Get the free Personal Financial Statement - Dollar Bank

Show details

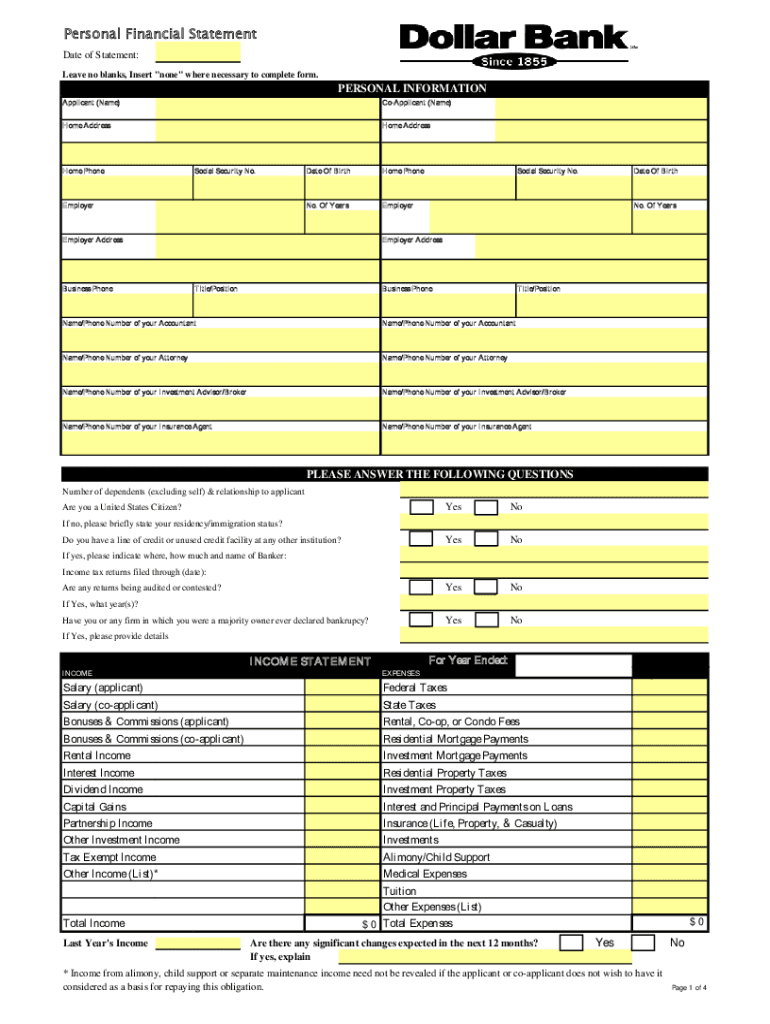

Personal Financial Statement Date of Statement: Leave no blanks, Insert none where necessary to complete form. PERSONAL INFORMATION Applicant (Name)Applicant (Name)Home Addressable Phonetician Security

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal financial statement

Edit your personal financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal financial statement online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal financial statement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal financial statement

How to fill out personal financial statement

01

To fill out a personal financial statement, follow these steps:

02

Gather all relevant financial documents, such as bank statements, investment statements, loan statements, and credit card statements.

03

Start by listing your personal information, including your name, address, and contact information.

04

Provide details about your assets, such as cash, real estate, investments, and vehicles. Include the current value of each asset.

05

List your liabilities, including mortgages, loans, credit card debt, and other outstanding debts. Specify the amount owed for each liability.

06

Calculate your net worth by subtracting your liabilities from your assets.

07

Provide information about your income, including salary, bonuses, commissions, rental income, and any other sources of income.

08

Specify your monthly expenses, including housing costs, utilities, transportation expenses, debt payments, insurance premiums, and other recurring expenses.

09

Calculate your monthly net cash flow by subtracting your expenses from your income.

10

Review your financial statement for accuracy and completeness. Make any necessary adjustments.

11

Sign and date the personal financial statement to certify its accuracy.

Who needs personal financial statement?

01

Personal financial statements are needed by individuals who:

02

- Are applying for a loan from a bank or financial institution

03

- Want to assess their current financial position and plan for the future

04

- Are going through a divorce or legal separation

05

- Need to provide financial information for tax purposes

06

- Want to track their personal net worth over time

07

- Are seeking investment opportunities and need to attract potential investors

08

- Are involved in estate planning and need to evaluate their assets and liabilities

09

- Want to apply for certain types of insurance policies

10

- Are considering a career change and want to assess their financial stability

11

- Wish to create a comprehensive financial plan to achieve their financial goals

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in personal financial statement?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your personal financial statement to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for the personal financial statement in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your personal financial statement in minutes.

How do I complete personal financial statement on an Android device?

Complete personal financial statement and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is personal financial statement?

A personal financial statement is a document that provides an overview of an individual's financial position, including their assets, liabilities, income, and expenses.

Who is required to file personal financial statement?

Individuals seeking loans, applying for grants, or involved in certain financial assessments, such as banks or government agencies, may be required to file a personal financial statement.

How to fill out personal financial statement?

To fill out a personal financial statement, list all assets and their values, all liabilities and their amounts, categorize income sources, and provide an overview of monthly expenses before summarizing the total assets, liabilities, and net worth.

What is the purpose of personal financial statement?

The purpose of a personal financial statement is to evaluate an individual's financial health, assist in securing loans or financing, and provide a basis for financial planning or investment decisions.

What information must be reported on personal financial statement?

The personal financial statement must report all assets (like cash, real estate, investments), liabilities (such as loans, credit card debts), income (salary, dividends), and expenses (living costs, debts).

Fill out your personal financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Financial Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.