NY IT-2105-I 2021 free printable template

Show details

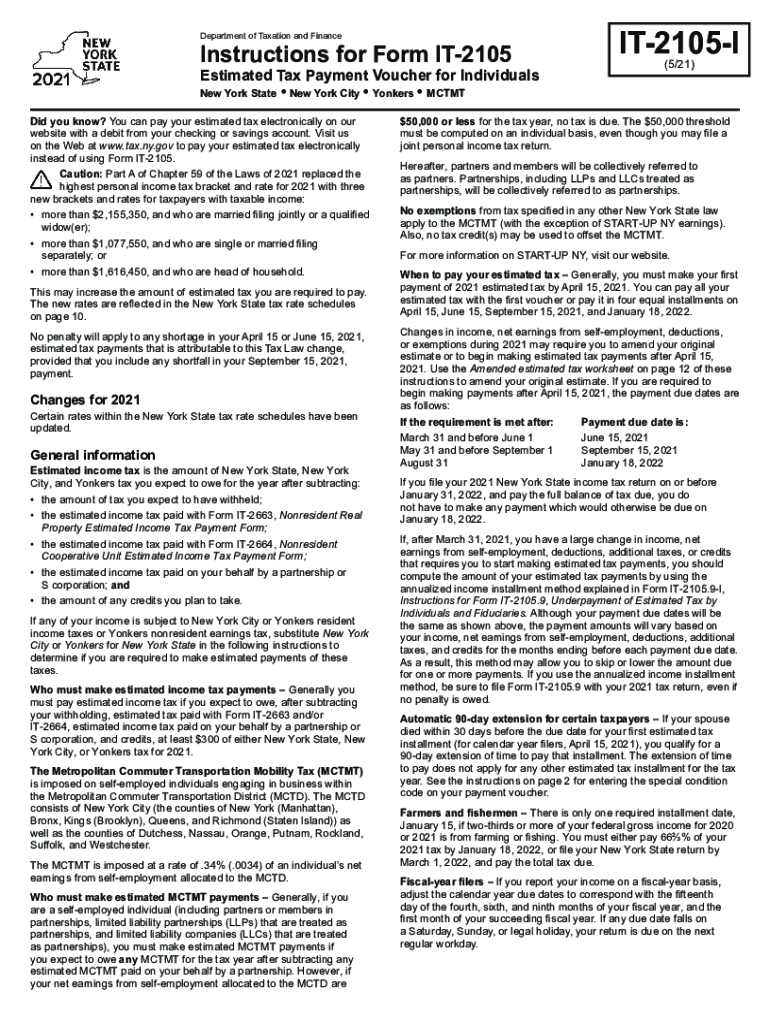

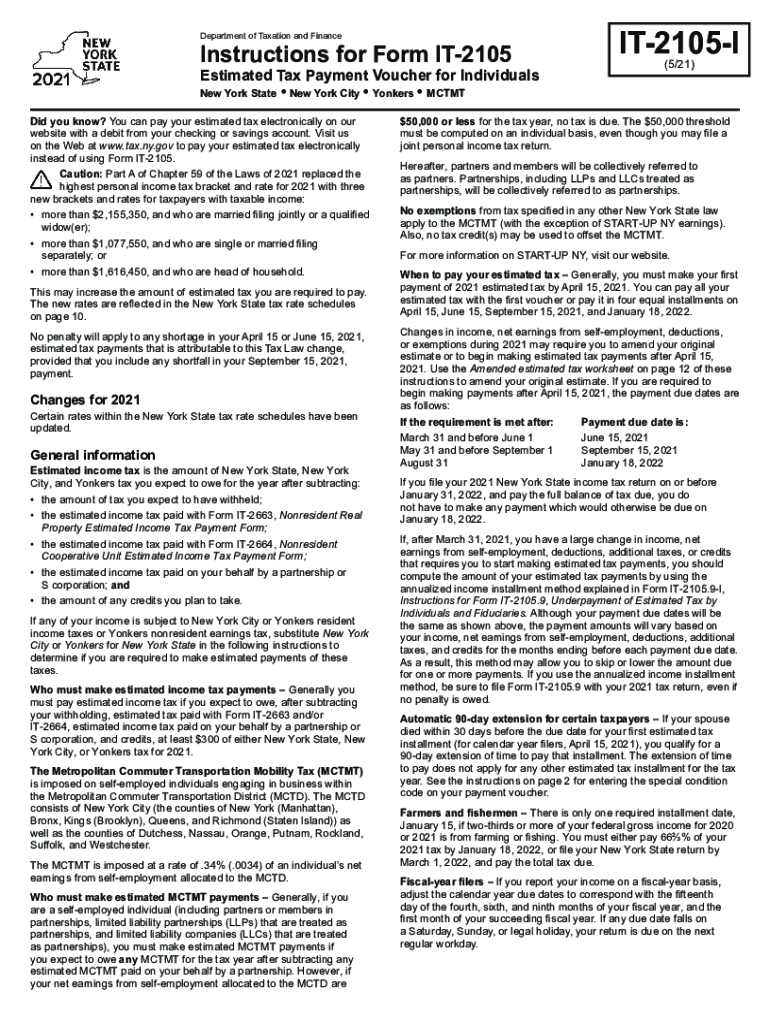

Department of Taxation and FinanceInstructions for Form IT2105Estimated Tax Payment Voucher for Individuals New York State New York City Yonkers MC TMT Did you know? You can pay your estimated tax

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY IT-2105-I

Edit your NY IT-2105-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY IT-2105-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY IT-2105-I online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY IT-2105-I. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY IT-2105-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY IT-2105-I

How to fill out NY IT-2105-I

01

Gather your personal information, including your Social Security Number and address.

02

Obtain income information from all sources for the year.

03

Complete Section A with your estimated tax due. Use the New York State income tax rate tables for assistance.

04

Fill out Section B if you anticipate having deductions, credits, or exemptions.

05

Calculate your total estimated tax liability in Section C.

06

Report any payments made on your behalf in Section D.

07

Review all information for accuracy before submission.

08

Sign and date the form, and keep a copy for your records.

Who needs NY IT-2105-I?

01

Individuals who expect to owe New York State income tax and need to make estimated tax payments.

02

Self-employed individuals or those with significant other income not subject to withholding.

03

Taxpayers who do not qualify for withholding on their income.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a NY state tax form?

Usually, you can also get the most commonly used income tax forms and instructions at your local library. Visit the New York State Education Department website to find libraries near you: Find Your Public Library in New York State by Public Library System.

How do I respond to a NYS tax audit?

Ready to respond? Log in to or create your Online Services account. Select the ≡ Services menu, then choose Respond to department notice. From the Notices page, select your notice from the Quick response section. Use the Actions drop-down to view or respond to the notice you received.

What is 2105.9 form?

Form IT-2105.9 Underpayment of Estimated Income Tax By Individuals and Fiduciaries Tax Year 2022.

How do I get NYS tax forms?

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

Does NY have state income tax form?

If you live in the state of New York or earn income within the state, it's likely you will have to pay New York income tax. And with that, comes completing and filing New York (NYS) tax forms. Read on to learn more about common NYS tax forms here!

What is estimated tax payment voucher for individuals?

The IRS provides Form 1040-ES for you to calculate and pay estimated taxes for the current year. While the 1040 relates to the previous year, the estimated tax form calculates taxes for the current year. You use Form 1040-ES to pay income tax, self-employment tax and any other tax you may be liable for.

How to make nys tax payment plan?

Log in to your Online Services account (You'll need to create an account if you don't already have one). Select the ≡ Services menu in the upper left-hand corner of your Account Summary homepage. Select Payments, bills and notices, and then Installment payment agreement from the drop-down menu.

How do I write a check to New York State income tax?

If you are paying New York State income tax by check or money order, you must include Form IT-201-V with your payment. Make your check or money order payable in U.S. funds to New York State Income Tax. Be sure to write the last four digits of your Social Security number (SSN), the tax year, and Income Tax on it.

What is NY IT 2105?

Form IT-2105, Estimated Tax Payment Voucher for Individuals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NY IT-2105-I from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including NY IT-2105-I, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I sign the NY IT-2105-I electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out NY IT-2105-I on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your NY IT-2105-I. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is NY IT-2105-I?

NY IT-2105-I is the New York State Estimated Tax Payment voucher for individuals. It is used by taxpayers to submit estimated tax payments to the New York State Department of Taxation and Finance.

Who is required to file NY IT-2105-I?

Individuals who expect to owe tax of $300 or more for the tax year and who are not subject to the withholding tax system are required to file NY IT-2105-I.

How to fill out NY IT-2105-I?

To fill out NY IT-2105-I, taxpayers need to provide their personal information including name, address, and Social Security number, indicate the amount of estimated tax due, and any prior payments made. Then, the total payment should be enclosed with the voucher.

What is the purpose of NY IT-2105-I?

The purpose of NY IT-2105-I is to facilitate the payment of estimated income tax for individuals who do not have sufficient tax withheld from their income throughout the year.

What information must be reported on NY IT-2105-I?

On NY IT-2105-I, taxpayers must report their name, address, Social Security number, tax year, amount of estimated tax due, and any payments already made towards their estimated taxes.

Fill out your NY IT-2105-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY IT-2105-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.