Get the free S "

Show details

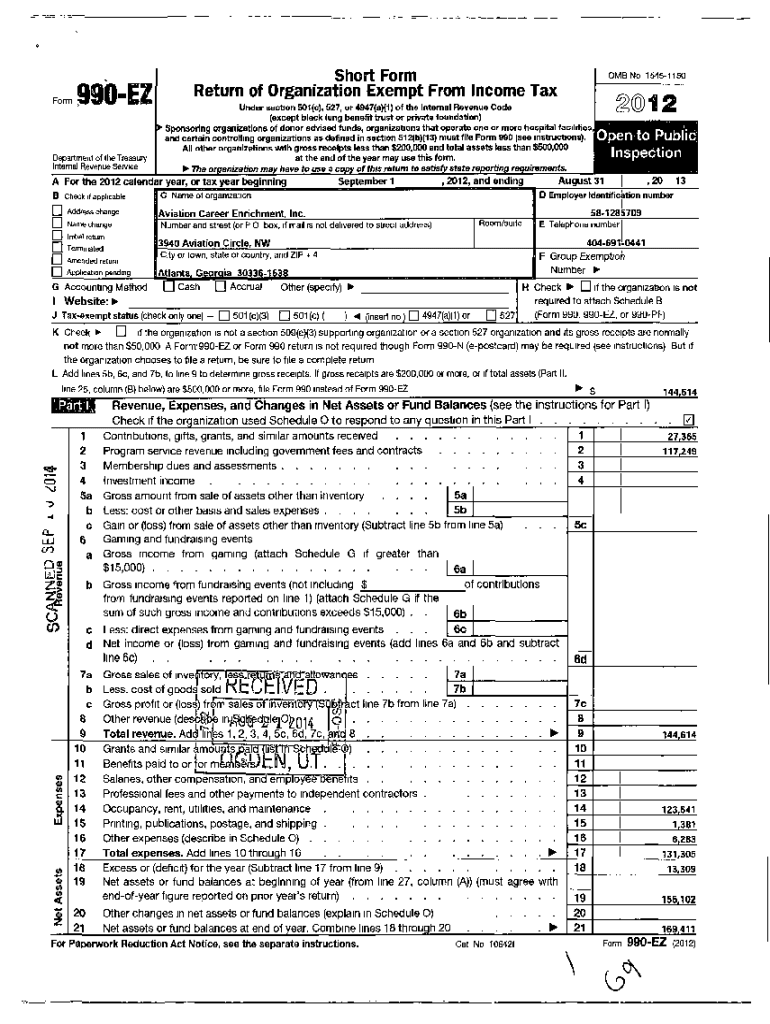

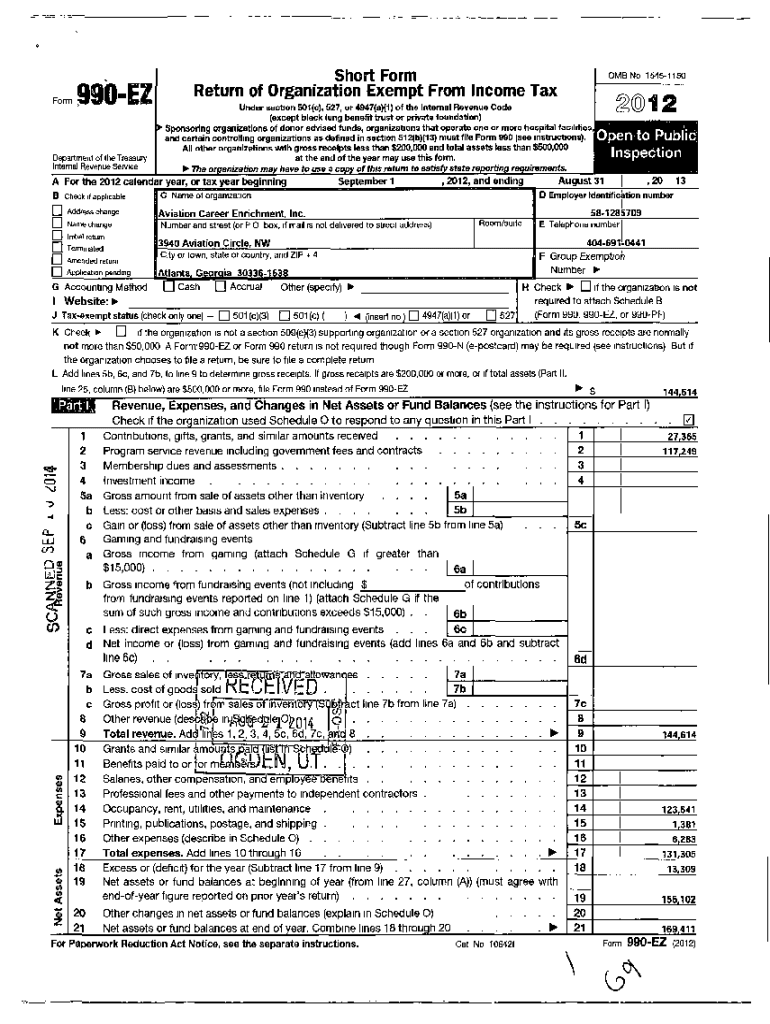

Short Form Return of Organization Exempt From Income Reinform 990EZOMB No 15451150 O1Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code I (except black lung benefit trust or private

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign s quot

Edit your s quot form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your s quot form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit s quot online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit s quot. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out s quot

How to fill out s quot

01

To fill out an s quot, follow these steps:

02

Collect all the necessary information, such as the name and contact details of the sender and recipient, the date, and the subject of the quot.

03

Start by writing the sender's information at the top of the quot, including the name, address, phone number, and email address.

04

Below the sender's information, include the recipient's details, such as their name, title, company name, address, and contact information.

05

Add a subject line that briefly describes the purpose of the quot.

06

Begin the body of the quot with a courteous greeting, such as 'Dear [Recipient's Name],'

07

Introduce the quot by stating the reason for writing and providing any necessary background information.

08

Break down the quot into clear and concise points, ensuring each point is numbered or bulleted for easy readability.

09

Include accurate pricing information, such as unit costs, quantities, and any discounts or additional charges.

10

Provide a total cost for the products or services offered, along with any applicable taxes or fees.

11

Mention any terms and conditions, such as payment terms, delivery schedules, and warranties.

12

Conclude the quot with a polite closing, such as 'Thank you for considering our proposal.'

13

Sign the quot with your name and position, and include any attachments, if necessary.

14

Proofread the quot for any errors or missing information before sending it to the recipient.

15

Save a copy of the filled out quot for future reference.

16

Ensure to comply with any specific formatting or documentation requirements as per your organization's guidelines.

Who needs s quot?

01

S quots are needed by various individuals, businesses, and organizations who provide products or services and wish to present a formal and detailed offer to potential clients or customers.

02

Some common examples of who needs s quots include:

03

- Freelancers or independent contractors, who need to provide a detailed breakdown of their services, rates, and terms to potential clients.

04

- Small businesses and startups, who want to present their pricing and offerings in a professional manner to attract customers.

05

- Sales teams or sales representatives, who use s quots as a formal document to present to customers during the sales process.

06

- Service providers, such as consultants, agencies, or contractors, who need to outline their services and associated costs for clients.

07

- Manufacturers or suppliers, who provide pricing and product details to potential buyers or distributors.

08

- Non-profit organizations, who may use s quots to present project proposals or funding requests to donors or grant organizations.

09

In summary, anyone who wants to provide a structured and detailed offer or proposal can benefit from using an s quot.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit s quot from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including s quot, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I create an electronic signature for signing my s quot in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your s quot directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out s quot on an Android device?

Complete your s quot and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is s quot?

The term 's quot' refers to a specific type of IRS form, commonly known as the S Corporation Tax Return, which is used to report income, gains, losses, deductions, and credits of an S corporation.

Who is required to file s quot?

Any corporation that has elected to be treated as an S corporation for tax purposes must file Form 1120S (S Corporation Tax Return).

How to fill out s quot?

To fill out the S corporation tax return, Form 1120S, a taxpayer must gather all financial information, report income and deductions, distribute income to shareholders, and sign the form before submission.

What is the purpose of s quot?

The purpose of the S Corporation Tax Return is to report the income and tax liability of the S corporation and to allocate income, deductions, and credits to its shareholders.

What information must be reported on s quot?

The S corporation must report its total income, deductions, credits, distributions to shareholders, and other pertinent financial information on Form 1120S.

Fill out your s quot online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

S Quot is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.