Get the free Property Tax - Alabama Department of Revenue

Show details

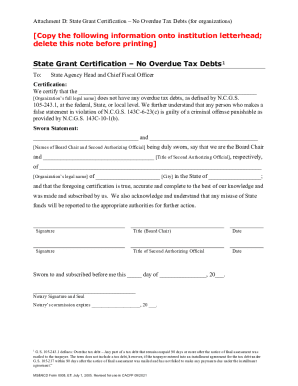

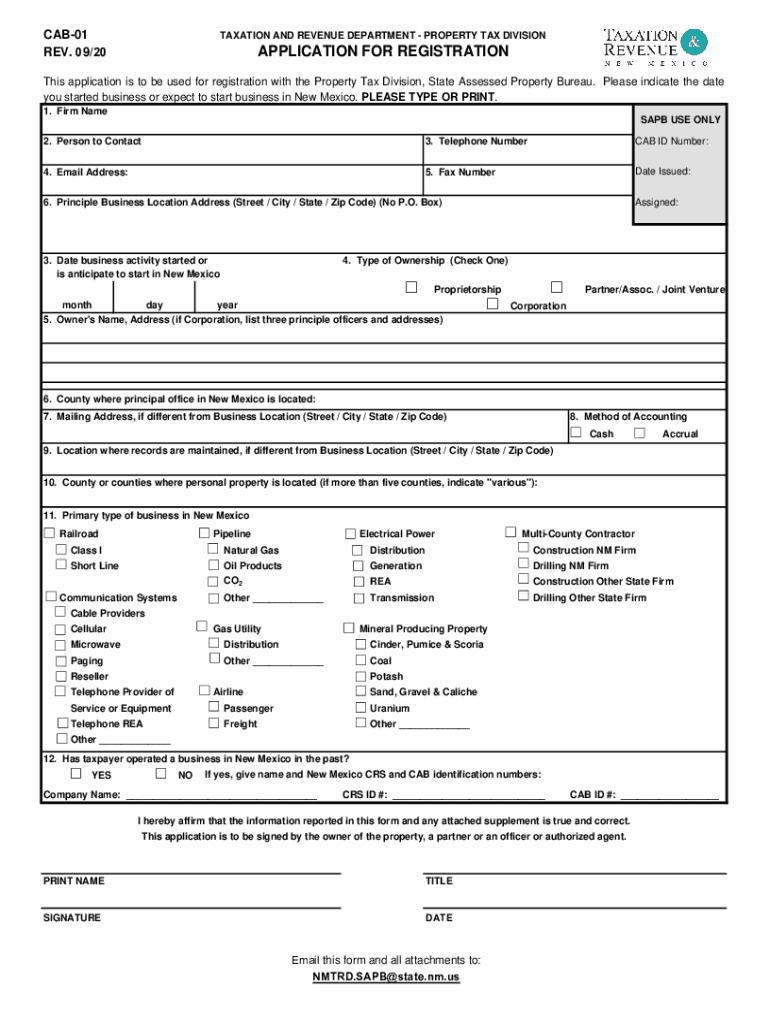

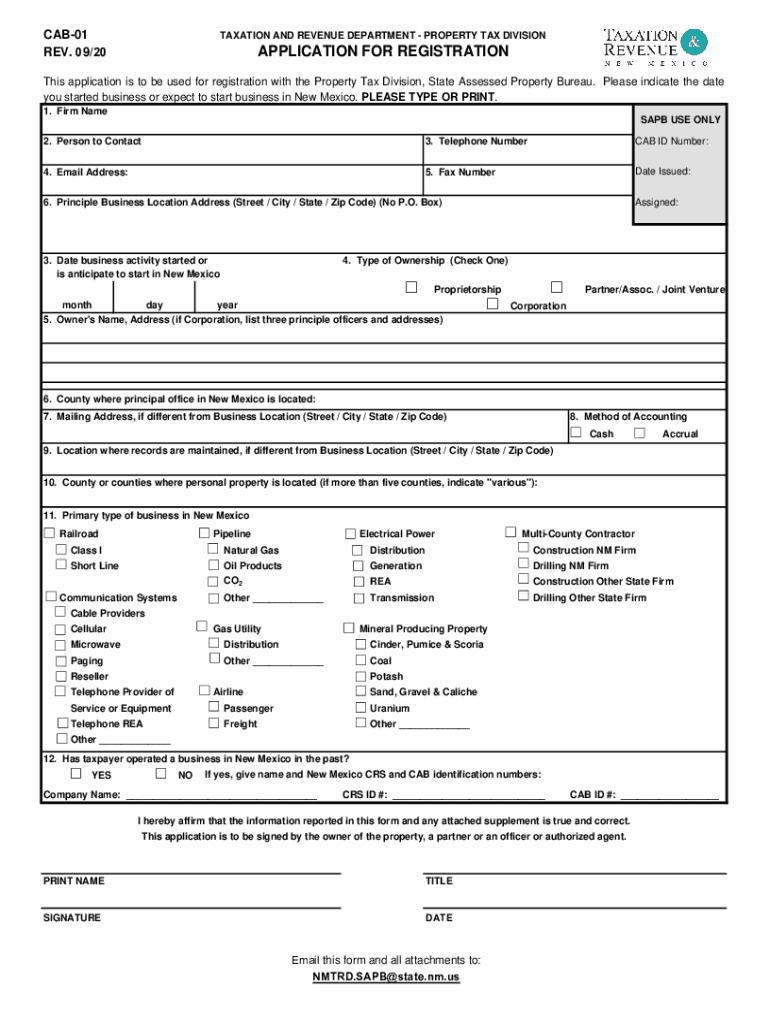

CAB01 REV. 09/20TAXATION AND REVENUE DEPARTMENT PROPERTY TAX DIVISIONALIZATION FOR Registrations application is to be used for registration with the Property Tax Division, State Assessed Property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax - alabama

Edit your property tax - alabama form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax - alabama form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax - alabama online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit property tax - alabama. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax - alabama

How to fill out property tax - alabama

01

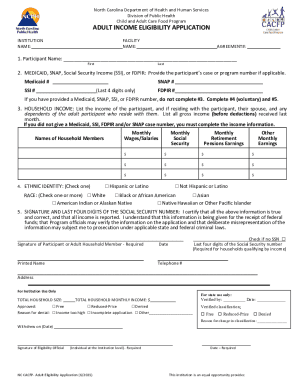

To fill out property tax in Alabama, follow these steps:

02

Obtain the property tax form from the Alabama Department of Revenue website or from your local county tax office.

03

Fill out your personal information including your name, address, and contact information.

04

Provide details about the property you own, such as the address, parcel number, and any improvements or changes made to the property since the last assessment.

05

Calculate the value of your property based on the assessment ratio provided by the county tax office.

06

Determine the applicable tax rate for your property based on its classification (residential, commercial, agricultural, etc.).

07

Calculate the amount of property tax owed by multiplying the value of your property by the tax rate.

08

Check if there are any deductions or exemptions available for your property, such as the Homestead Exemption for primary residences.

09

Apply for any eligible deductions or exemptions by providing the required documentation.

10

Include any additional information or supporting documents as requested on the tax form.

11

Review the completed form for accuracy and sign it.

12

Submit the filled out property tax form along with any required payment to the designated county tax office by the specified deadline.

13

Note: The specific process and requirements may vary slightly depending on the county in Alabama.

Who needs property tax - alabama?

01

Anyone who owns property in Alabama needs to pay property tax. This includes individuals, corporations, and other legal entities that own residential, commercial, or agricultural properties.

02

Property tax is assessed and collected by the local county tax office, and the funds generated from property tax are used to support local services and infrastructure such as schools, roads, and public safety.

03

Failure to pay property tax can result in penalties, interest charges, and even the potential loss of the property through a tax lien or foreclosure process.

04

Therefore, it is essential for property owners in Alabama to fulfill their property tax obligations to avoid negative consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get property tax - alabama?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific property tax - alabama and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit property tax - alabama on an Android device?

You can make any changes to PDF files, such as property tax - alabama, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I fill out property tax - alabama on an Android device?

Complete property tax - alabama and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is property tax - Alabama?

Property tax in Alabama is a tax on real estate property imposed by local governments to generate revenue for services and programs.

Who is required to file property tax - Alabama?

Property owners in Alabama are required to file property tax.

How to fill out property tax - Alabama?

To fill out property tax in Alabama, property owners must provide information about their property, including its value and any improvements.

What is the purpose of property tax - Alabama?

The purpose of property tax in Alabama is to fund local government services, such as schools, roads, and public safety.

What information must be reported on property tax - Alabama?

Property owners in Alabama must report information such as the value of their property, any improvements made, and any exemptions they may qualify for.

Fill out your property tax - alabama online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax - Alabama is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.