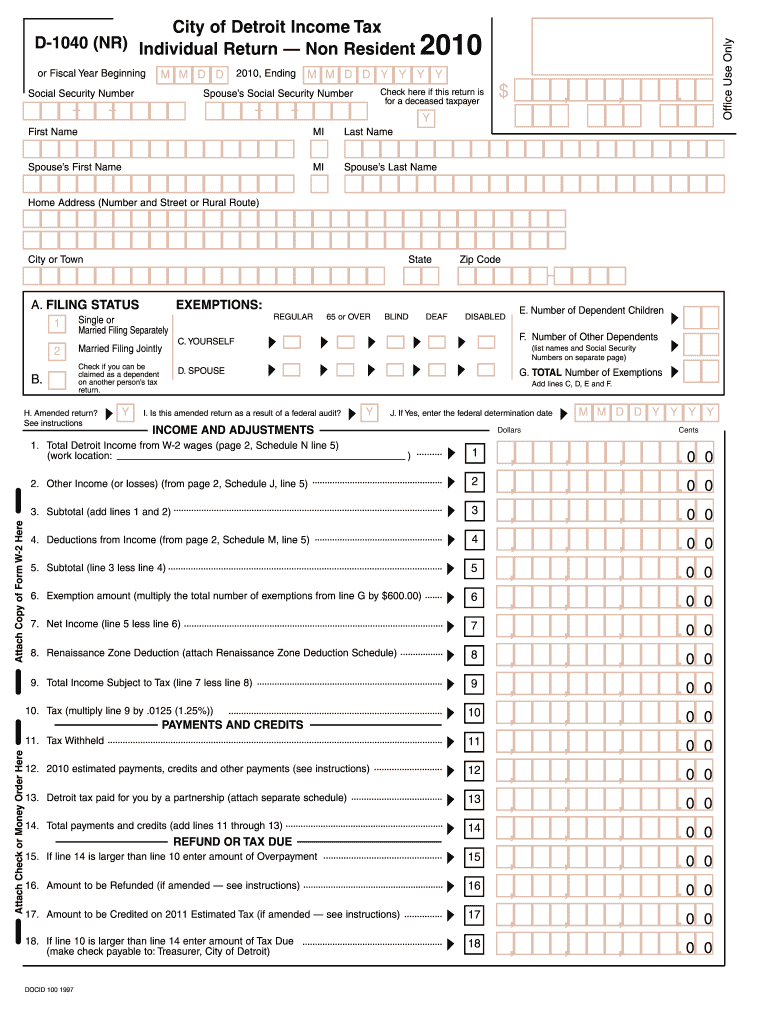

MI D-1040(NR) - Detroit 2010 free printable template

Show details

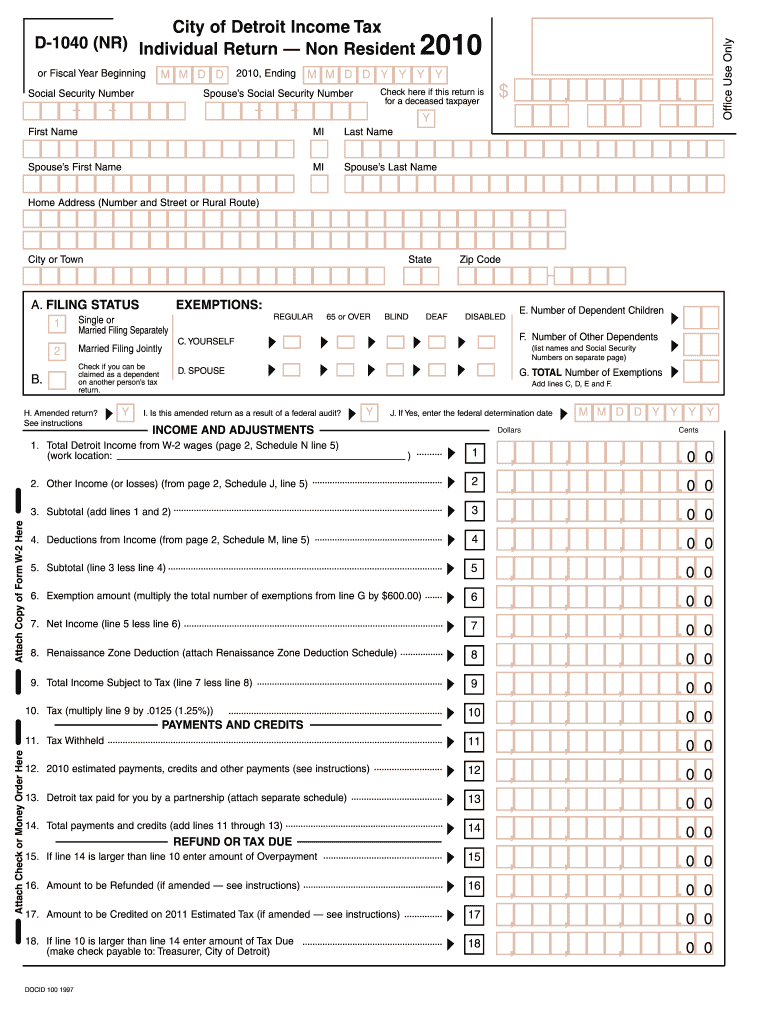

Or Fiscal Year Beginning Social Security Number M D 2010, Ending M D D Y Y Y Y Check here if this return is for a deceased taxpayer Spouse's Social Security Number $, Y First Name Spouse's First Name

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI D-1040NR - Detroit

Edit your MI D-1040NR - Detroit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI D-1040NR - Detroit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI D-1040NR - Detroit online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MI D-1040NR - Detroit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

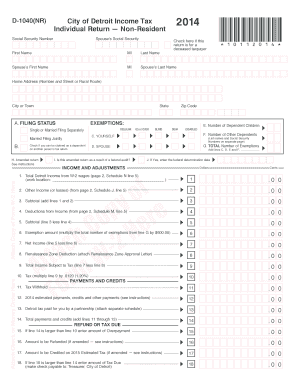

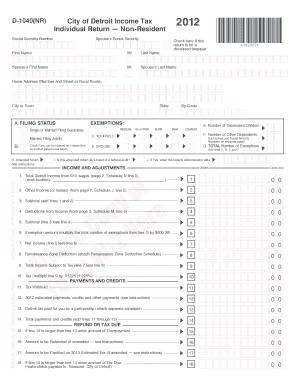

MI D-1040(NR) - Detroit Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI D-1040NR - Detroit

How to fill out MI D-1040(NR) - Detroit

01

Begin by downloading the MI D-1040(NR) form from the Michigan Department of Treasury website or obtain a physical copy.

02

Fill in your personal information in the designated fields, including your name, address, and Social Security number.

03

Indicate your filing status by selecting the appropriate option (e.g., single, married, etc.).

04

Report your income sources clearly in the income section, including income earned in Michigan and any other relevant income.

05

Calculate your deductions and credits as permitted under Michigan tax law, ensuring to include any specific NR deductions.

06

Complete the tax calculation sections to determine your total tax owed or refund due.

07

Review the form for accuracy and completeness, ensuring all necessary signatures are included.

08

Submit your completed form by mail to the address specified in the instructions or electronically if available.

Who needs MI D-1040(NR) - Detroit?

01

Individuals who are non-residents but earned income or have a tax obligation in Michigan during the tax year.

02

Any non-resident who needs to report Michigan source income on their tax return for state tax compliance.

Fill

form

: Try Risk Free

People Also Ask about

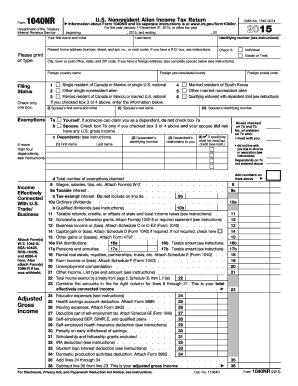

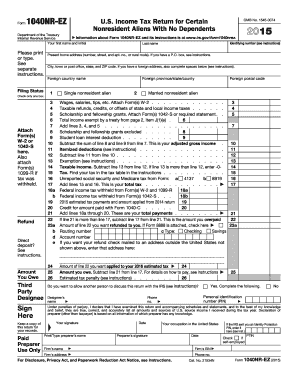

What is the minimum income to file 1040NR?

There is no minimum income threshold to file 1040NR Form as a non-resident alien. You should only report your U.S. sourced income on this form. However, foreigners investing in the US should first determine if their U.S. visits make them U.S. residents for tax purposes.

What is a 1040NR tax form?

More In Forms and Instructions You may need to file Form 1040-NR if you: Were a nonresident alien engaged in a trade or business in the United States. Represented a deceased person who would have had to file Form 1040-NR. Represented an estate or trust that had to file Form 1040-NR.

Who needs to file Form 1040NR?

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

Can I file 1040NR electronically?

Form 1040NR, U.S. Nonresident Alien Income Tax Return can be filed electronically using UltraTax CS. Extensions for Form 1040NR can also be filed electronically. Follow the same procedures for preparing 1040 returns or extensions for electronic filing to prepare Form 1040NR for electronic filing.

Who has to file a 1040NR?

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

What is the difference between filing 1040 and 1040NR?

IRS Form 1040NR is a variation of Form 1040, which taxpayers use to file their Annual Tax Return. This variation is for individuals who are not American citizens and who do not pass the Substantial Presence Test. IRS Form 1040NR is also known as the U.S. Nonresident Alien Income Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MI D-1040NR - Detroit online?

pdfFiller has made it simple to fill out and eSign MI D-1040NR - Detroit. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I complete MI D-1040NR - Detroit on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your MI D-1040NR - Detroit from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I fill out MI D-1040NR - Detroit on an Android device?

Complete MI D-1040NR - Detroit and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is MI D-1040(NR) - Detroit?

MI D-1040(NR) - Detroit is a non-resident income tax form used by individuals who earn income in the city of Detroit but do not reside there.

Who is required to file MI D-1040(NR) - Detroit?

Non-residents of Detroit who earn income from sources within the city are required to file the MI D-1040(NR) - Detroit.

How to fill out MI D-1040(NR) - Detroit?

To fill out MI D-1040(NR) - Detroit, gather your income information, including W-2s and other documents, complete the form with the required details, and submit it to the appropriate Detroit tax authority.

What is the purpose of MI D-1040(NR) - Detroit?

The purpose of MI D-1040(NR) - Detroit is to assess and collect income taxes from non-residents who earn income within the city limits of Detroit.

What information must be reported on MI D-1040(NR) - Detroit?

The information that must be reported on MI D-1040(NR) - Detroit includes the taxpayer's personal information, income earned in Detroit, deductions, and any tax credits applicable.

Fill out your MI D-1040NR - Detroit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI D-1040nr - Detroit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.