Get the free Make a Budget - NACA

Show details

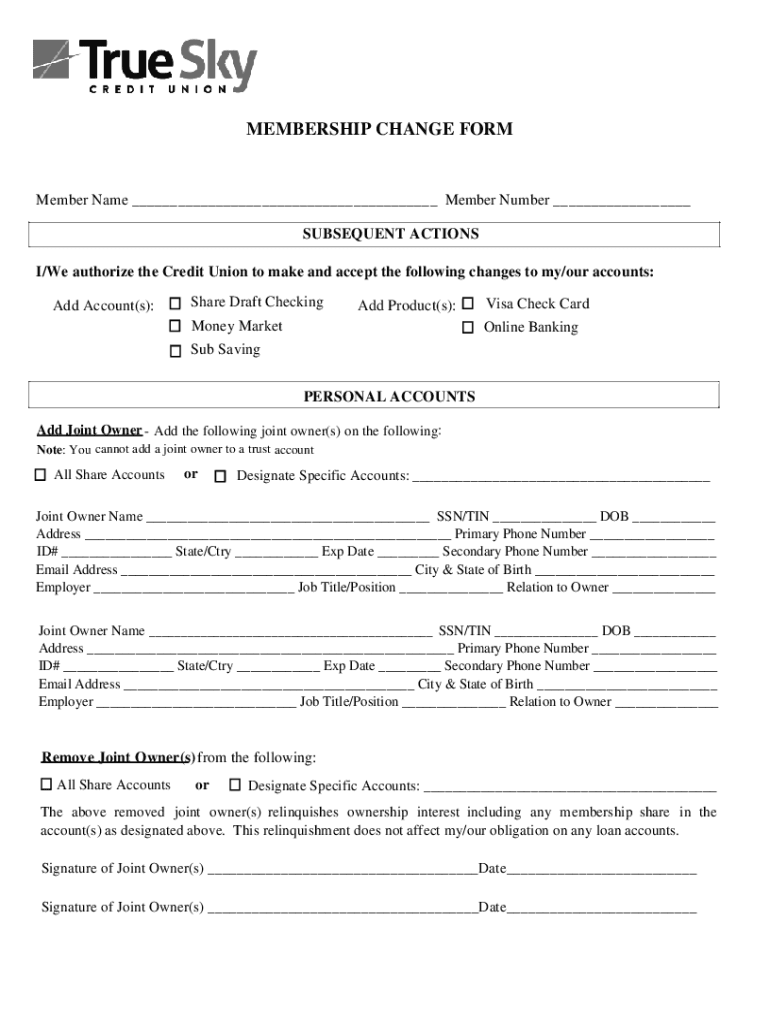

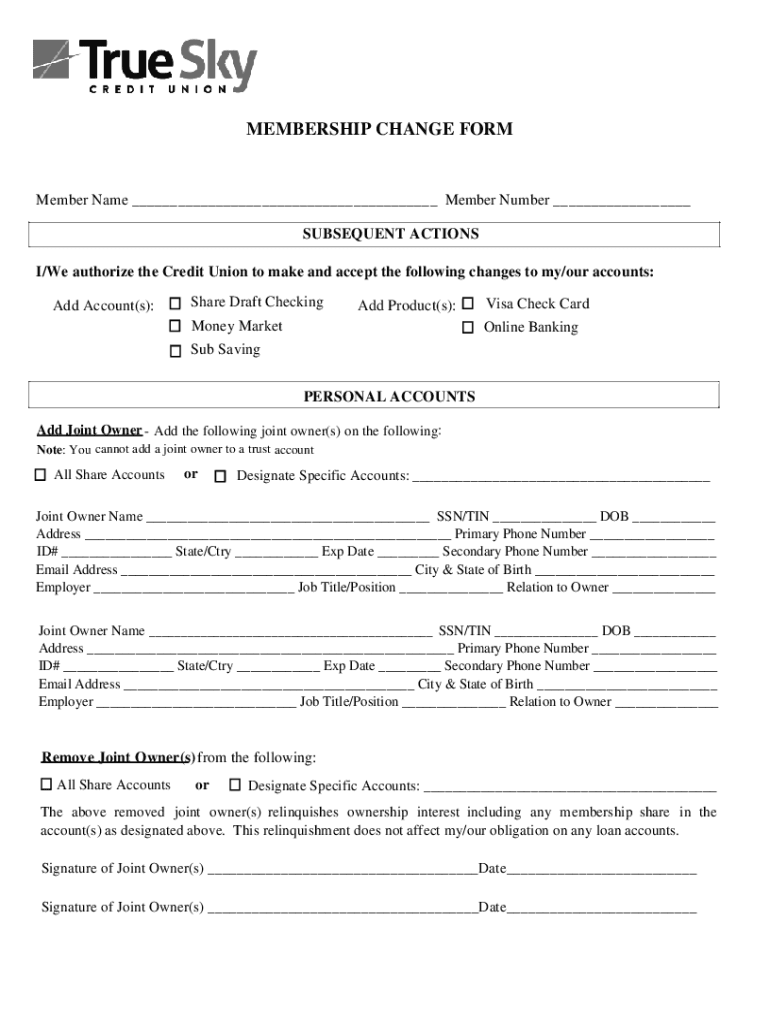

Load Membership CHANGE Remember Name Member Number SUBSEQUENT ACTIONSFidu Add SSN DAT Phi/We authorize the Credit Union to make and accept the following changes to my/our accounts: Share Draft Checking

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign make a budget

Edit your make a budget form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your make a budget form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit make a budget online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit make a budget. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out make a budget

How to fill out make a budget

01

Determine your income: Start by listing all of your sources of income, including your salary, investments, and any other sources of money you receive regularly.

02

Track your expenses: Keep track of all your expenses for a month or longer. Categorize them into essential expenses (such as rent, groceries, and bills) and discretionary expenses (such as dining out, entertainment, and shopping).

03

Set financial goals: Determine what you want to achieve financially. It could be saving for a vacation, paying off debt, or building an emergency fund.

04

Create a budget template: Use a spreadsheet or budgeting app to create a budget template. Include separate sections for income, essential expenses, discretionary expenses, savings, and debt payments.

05

Allocate your income: Distribute your income among the different budget categories based on your financial goals and priorities. Make sure to allocate enough for essential expenses and savings.

06

Prioritize savings and debt payments: It's crucial to save a portion of your income and allocate some towards debt payments, if applicable. Aim to save at least 10-20% of your income.

07

Track and adjust your budget: Regularly review your budget and track your actual spending. Make adjustments as necessary to ensure you stay on track and meet your financial goals.

08

Seek professional help if needed: If you find it challenging to create or stick to a budget, consider seeking help from a financial advisor or counselor. They can provide guidance and support.

Who needs make a budget?

01

Anyone who wants to take control of their finances and improve their financial situation can benefit from making a budget.

02

Individuals who have irregular income or find it hard to manage their expenses can greatly benefit from budgeting.

03

People who are looking to save money, reduce debt, plan for retirement, or achieve any financial goal can benefit from creating a budget.

04

Budgeting is especially important for young adults who are just starting their careers and want to establish good financial habits early on.

05

Families and individuals experiencing financial difficulties or aiming to better manage their spending can also benefit from making a budget.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send make a budget to be eSigned by others?

Once your make a budget is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get make a budget?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific make a budget and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit make a budget on an iOS device?

Use the pdfFiller mobile app to create, edit, and share make a budget from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is make a budget?

Making a budget involves creating a plan for managing your income and expenses to ensure you can meet your financial goals.

Who is required to file make a budget?

Individuals and organizations looking to manage their finances effectively are encouraged to make a budget, but there are no legal requirements for most people.

How to fill out make a budget?

To fill out a budget, list your income sources, categorize your expenses, estimate costs for each category, and ensure your total expenses do not exceed your total income.

What is the purpose of make a budget?

The purpose of making a budget is to gain control over your finances, track spending, save for future goals, and avoid debt.

What information must be reported on make a budget?

A budget should report income details, fixed and variable expenses, savings, and any debts to provide a full financial picture.

Fill out your make a budget online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Make A Budget is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.