Carol Topp CPA Rental Property Records free printable template

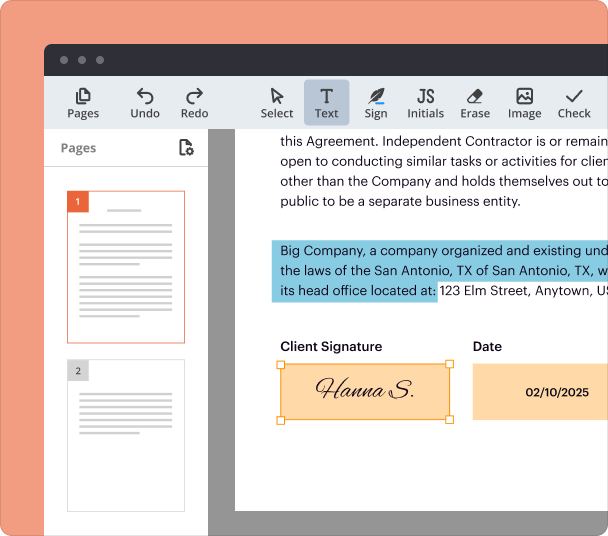

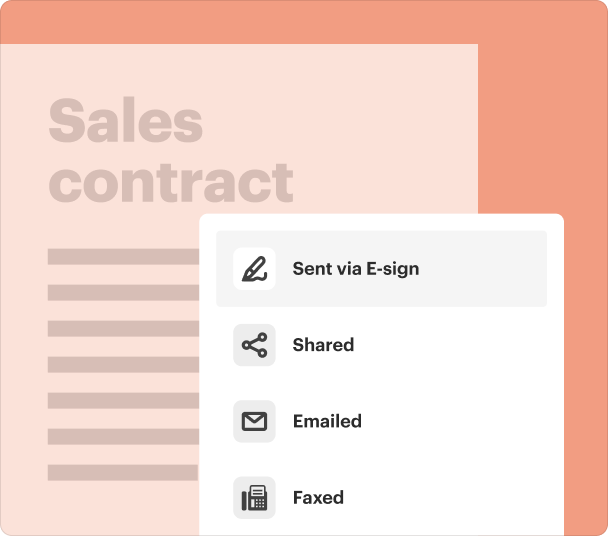

Fill out, sign, and share forms from a single PDF platform

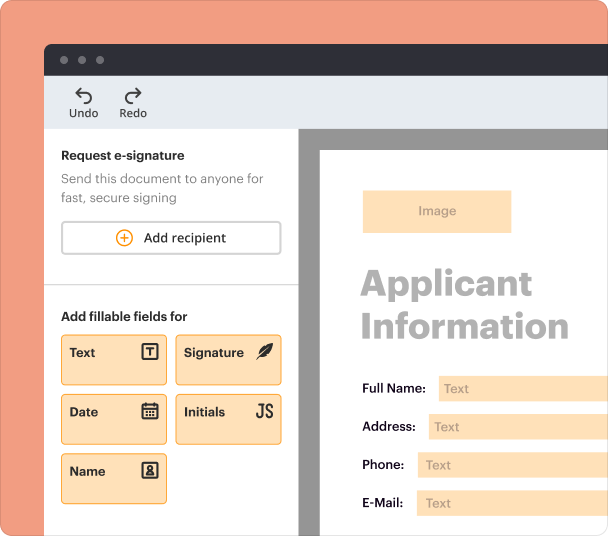

Edit and sign in one place

Create professional forms

Simplify data collection

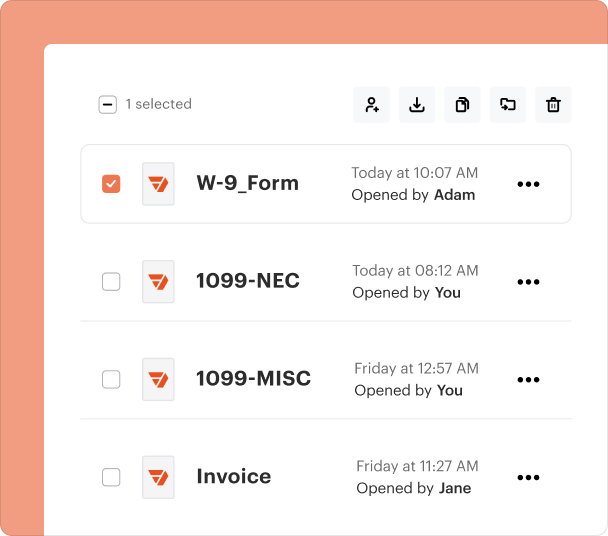

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

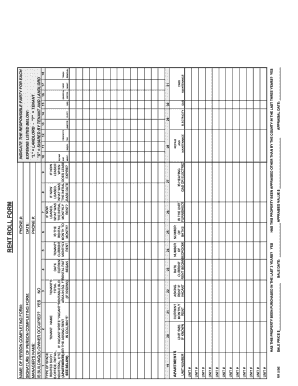

Understanding the Carol Topp CPA Rental Form

What is the Carol Topp CPA Rental Form?

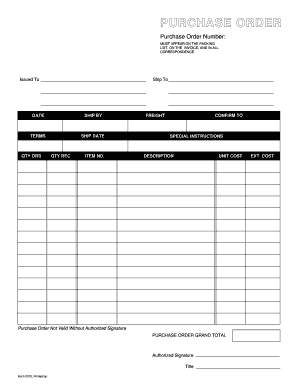

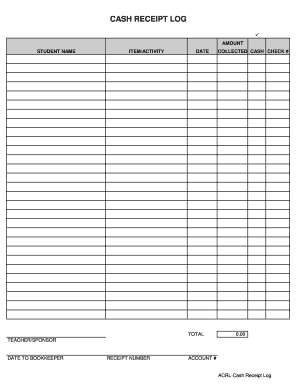

The Carol Topp CPA Rental Form is a specialized document designed for landlords and property managers to efficiently track rental property income and expenses. It serves as a key tool for ensuring accurate financial reporting and tax preparation. This form streamlines the process of capturing essential data related to rental properties, such as purchase details, income received, and various expenses incurred throughout the year.

Key Features of the Carol Topp CPA Rental Form

This form includes several important features that make it invaluable for property management:

-

Includes sections for advertising, cleaning, maintenance, and utilities.

-

Designated areas to input income from rent and other sources.

-

Allows users to edit, eSign, and save digitally without paper clutter.

-

Facilitates proper reporting for taxable income and associated expenses.

Who Needs the Carol Topp CPA Rental Form?

The form is essential for landlords, real estate investors, and property management companies. It is particularly beneficial for individuals who own one or multiple rental properties and aim to keep detailed financial records for tax purposes. Property managers can utilize the form to produce accurate financial reports and maintain transparency with property owners.

How to Fill the Carol Topp CPA Rental Form

Filling out the Carol Topp CPA Rental Form involves several straightforward steps. First, gather all necessary documentation, including purchase records and expense receipts. Next, enter the property's address and relevant financial details such as purchase amount and date. Provide a breakdown of income received and categorize all expenses based on the form's sections. Remember to include any improvements that may affect the property’s value. Finally, review all entries for accuracy before saving or printing the form.

Best Practices for Accurate Completion

To ensure that the Carol Topp CPA Rental Form is completed accurately, consider the following best practices:

-

Update the form regularly to reflect current income and expenses.

-

Keep all receipts and documentation in a systematic manner for reference.

-

If uncertain about any entries, seek advice from a qualified CPA.

-

Double-check all calculations to prevent errors during tax preparation.

Common Errors and Troubleshooting

When using the Carol Topp CPA Rental Form, several common errors can arise, such as incorrect data entry, overlooking to capture all income, or misclassifying expenses. To avoid these issues, cross-reference financial records with the entries on the form. Ensure that all income sources are reported and that any significant expenses are documented adequately. If errors are found, update the form promptly to maintain accurate records for tax filing.

Frequently Asked Questions about property rent tax form

What types of expenses can be recorded on the form?

The form allows for the recording of various rental property expenses, including advertising, cleaning, maintenance, utilities, insurance, and depreciation, ensuring comprehensive tracking of financial activity.

Is there a deadline for submitting forms generated using the Carol Topp CPA Rental Form?

It is important to keep track of tax deadlines, as forms detailing rental property income and expenses must often be submitted according to IRS guidelines, with specific attention to the delivery of 1099MISC forms by January 31 each year.

pdfFiller scores top ratings on review platforms