Get the free 2011 LASER 1099 QUICK REFERENCE SHEET - scouting

Show details

This document serves as a quick reference sheet for the 2011 LASER 1099 Misc. form, detailing the different copies, packaging, state requirements, and ordering instructions for tax forms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 laser 1099 quick

Edit your 2011 laser 1099 quick form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 laser 1099 quick form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2011 laser 1099 quick online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2011 laser 1099 quick. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 laser 1099 quick

How to fill out 2011 LASER 1099 QUICK REFERENCE SHEET

01

Gather all necessary financial information for the year 2011.

02

Obtain the 2011 LASER 1099 Quick Reference Sheet from the IRS or your tax preparation software.

03

Identify the appropriate recipient for the 1099 form and ensure their information is accurate.

04

Fill out the payer's information, including name, address, and identification number.

05

Input the amount paid to the recipient in the appropriate box on the form.

06

Select the correct type of 1099 form based on the nature of the payment.

07

Double-check all entries for accuracy and compliance with IRS guidelines.

08

Sign and date the form, if required, and send it to the recipient and the IRS by the deadline.

Who needs 2011 LASER 1099 QUICK REFERENCE SHEET?

01

Businesses that made payments to independent contractors or other entities in 2011.

02

Individuals who require documentation for tax filing purposes regarding 1099 reporting.

03

Accountants and tax preparers handling multiple clients who need to report payments made in 2011.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get free 1099 forms?

No cost. You can order as many forms as you like by calling 1-800-TAX-FORM (800-829-3676), an IRS provided toll-free number. There is no charge for calling, shipping or handling and they will ship up to 100 forms per call. It takes anywhere from 3 days to 2-weeks to receive the forms.

Can I get 1099 forms at the library?

During the tax-filing season, many libraries and some post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly-requested publications. Braille materials for the blind are also available.

How can I get a copy of an old 1099?

If you are looking for 1099s from earlier years, you can contact the IRS and order a “wage and income transcript”.

Can I get blank 1099 forms at the post office?

No, Post Offices do not have tax forms available for customers. However, you can view, download, and print specific tax forms and publications at the "Forms, Instructions & Publications" page of the IRS website. You may also acquire tax forms through the mail.

Can I download and print a 1099 form?

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient. If you have 10 or more information returns to file, you may be required to file e-file.

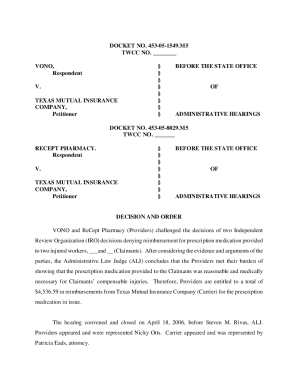

What is the difference between 1099 and 1099-NEC?

Form 1099-MISC reports for various payments, like rent or prizes, that aren't subject to self-employment tax. Form 1099-NEC reports nonemployee compensation, such as payments to independent contractors.

Can 1099 be printed on regular paper?

You can use plain white paper to print W-2 Copy A and W-3 forms. For Form 1099s, Copy A uses red ink and must be ordered from the IRS or purchased from a tax supply vendor. All other parts of Form 1099 can be printed on plain white paper.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2011 LASER 1099 QUICK REFERENCE SHEET?

The 2011 LASER 1099 Quick Reference Sheet is a guide that provides information and instructions on how to complete Form 1099 for reporting various types of income to the IRS.

Who is required to file 2011 LASER 1099 QUICK REFERENCE SHEET?

Organizations and individuals who have made payments that meet certain thresholds in the previous tax year, such as independent contractors or specific types of payments, are required to file the 2011 LASER 1099.

How to fill out 2011 LASER 1099 QUICK REFERENCE SHEET?

To fill out the 2011 LASER 1099 Quick Reference Sheet, one should gather the required information for the payee and payor, enter it in the correct boxes on the form, and ensure that the amounts are accurate before submitting it to the IRS.

What is the purpose of 2011 LASER 1099 QUICK REFERENCE SHEET?

The purpose of the 2011 LASER 1099 Quick Reference Sheet is to assist taxpayers in understanding their reporting obligations and provide a streamlined method for correctly completing the Form 1099.

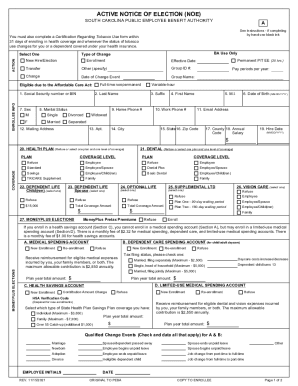

What information must be reported on 2011 LASER 1099 QUICK REFERENCE SHEET?

Information that must be reported includes the payee's name, address, taxpayer identification number, the total amount of payments made, and the type of payments.

Fill out your 2011 laser 1099 quick online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 Laser 1099 Quick is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.