Get the free Non Fraud Cardholder Dispute Form - True Sky Credit Union

Show details

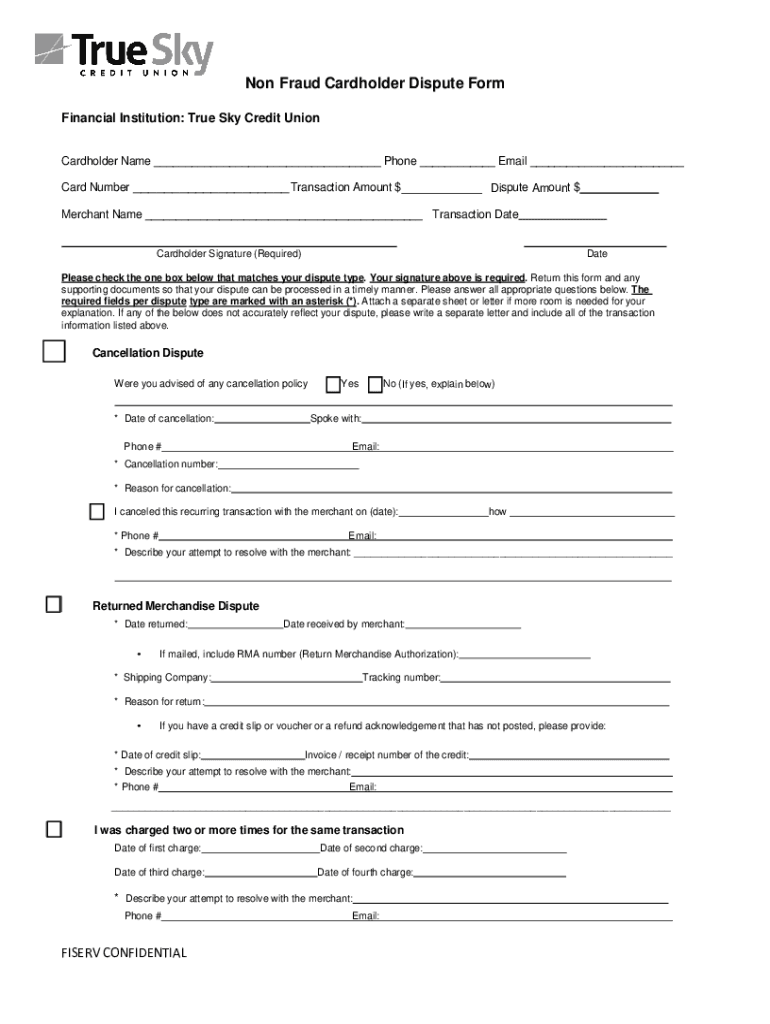

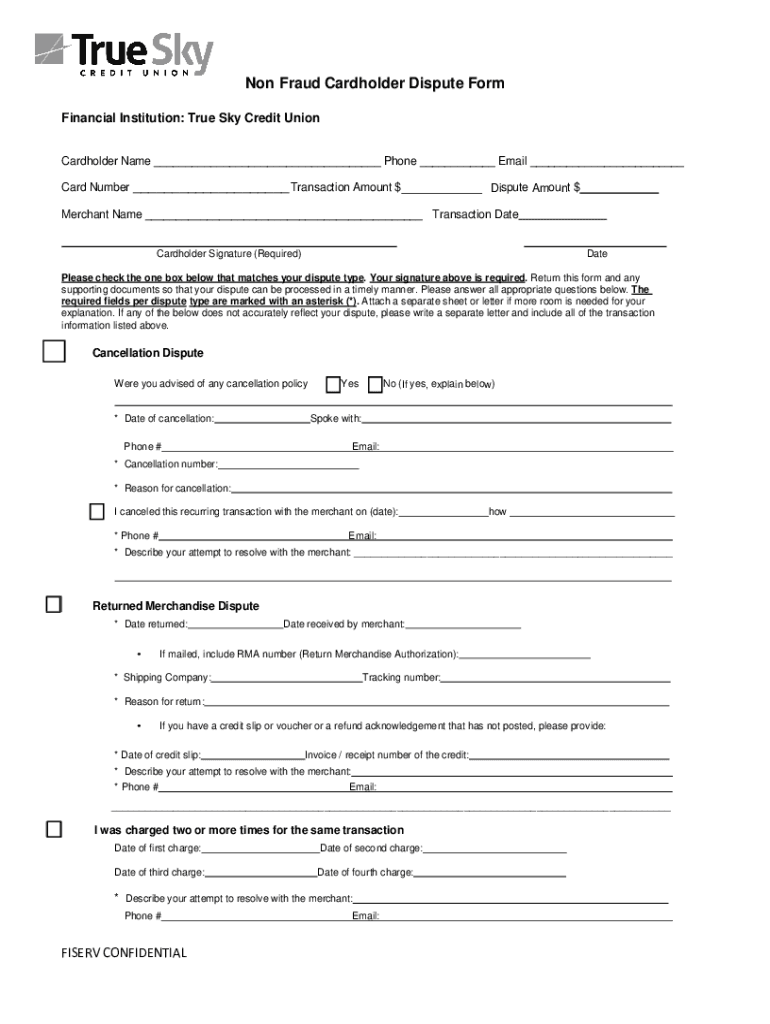

Non Fraud Cardholder Dispute Form Financial Institution: True Sky Credit Union Cardholder Name Phone Email Card Number Transaction Amount dispute Amount merchant Name Transaction Date Cardholder Signature

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non fraud cardholder dispute

Edit your non fraud cardholder dispute form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non fraud cardholder dispute form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non fraud cardholder dispute online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit non fraud cardholder dispute. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non fraud cardholder dispute

How to fill out non fraud cardholder dispute

01

To fill out a non-fraud cardholder dispute, follow these steps:

02

Gather all relevant information and documentation related to the dispute, such as transaction details, receipts, and any supporting evidence.

03

Contact your card issuer or bank and inform them about the dispute. Provide them with complete details and be prepared to answer any questions they may have.

04

Follow the instructions provided by your card issuer or bank on how to fill out their dispute form. This may involve completing an online form or submitting a written dispute letter.

05

Clearly and concisely explain the reason for your dispute, providing as much detail as possible. Include any supporting evidence or documentation that can help prove your case.

06

Make sure to submit your dispute within the specified timeframe set by your card issuer or bank. Missing this deadline may result in the rejection of your dispute.

07

Wait for the investigation to be carried out by your card issuer or bank. They may contact you for additional information or evidence during this process.

08

Keep records of all communications with your card issuer or bank regarding the dispute, including dates, names of representatives, and any reference numbers provided.

09

Review the final decision provided by your card issuer or bank. If you disagree with the outcome, you may have the option to escalate the dispute further.

10

If your dispute is resolved in your favor, make sure to monitor your account to ensure any disputed charges are properly credited back to your account.

Who needs non fraud cardholder dispute?

01

Non fraud cardholder disputes are needed by individuals who have identified unauthorized or disputed charges on their credit or debit card statements.

02

Common situations where non fraud cardholder disputes may be necessary include:

03

- Billing errors, such as double charges, incorrect amounts, or charges for goods or services not received.

04

- Disputes with merchants over the quality or non-delivery of goods or services purchased.

05

- Unauthorized charges made by someone other than the cardholder, such as in cases of stolen or lost cards.

06

Anyone who believes they have been wrongly charged or has a legitimate dispute regarding their card transactions should consider filing a non fraud cardholder dispute with their card issuer or bank. This allows them to seek resolution and potentially have any disputed charges refunded or reversed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my non fraud cardholder dispute in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your non fraud cardholder dispute and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find non fraud cardholder dispute?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the non fraud cardholder dispute. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in non fraud cardholder dispute?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your non fraud cardholder dispute to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is non fraud cardholder dispute?

A non fraud cardholder dispute refers to a situation where a cardholder contests a charge on their credit card statement for reasons other than fraud, such as dissatisfaction with a product or service, not receiving a product, or being charged incorrectly.

Who is required to file non fraud cardholder dispute?

Any cardholder who finds discrepancies or issues with their transactions that are not related to fraudulent activity is required to file a non fraud cardholder dispute.

How to fill out non fraud cardholder dispute?

To fill out a non fraud cardholder dispute, a cardholder typically needs to complete a dispute form provided by their credit card issuer, detailing the transaction in question, the reason for the dispute, and any supporting documentation.

What is the purpose of non fraud cardholder dispute?

The purpose of a non fraud cardholder dispute is to address and resolve issues regarding charges on a credit card statement that the cardholder believes are incorrect or unjust, thereby protecting consumer rights.

What information must be reported on non fraud cardholder dispute?

The information that must be reported typically includes the transaction date, transaction amount, merchant name, reasoning for the dispute, and any evidence supporting the claim.

Fill out your non fraud cardholder dispute online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non Fraud Cardholder Dispute is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.