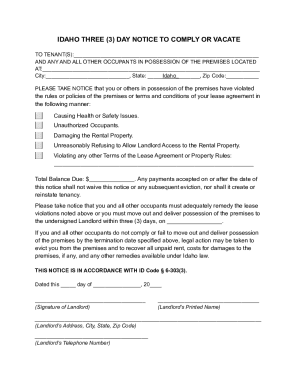

Get the free Non Banking Financial Companies(NBFCs) - Reserve Bank of India

Show details

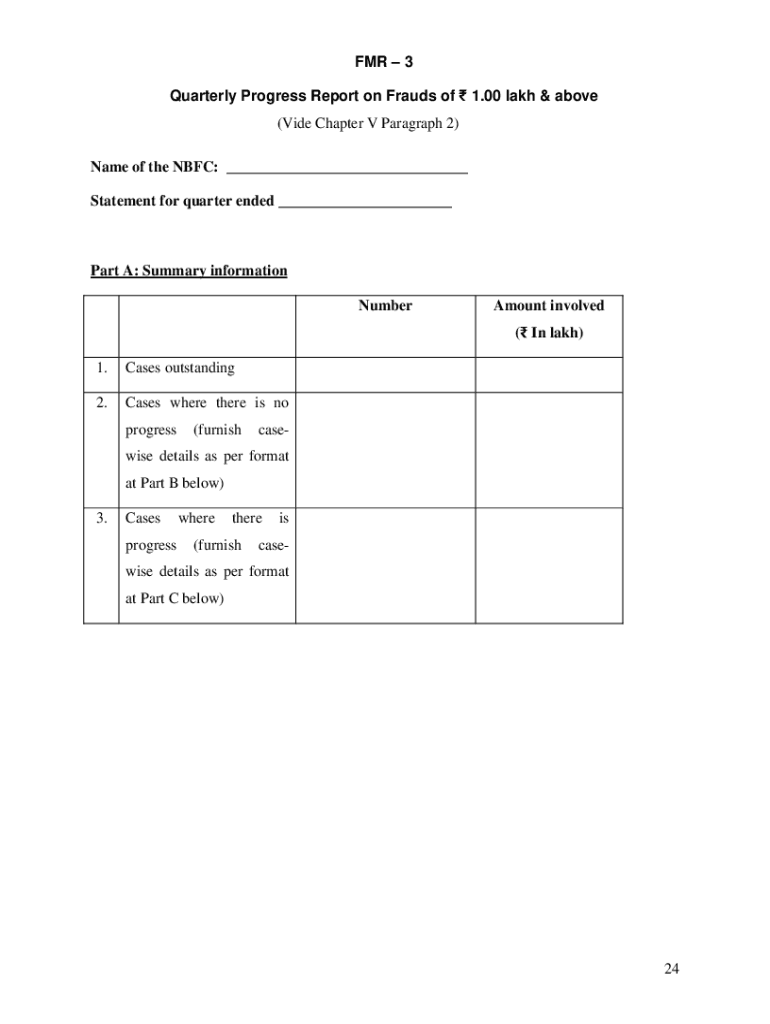

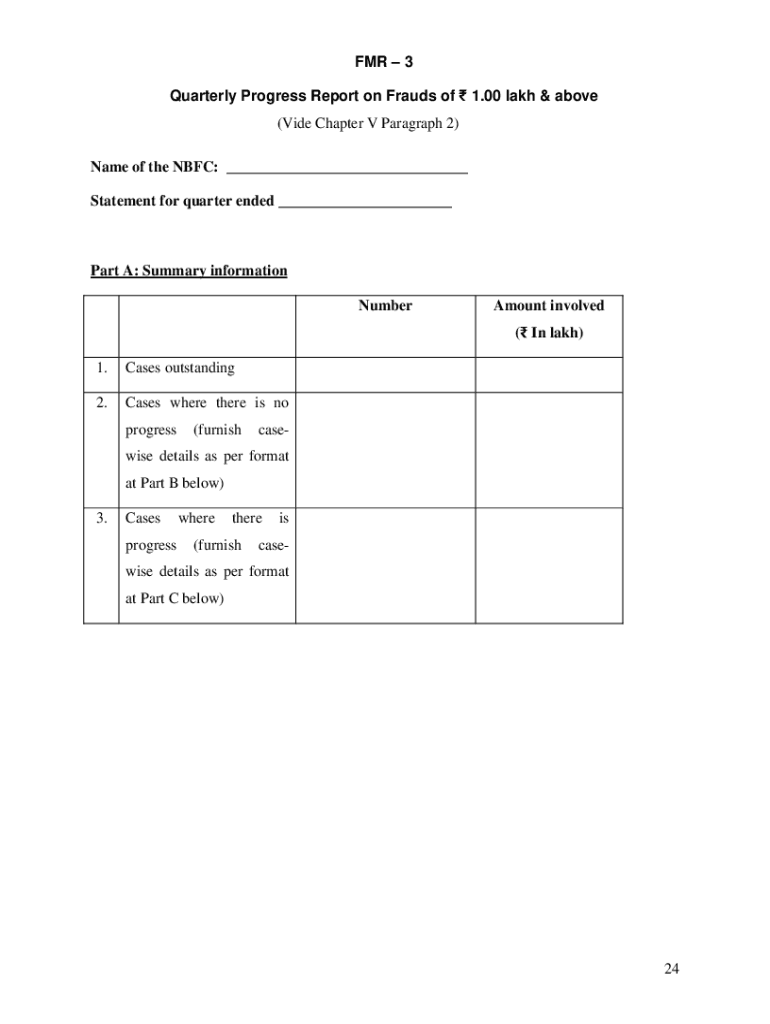

FOR 3 Quarterly Progress Report on Frauds of 1.00 lakh & above (Vide Chapter V Paragraph 2) Name of the NBFC: Statement for quarter ended Part A: Summary information NumberAmount involved (In lakh)1.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non banking financial companiesnbfcs

Edit your non banking financial companiesnbfcs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non banking financial companiesnbfcs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non banking financial companiesnbfcs online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non banking financial companiesnbfcs. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non banking financial companiesnbfcs

How to fill out non banking financial companiesnbfcs

01

To fill out non banking financial companies (NBFCs), you need to follow these steps:

02

Determine the type of NBFC you want to establish. There are different types of NBFCs such as investment companies, asset financing companies, infrastructure debt funds, etc.

03

Incorporate a company under the Companies Act, 2013. Choose a suitable name for the NBFC and complete the registration process with the Registrar of Companies (ROC).

04

Obtain a certificate of incorporation from the ROC.

05

Apply for a permanent account number (PAN) and tax deduction account number (TAN) from the Income Tax Department.

06

Prepare the necessary documents including the Memorandum of Association (MoA), Articles of Association (AoA), and other legal documents as required by the Reserve Bank of India (RBI).

07

Submit the application for NBFC registration to the RBI along with the required documents.

08

Pay the necessary fees for NBFC registration.

09

Fulfill the minimum capital requirements as specified by the RBI.

10

Cooperate with the RBI during the verification process, which includes background checks of the promoters and directors.

11

Obtain the Certificate of Registration (CoR) from the RBI once the application is approved.

12

Comply with the ongoing regulatory requirements like maintaining capital adequacy, submitting regular reports to the RBI, etc.

13

Follow all the applicable laws and regulations related to NBFCs in order to operate legally and ethically.

Who needs non banking financial companiesnbfcs?

01

Different individuals and entities may need non banking financial companies (NBFCs) for various reasons:

02

- Individuals seeking alternative sources of financing, especially when traditional banking services are unavailable or less accessible.

03

- Small and medium-sized enterprises (SMEs) in need of funds for growth and expansion.

04

- Startups and entrepreneurs looking for capital to launch or scale their businesses.

05

- Retail customers interested in specialized financial products and services like consumer loans, asset financing, investment advice, etc., which may not be provided by traditional banks.

06

- Investors seeking higher returns on their investments through investment in NBFCs.

07

- Real estate developers and builders requiring project financing and construction loans.

08

- Agriculture and rural sector stakeholders looking for agricultural financing.

09

Overall, NBFCs cater to the diverse financial needs of individuals, businesses, and communities that may not be fully served by traditional banking institutions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non banking financial companiesnbfcs directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign non banking financial companiesnbfcs and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I fill out non banking financial companiesnbfcs on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your non banking financial companiesnbfcs from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I fill out non banking financial companiesnbfcs on an Android device?

Use the pdfFiller Android app to finish your non banking financial companiesnbfcs and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is non banking financial companiesnbfcs?

Non-Banking Financial Companies (NBFCs) are financial institutions that provide various financial services similar to traditional banks but do not have a full banking license. They primarily engage in activities such as loans and credit facilities, asset management, and investment in securities.

Who is required to file non banking financial companiesnbfcs?

Entities that operate as non-banking financial companies and are registered under the regulatory authority (such as the Reserve Bank of India in India) are required to file the necessary reports and compliance documents related to their operations.

How to fill out non banking financial companiesnbfcs?

To fill out the non-banking financial companies (NBFCs) documentation, entities must collect relevant financial data, follow the prescribed formats provided by regulatory authorities, and ensure compliance with all reporting requirements specific to NBFC operations and financial disclosures.

What is the purpose of non banking financial companiesnbfcs?

The purpose of non-banking financial companies (NBFCs) is to provide a wide range of financial services, including loans, financing, investment products, and wealth management, to individuals and businesses, thereby enhancing financial inclusion and promoting economic growth.

What information must be reported on non banking financial companiesnbfcs?

Non-banking financial companies are required to report information including financial statements, loan and asset details, capital adequacy, risk management practices, and compliance with regulatory guidelines, as defined by the relevant financial regulatory authority.

Fill out your non banking financial companiesnbfcs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non Banking Financial Companiesnbfcs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.