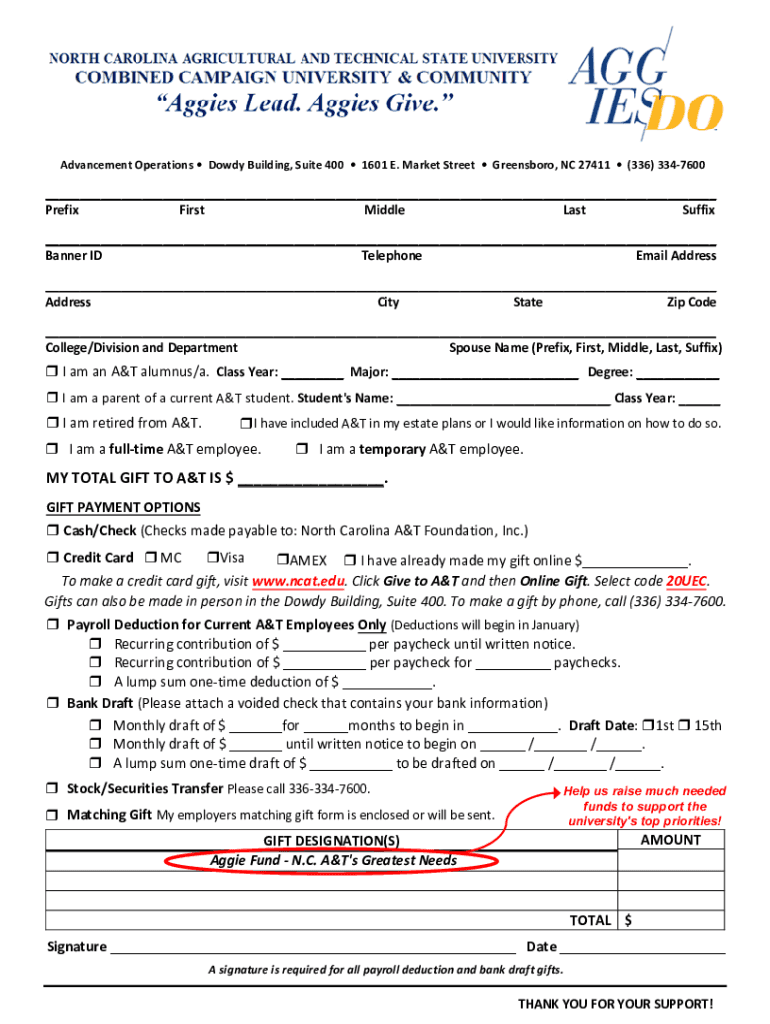

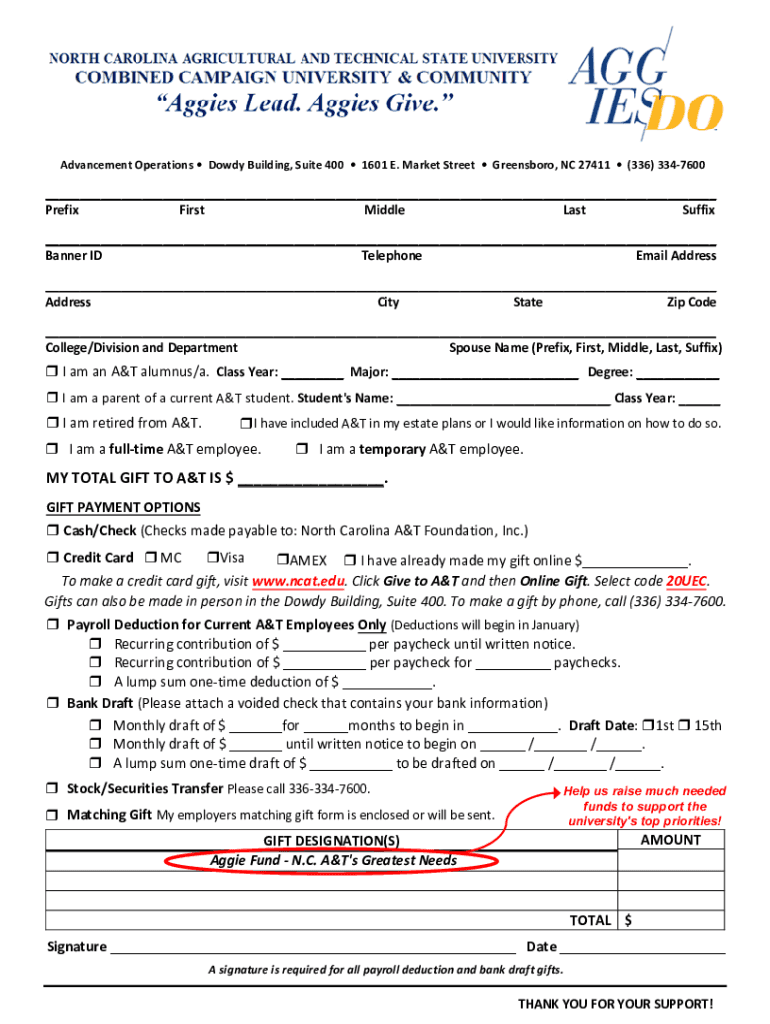

Advancement Operations Dowdy Building, Suite 400 1601 E. Market Street Greensboro, NC 27411 (336) 3347600 Prefix First Middle Last Suffix Banner ID Telephone Email Address City State Zip Code College/Division

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign my total gift to

Edit your my total gift to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your my total gift to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit my total gift to online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit my total gift to. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out my total gift to

How to fill out my total gift to

01

Start by identifying the organization or individual you want to give your total gift to.

02

Determine the method through which you want to give your gift. It can be through cash, check, bank transfer, or online payment.

03

Contact the organization or individual to discuss the details of your gift and any specific requirements they may have.

04

Obtain any necessary forms or documentation required for the gift, such as a donation receipt or tax-related documents.

05

Fill out the necessary information on the forms or documents accurately and completely. Include your personal details, the amount of the gift, and any designated purposes for the donation.

06

Review and double-check all the information you provided to ensure its accuracy.

07

Submit the completed forms or documents to the organization or individual as per their instructions.

08

Follow up with the recipient to confirm the successful receipt of your total gift.

09

Keep a copy of all the documentation related to your gift for your records and potential future reference.

10

Consider sharing your act of giving with others to inspire and encourage more people to make meaningful contributions.

Who needs my total gift to?

01

Various organizations and individuals can benefit from your total gift, depending on your intended purpose. Some examples include:

02

- Non-profit organizations working towards social causes such as education, healthcare, poverty alleviation, environmental preservation, etc.

03

- Local community initiatives like food banks, homeless shelters, animal rescue centers, etc.

04

- Educational institutions or scholarship programs aiming to support deserving students.

05

- Medical research institutions or charities involved in finding cures for diseases.

06

- Arts and cultural organizations promoting creativity and preserving heritage.

07

- Individuals or families experiencing financial hardships or facing unexpected circumstances.

08

It is important to research and select a cause or recipient that aligns with your values and objectives for making a positive impact.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute my total gift to online?

pdfFiller has made filling out and eSigning my total gift to easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit my total gift to online?

The editing procedure is simple with pdfFiller. Open your my total gift to in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit my total gift to in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your my total gift to, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

What is my total gift to?

Your total gift to refers to the total amount of money or property given as gifts during a specific period, typically calculated for tax purposes.

Who is required to file my total gift to?

Generally, the donor (the person giving the gift) is required to file a total gift tax return if they exceed the annual exclusion limit for gifts.

How to fill out my total gift to?

To fill out your total gift tax return, you will need to complete IRS Form 709, reporting the amount of gifts made and the recipients' details, along with any necessary deductions.

What is the purpose of my total gift to?

The purpose of reporting your total gift to is to ensure compliance with tax laws and to determine if any gift tax is owed based on the total value of gifts given.

What information must be reported on my total gift to?

You must report the names and addresses of the recipients, the date and description of the gifts, and their fair market value.

Fill out your my total gift to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

My Total Gift To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.