Get the free DOCUMENTACIN ICF UNIVERSIDAD DE NAVARRA

Show details

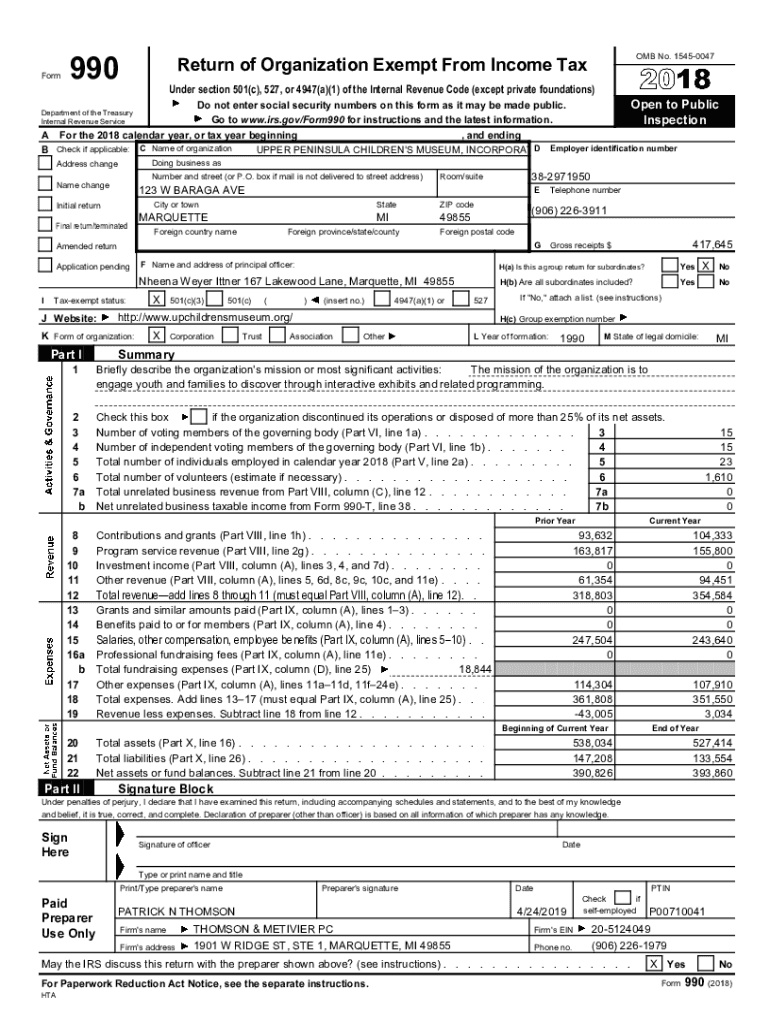

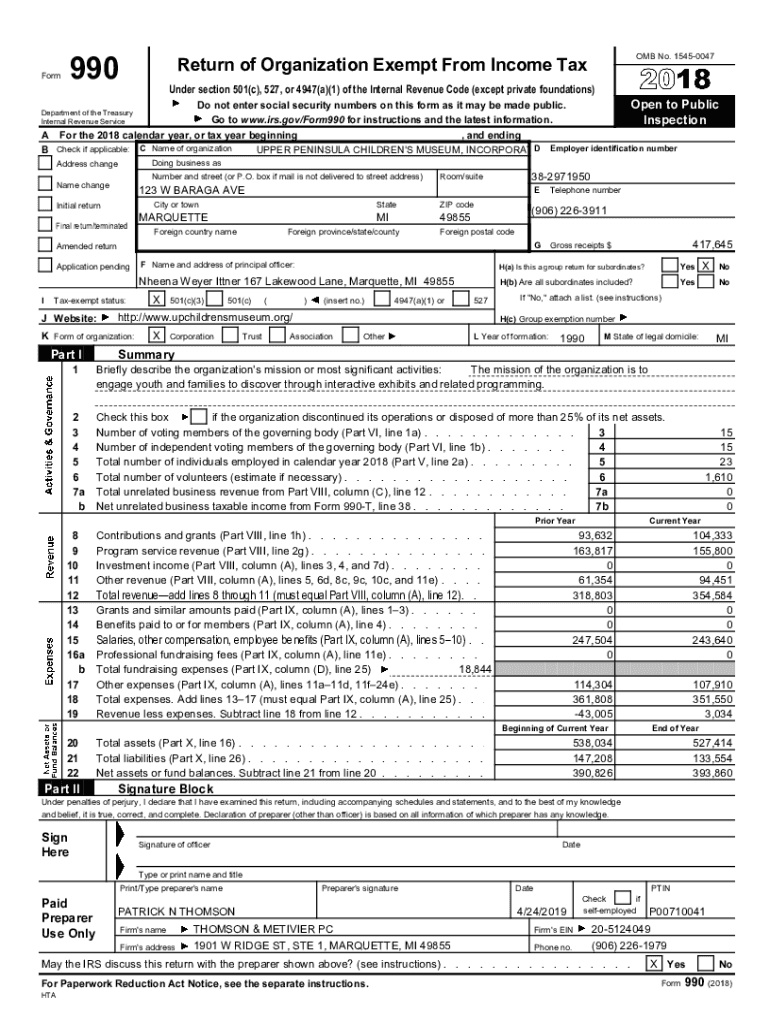

990FormOMB No. 15450047Return of Organization Exempt From Income Tax Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)Open to Public Inspection not

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign documentacin icf universidad de

Edit your documentacin icf universidad de form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your documentacin icf universidad de form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing documentacin icf universidad de online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit documentacin icf universidad de. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out documentacin icf universidad de

How to fill out documentacin icf universidad de

01

To fill out the documentacin icf universidad de, follow these steps:

02

Start by visiting the official website of ICF Universidad de.

03

Locate the documentacin section or any specific form related to the desired documentation.

04

Download the form or documents required for the specific purpose.

05

Carefully read the instructions and requirements mentioned in the document.

06

Gather all the necessary information and supporting documents as per the requirements.

07

Fill out the form or documents accurately and legibly.

08

Double-check the provided information for any mistakes or missing fields.

09

Once you are confident that everything is filled out correctly, submit the filled forms/documents as per the provided instructions.

10

Keep a copy of the filled documents for your records.

11

If required, follow up with the university or relevant department for any further steps or clarifications.

Who needs documentacin icf universidad de?

01

Documentacin icf universidad de is needed by individuals who are applying to ICF Universidad de for various purposes such as admission, enrollment, scholarship, or any other academic or administrative procedures.

02

Students who wish to pursue a degree or certificate program, transfer credits, or receive financial aid may require documentacin icf universidad de.

03

Faculty and staff members may also need to submit specific documents for employment or administrative purposes.

04

In general, anyone who has a formal affiliation or interaction with ICF Universidad de may require documentacin icf universidad de at some point in their academic or professional journey.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send documentacin icf universidad de to be eSigned by others?

When your documentacin icf universidad de is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my documentacin icf universidad de in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your documentacin icf universidad de directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out documentacin icf universidad de on an Android device?

Use the pdfFiller Android app to finish your documentacin icf universidad de and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is documentacin icf universidad de?

ICF Universidad de is a set of documentation required for university enrollment.

Who is required to file documentacin icf universidad de?

All students applying to Universidad de are required to submit the documentacin ICF.

How to fill out documentacin icf universidad de?

The documentacin ICF can be filled out online through the university's portal or in person at the admissions office.

What is the purpose of documentacin icf universidad de?

The purpose of documentacin ICF is to verify the academic background and qualifications of the applicants.

What information must be reported on documentacin icf universidad de?

The documentacin ICF typically includes academic transcripts, certificates, and proof of identity.

Fill out your documentacin icf universidad de online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Documentacin Icf Universidad De is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.