Get the free Mortgage or Fixed Equity Loan Flex Drafting Automatic ...

Show details

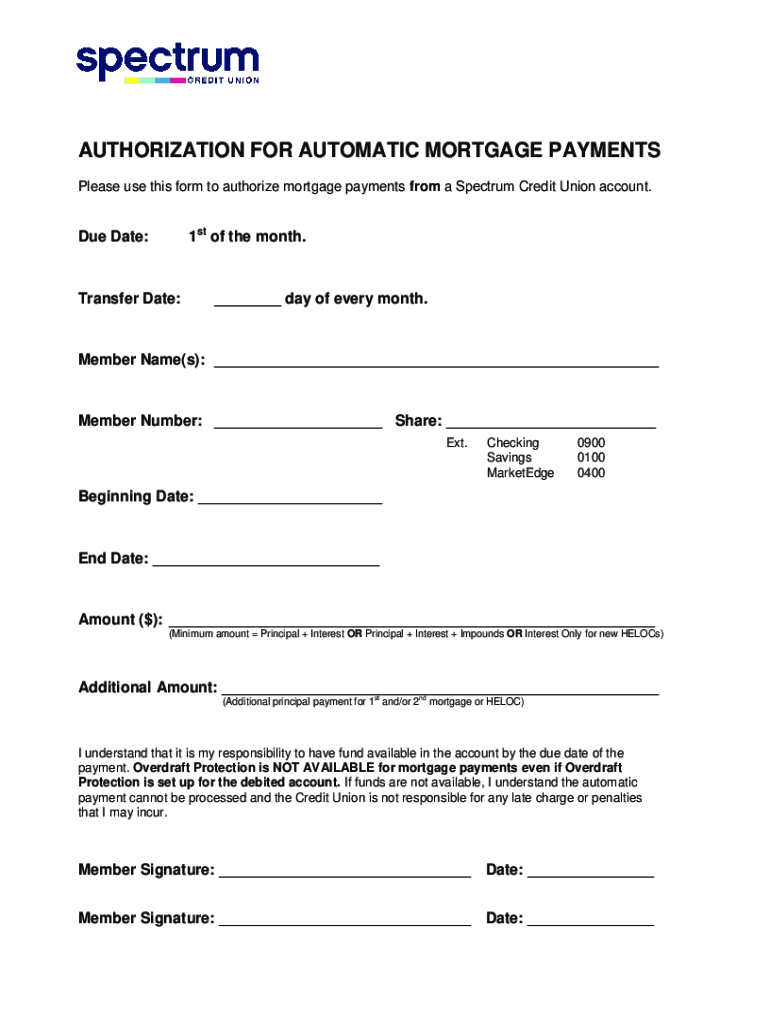

AUTHORIZATION FOR AUTOMATIC MORTGAGE PAYMENTS Please use this form to authorize mortgage payments from a Spectrum Credit Union account.1st of the month. Due Date:Transfer Date: day of every month.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage or fixed equity

Edit your mortgage or fixed equity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage or fixed equity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage or fixed equity online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mortgage or fixed equity. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage or fixed equity

How to fill out mortgage or fixed equity

01

Gather all necessary financial documents, such as pay stubs, tax returns, and bank statements.

02

Research and compare different mortgage or fixed equity lenders to find the best rates and terms.

03

Calculate your budget and determine how much you can afford to borrow.

04

Fill out the mortgage or fixed equity application form, providing accurate and complete information.

05

Submit the application along with all required documents to the lender.

06

Await the lender's decision and respond promptly to any requests for additional information or documentation.

07

Review the loan terms and conditions carefully before signing the agreement.

08

Arrange for a home appraisal, if required by the lender.

09

Complete any remaining paperwork and provide any requested information or documentation.

10

Attend the closing meeting to finalize the mortgage or fixed equity loan.

11

Make regular payments towards the loan as outlined in the agreement.

Who needs mortgage or fixed equity?

01

Individuals looking to purchase a property but do not have enough cash to make the full payment upfront.

02

Homeowners looking to access the equity in their property for various purposes, such as home renovations or debt consolidation.

03

Borrowers who prefer the stability of a fixed interest rate and consistent monthly payments.

04

Those seeking to take advantage of potential tax deductions on mortgage interest payments.

05

Individuals who want to build credit and establish a payment history by responsibly managing a mortgage or fixed equity loan.

06

Investors looking to purchase properties for rental income or to generate capital gains over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find mortgage or fixed equity?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific mortgage or fixed equity and other forms. Find the template you need and change it using powerful tools.

How do I make edits in mortgage or fixed equity without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing mortgage or fixed equity and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I edit mortgage or fixed equity on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as mortgage or fixed equity. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is mortgage or fixed equity?

Mortgage or fixed equity refers to a type of secured loan where the borrower receives funds secured against the value of their property. This enables the borrower to access funds while the property serves as collateral.

Who is required to file mortgage or fixed equity?

Individuals or entities that have taken out a mortgage or established a fixed equity line against their property are typically required to file mortgage or fixed equity.

How to fill out mortgage or fixed equity?

To fill out mortgage or fixed equity forms, you need to provide detailed information about the property, the loan amount, interest rates, repayment terms, and personal identification information of the borrower.

What is the purpose of mortgage or fixed equity?

The purpose of mortgage or fixed equity is to secure funding for purchases or home improvements, allowing homeowners to leverage their property’s value while receiving a loan with lower interest rates compared to unsecured loans.

What information must be reported on mortgage or fixed equity?

Information that must be reported includes the borrower’s details, property description, loan amount, loan purpose, interest rate, repayment schedule, and terms and conditions of the mortgage.

Fill out your mortgage or fixed equity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Or Fixed Equity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.