Get the free SBRK Profit and Loss Worksheet

Show details

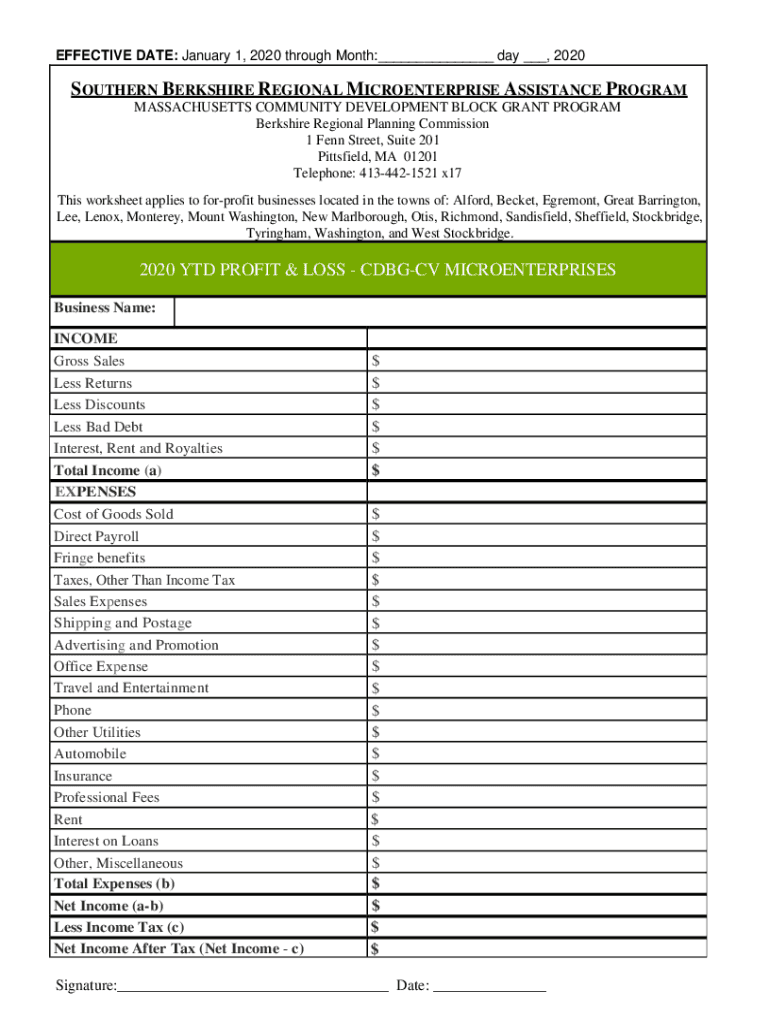

EFFECTIVE DATE: January 1, 2020, through Month: day, 2020SOUTHERN BERKSHIRE REGIONAL MICROENTERPRISE ASSISTANCE PROGRAM MASSACHUSETTS COMMUNITY DEVELOPMENT BLOCK GRANT PROGRAM Berkshire Regional Planning

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sbrk profit and loss

Edit your sbrk profit and loss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sbrk profit and loss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sbrk profit and loss online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sbrk profit and loss. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sbrk profit and loss

How to fill out sbrk profit and loss

01

To fill out the sbrk profit and loss, follow these steps:

02

Start by entering the relevant financial period or date range for the profit and loss statement.

03

List all the revenue sources separately, such as sales, services, or other income.

04

Deduct any direct costs associated with revenue, such as production costs or cost of goods sold.

05

Include any operating expenses, such as rent, utilities, salaries, or marketing expenses.

06

Subtract the total expenses from the total revenue to calculate the gross profit.

07

List any non-operating income or expenses, such as interest or gains/losses from investments.

08

Subtract non-operating expenses from non-operating income to calculate the net non-operating result.

09

Finally, calculate the net profit or loss by adding the gross profit and the net non-operating result.

10

Double-check all the calculations for accuracy and make sure the profit and loss statement is balanced.

11

Once completed, review and analyze the profit and loss statement to make informed financial decisions.

Who needs sbrk profit and loss?

01

Sbrk profit and loss is needed by various entities, such as:

02

- Business owners who want to assess the financial performance of their company.

03

- Investors who want to evaluate the profitability and viability of a business before making investment decisions.

04

- Lenders or financial institutions who require financial statements as part of loan application processes.

05

- Accountants or financial professionals who analyze the financial health of a company and provide financial advice.

06

- Tax authorities who use profit and loss statements to verify tax compliance and assess tax liabilities.

07

- Government agencies or regulatory bodies who monitor the financial activities of businesses for legal and regulatory purposes.

Fill

form

: Try Risk Free

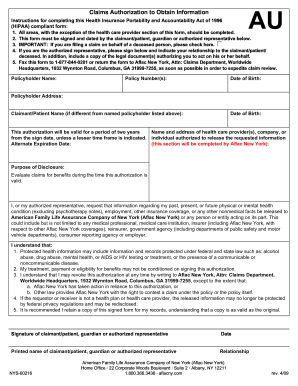

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sbrk profit and loss from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your sbrk profit and loss into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete sbrk profit and loss online?

pdfFiller has made filling out and eSigning sbrk profit and loss easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the sbrk profit and loss in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your sbrk profit and loss right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is sbrk profit and loss?

SBRK profit and loss refers to the financial statement that shows the revenues, expenses, and resulting net income or loss of an individual or business using the SBRK method of accounting.

Who is required to file sbrk profit and loss?

Any individual or business that follows the SBRK method of accounting is required to file a profit and loss statement.

How to fill out sbrk profit and loss?

To fill out an SBRK profit and loss statement, one must list all revenues earned and expenses incurred during a specific period, calculate the resulting net income or loss, and provide any additional information required by tax authorities.

What is the purpose of sbrk profit and loss?

The purpose of an SBRK profit and loss statement is to provide an overview of the financial performance of an individual or business using the SBRK method of accounting.

What information must be reported on sbrk profit and loss?

The information that must be reported on an SBRK profit and loss statement includes revenues, expenses, net income or loss, and any additional details requested by tax authorities.

Fill out your sbrk profit and loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sbrk Profit And Loss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.