Get the free Year End Giving - Supporting the Catholic Diocese of Fort ...

Show details

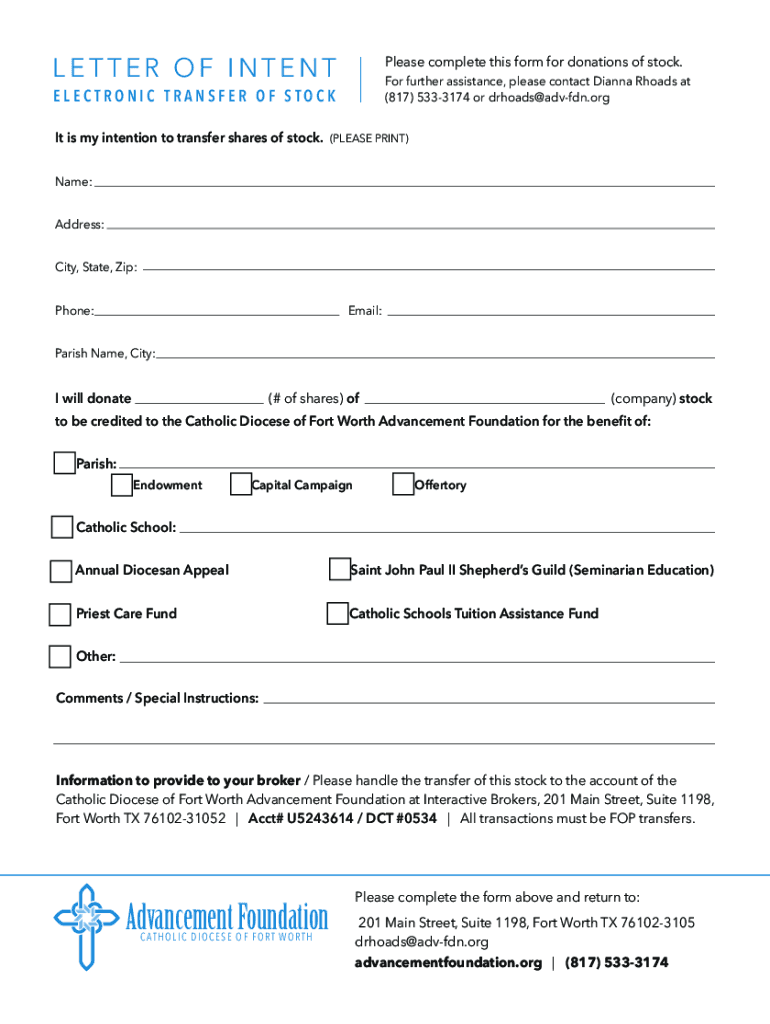

Donate stocks or other assets to the Church. We make it easy to support the Diocese of Fort Worth, your parish, Catholic school or other ministry. Make a bigger impact by donating long term appreciated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign year end giving

Edit your year end giving form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your year end giving form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing year end giving online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit year end giving. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out year end giving

How to fill out year end giving

01

To fill out year end giving, follow these steps:

02

Start by gathering all necessary documentation, including receipts for donations made throughout the year and any other relevant financial records.

03

Begin by determining the amount you wish to contribute for year end giving. This can be based on personal financial goals or tax-saving strategies.

04

Consider the organizations or causes you would like to support with your year end giving. Research and choose reputable and registered nonprofit organizations that align with your values and goals.

05

Review the guidelines and requirements set by each chosen organization for year end giving. Some organizations may have specific forms or procedures for donation.

06

Calculate the total amount you plan to donate and divide it among the chosen organizations according to your preference.

07

Fill out the appropriate donation forms for each organization, ensuring all necessary details are accurately provided.

08

Double-check your donation forms and attached documents to ensure they are complete and error-free.

09

Submit your completed forms and contributions to the respective organizations by their specified deadline. Consider using secure and trackable methods of delivery.

10

Keep copies of all documentation for your records and for future reference during tax season.

11

Finally, retain the acknowledgement or receipt of your donations from each organization for future tax deduction purposes.

Who needs year end giving?

01

Year end giving can benefit various individuals and entities, including:

02

- Individuals who want to support charitable causes and contribute to their communities.

03

- Nonprofit organizations that rely on year end donations for financial sustainability and to continue their programs and services.

04

- Donors who are seeking tax deductions for charitable contributions made during the year.

05

- Businesses and corporations that aim to fulfill their corporate social responsibility goals and give back to society.

06

- Fundraising campaigns and initiatives that rely on year end giving to reach their fundraising targets.

07

- Religious organizations that receive support from their congregations and community members.

08

- Students and educational institutions that rely on year end giving to provide financial assistance for scholarships and educational programs.

09

- Artists, musicians, and cultural institutions that depend on year end giving to sustain their creative practices and showcase their work to the public.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in year end giving without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your year end giving, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for the year end giving in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out year end giving using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign year end giving and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is year end giving?

Year end giving refers to the donations or contributions made to charitable organizations or non-profit entities at the end of the calendar year.

Who is required to file year end giving?

Individuals, businesses, and organizations who make charitable donations or contributions during the year are required to report their year end giving.

How to fill out year end giving?

Year end giving can be filled out by keeping track of all donations or contributions made throughout the year and providing this information to the charitable organization or non-profit entity.

What is the purpose of year end giving?

The purpose of year end giving is to support charitable organizations and non-profit entities, as well as to potentially receive tax deductions for the donations made.

What information must be reported on year end giving?

The information reported on year end giving typically includes the amount of donations or contributions made, the name of the charitable organization or non-profit entity, and the date the donation was made.

Fill out your year end giving online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Year End Giving is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.