Get the free Tax Preparation Checklist

Show details

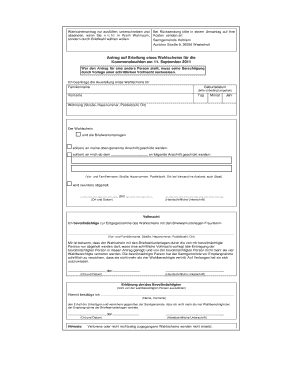

A comprehensive checklist to help individuals gather necessary documentation and information required for preparing their income tax return for the year 2011. It covers personal information, income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax preparation checklist

Edit your tax preparation checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax preparation checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax preparation checklist online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax preparation checklist. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax preparation checklist

How to fill out Tax Preparation Checklist

01

Gather all necessary documents, including income statements, W-2s, 1099s, and deduction receipts.

02

Review last year's tax return for reference and any carryover information.

03

Complete sections for personal information, including names, addresses, and Social Security numbers.

04

Enter income details accurately from all sources of income.

05

List any tax deductions and credits you qualify for, supported by necessary documentation.

06

Double-check entries for accuracy and completeness.

07

Sign and date the checklist once all information is verified.

Who needs Tax Preparation Checklist?

01

Individuals who are filing their taxes, including both employed and self-employed persons.

02

Small business owners needing to prepare their business taxes.

03

Tax preparers who assist clients in organizing their tax documents.

04

Students and educators looking for tax credits and deductions applicable to them.

05

Anyone seeking to ensure they don't miss any essential tax items.

Fill

form

: Try Risk Free

People Also Ask about

What documents do I need to keep for tax purposes?

Supporting documents include sales slips, paid bills, invoices, receipts, deposit slips, and canceled checks. These documents contain the information you need to record in your books. It is important to keep these documents because they support the entries in your books and on your tax return.

How much should I pay for tax preparation?

Average cost of Tax Preparation in the US LocationAverage tax preparation cost California $250 Texas $195 New York $235 Wisconsin $1701 more row

What are the 5 simple steps for filing taxes?

So, let's walk step by step through how to file taxes—with zero worry. Step 1: Check Whether You Need to File. First things first: Do you even have to file taxes? Step 2: Gather Your Tax Documents. Step 3: Pick a Filing Status. Step 4: Take Advantage of Deductions and Credits. Step 5: File Your Taxes.

What do I need to bring to my IRS appointment?

Prepare for your appointment A driver's license. State identification card. Passport. Social Security Card. Tribal membership document. NOTE: A Tribal Membership card is not a federally issued ID. Car Title. Voter Registration card. Mortgage Statement.

Do I need to bring my social security card to file my taxes?

In addition to proof of your identity, and the identities of your family members, documents you should bring to a tax preparer include: Social Security cards. income statements such as W-2s and 1099s. tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations.

What do I need to prepare for an income tax return?

Forms W-2, 1099 or other information returns Form 1099-K for payments from payment cards and online marketplaces. Form 1099-G for government payments such as unemployment benefits. Form 1099-INT from banks and brokers showing interest you received. Form 1099-DIV for dividends and distributions paid to you.

What forms do I need to wait for to file taxes?

Forms W-2, 1099 or other information returns People or organizations that paid you during the year are required to report the payments to the IRS on an information return. They must file these forms with the IRS and send a copy to you. You should get them electronically or by mail in January or February.

What documents do I need when doing my taxes?

A W-2 form from each employer. Other earning and interest statements (1099 and 1099-INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business costs; and other tax-deductible expenses if you are itemizing your return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Preparation Checklist?

A Tax Preparation Checklist is a document or guide that outlines all the necessary steps and information needed to prepare and file taxes efficiently and accurately.

Who is required to file Tax Preparation Checklist?

Individuals and businesses who are required to file taxes should use a Tax Preparation Checklist to ensure they have all the necessary documents and information.

How to fill out Tax Preparation Checklist?

To fill out a Tax Preparation Checklist, review each item on the list, gather the required documents and information, and check off each item as you complete it.

What is the purpose of Tax Preparation Checklist?

The purpose of a Tax Preparation Checklist is to help taxpayers organize their financial information and documents to simplify the tax filing process and reduce the risk of errors.

What information must be reported on Tax Preparation Checklist?

The information that must be reported on a Tax Preparation Checklist includes income details, deduction receipts, tax credits, previous year tax returns, and any relevant financial documents.

Fill out your tax preparation checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Preparation Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.