Get the free Form 940-EZ - irs

Show details

This document provides comprehensive instructions for completing Form 940-EZ, which is used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax obligations. It details eligibility

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 940-ez - irs

Edit your form 940-ez - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 940-ez - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 940-ez - irs online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 940-ez - irs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 940-ez - irs

How to fill out Form 940-EZ

01

Obtain Form 940-EZ from the IRS website or through a tax professional.

02

Enter your name and business address in the designated fields.

03

Indicate your Employer Identification Number (EIN).

04

Fill out the payroll information for the applicable tax year.

05

Report the total taxable wages and the number of employees.

06

Calculate the amount of federal unemployment tax (FUTA) owed.

07

If applicable, claim any credits and deductions.

08

Sign and date the form.

09

Submit the completed form to the IRS via mail or electronically.

Who needs Form 940-EZ?

01

Employers who paid wages of $1,500 or more in any quarter during the calendar year.

02

Employers who had at least one employee for some part of a day in any 20 or more different weeks in the current or preceding calendar year.

03

Certain seasonal employers who want to file a simplified form instead of the longer Form 940.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file a form 940?

Each year, every business with employees must file Form 940 to compute the amount of unemployment tax that must be paid on the federal level. This payroll tax is based on the first $7,000 of each employee's wages (including owners of S corporations who receive a salary for work performed for their businesses).

Can I print form 940?

To print Form 940 Information can be edited on the IRS Form 940 screen before printing the form. Once the information on this screen is correct, click Print.

Who can file an EZ tax form?

Form 1040EZ was a shortened version of Form 1040 for taxpayers with basic tax situations. The form was discontinued as of the 2018 tax year and replaced with the redesigned Form 1040. Form 1040EZ could only be used by people with no dependents who were younger than age 65 and earned less than $100,000 per year.

Can I file form 940 electronically?

Modernized e-file (MeF) for employment taxes offers a secure and accurate way to file the following forms electronically: Form 940, Employer's Annual Federal Unemployment Tax Return. Form 940 (PR), Employer's Annual Federal Unemployment Tax Return.

What is 940 EZ?

Use Form 940-EZ to report your annual Federal Unemployment Tax Act (FUTA) tax. FUTA tax, together with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their jobs. Most employers pay both federal and state unemployment taxes. Only the employer pays FUTA tax.

What is form 940 EZ?

Use Form 940 to report your annual Federal Unemployment Tax Act (FUTA) tax. Together with state unemployment tax systems, the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax.

Why is FUTA taken out of my paycheck?

California employers fund regular Unemployment Insurance (UI) benefits through contributions to the state's UI Trust Fund on behalf of each employee. They also pay Federal Unemployment Tax Act (FUTA) taxes to the federal government to help pay for: Administration of the UI program. UI loans to insolvent states.

Does everyone have to pay FUTA?

Only the employer pays FUTA tax; it is not deducted from the employee's wages. For more information, refer to the Instructions for Form 940.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

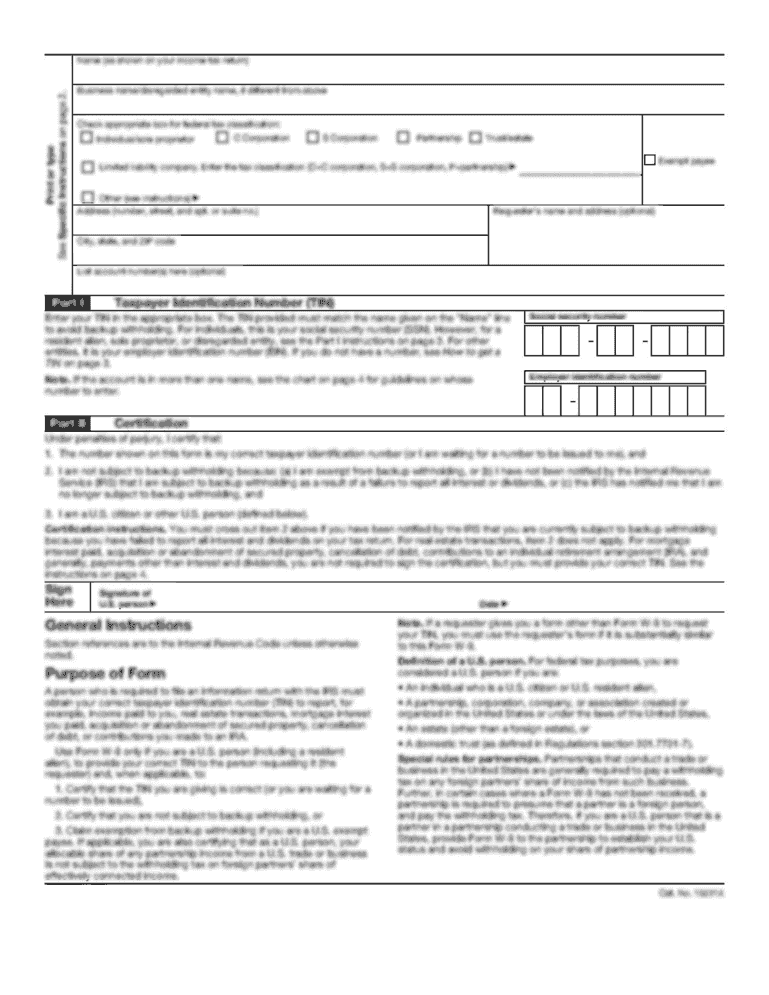

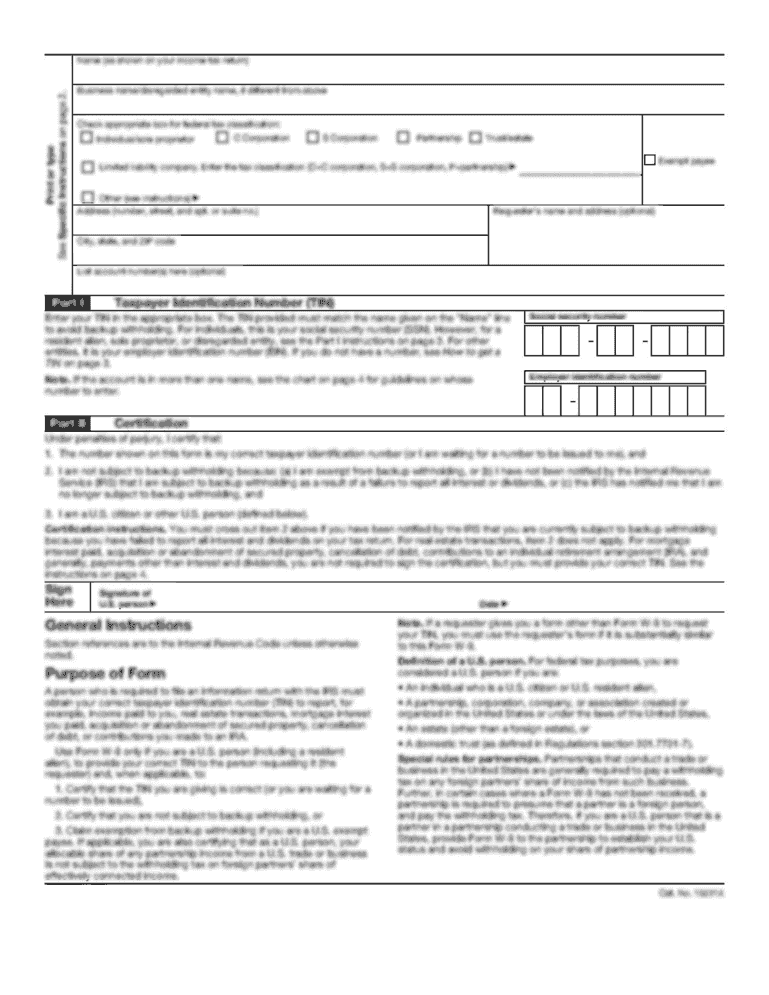

What is Form 940-EZ?

Form 940-EZ is a simplified version of Form 940, used by employers to report annual Federal Unemployment Tax Act (FUTA) taxes.

Who is required to file Form 940-EZ?

Employers with a small number of employees and a simple payroll situation who owe less than $500 in FUTA taxes can file Form 940-EZ instead of the longer Form 940.

How to fill out Form 940-EZ?

To fill out Form 940-EZ, provide your business name, address, Employer Identification Number (EIN), and total payments made to employees. Calculate and report your FUTA tax liability based on your payroll information.

What is the purpose of Form 940-EZ?

The purpose of Form 940-EZ is to simplify the process for eligible employers to report their annual FUTA tax obligations to the IRS.

What information must be reported on Form 940-EZ?

Form 940-EZ requires reporting of the total wages paid, the number of employees, credits for state unemployment taxes, and the total FUTA tax due after credits.

Fill out your form 940-ez - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 940-Ez - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.