Get the free AUDIT AND RISK SCRUTINY COMMITTEE

Show details

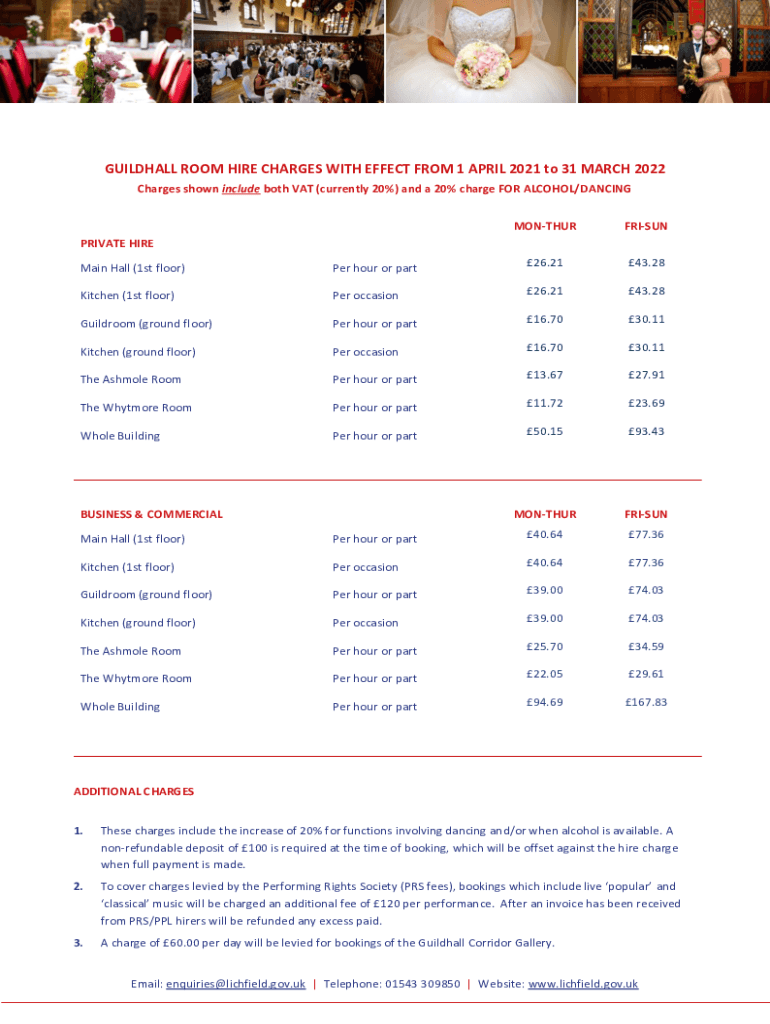

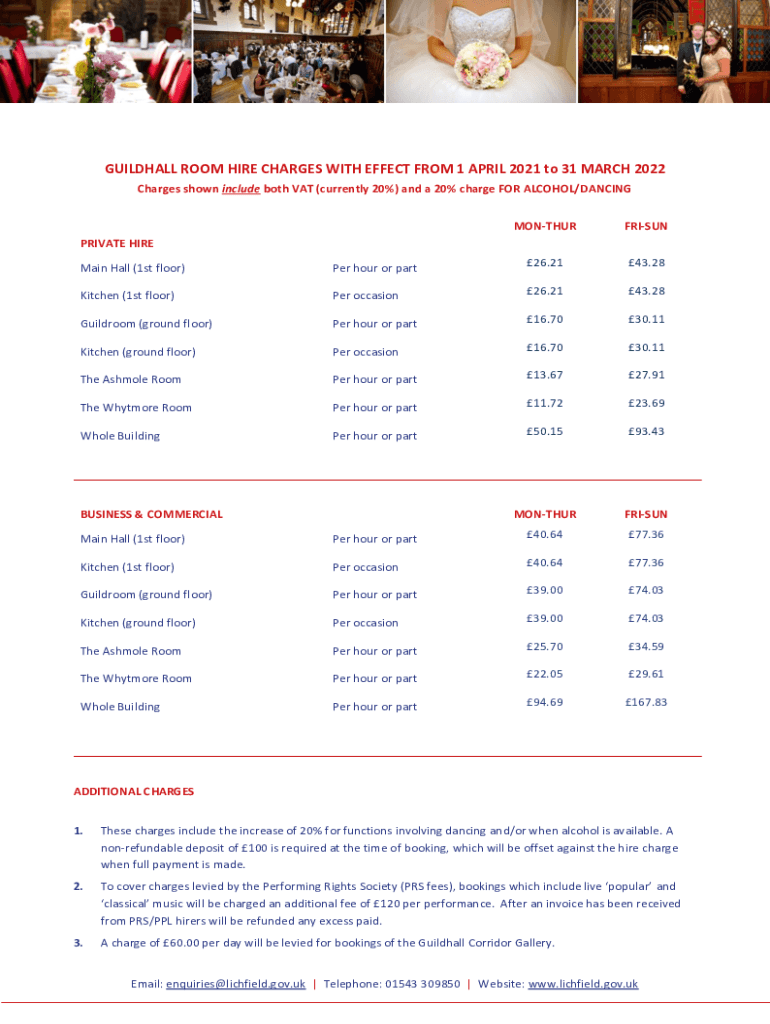

GUILDHALL ROOM HIRE CHARGES WITH EFFECT FROM 1 APRIL 2021 to 31 MARCH 2022 Charges shown include both VAT (currently 20%) and a 20% charge FOR ALCOHOL/DANCING MONTHURFRISUNPRIVATE HIRE Main Hall (1st

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit and risk scrutiny

Edit your audit and risk scrutiny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit and risk scrutiny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit audit and risk scrutiny online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit audit and risk scrutiny. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audit and risk scrutiny

How to fill out audit and risk scrutiny

01

To fill out an audit and risk scrutiny, follow these steps:

02

Begin by gathering all necessary information and documents related to the audit and risk being scrutinized.

03

Identify the scope and objectives of the audit and risk scrutiny.

04

Conduct a thorough analysis of the audit and risk factors, considering both internal and external influences.

05

Evaluate the effectiveness of existing controls and procedures in place to manage audit and risk.

06

Document any identified weaknesses or areas for improvement.

07

Develop and implement recommendations for enhancing audit and risk management practices.

08

Review and validate the findings, ensuring accuracy and relevance.

09

Prepare a comprehensive report summarizing the audit and risk scrutiny, including the methodology, findings, and recommendations.

10

Communicate the report to relevant stakeholders, such as management and board members.

11

Monitor the implementation of recommended changes and track their impact over time.

Who needs audit and risk scrutiny?

01

Audit and risk scrutiny is needed by various stakeholders, including:

02

- Organizations of all sizes and across industries to ensure compliance with regulations and mitigate potential risks.

03

- Internal audit departments within companies to evaluate and improve internal controls and identify areas of vulnerability.

04

- External auditors to assess the financial statements and accounts of organizations.

05

- Investors and shareholders to gain confidence in the financial health and risk management practices of a company.

06

- Regulators and government agencies to oversee the compliance of organizations with legal and regulatory requirements.

07

- Insurance companies to assess the risk profiles of potential clients and determine appropriate coverage and premiums.

08

- Non-profit organizations to ensure transparency and accountability in the use of funds and resources.

09

- Individuals or groups seeking to acquire or invest in a company, conducting due diligence to understand its financial position and risk exposure.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit audit and risk scrutiny from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your audit and risk scrutiny into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I get audit and risk scrutiny?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the audit and risk scrutiny. Open it immediately and start altering it with sophisticated capabilities.

How do I edit audit and risk scrutiny straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing audit and risk scrutiny right away.

What is audit and risk scrutiny?

Audit and risk scrutiny is a process of evaluating and examining an organization's financial records and procedures to ensure accuracy, compliance, and risk management.

Who is required to file audit and risk scrutiny?

Companies, organizations, and individuals subject to regulatory requirements or internal policies may be required to file audit and risk scrutiny.

How to fill out audit and risk scrutiny?

Audit and risk scrutiny can be filled out by gathering necessary financial documents, analyzing data, and documenting findings in the appropriate forms.

What is the purpose of audit and risk scrutiny?

The purpose of audit and risk scrutiny is to identify potential financial risks, ensure regulatory compliance, and improve overall financial management practices.

What information must be reported on audit and risk scrutiny?

Information such as financial statements, transaction details, internal controls, and risk assessments must be reported on audit and risk scrutiny.

Fill out your audit and risk scrutiny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit And Risk Scrutiny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.