Get the free Refund and Claims for Appeal Rights, of ... - IRS tax forms

Show details

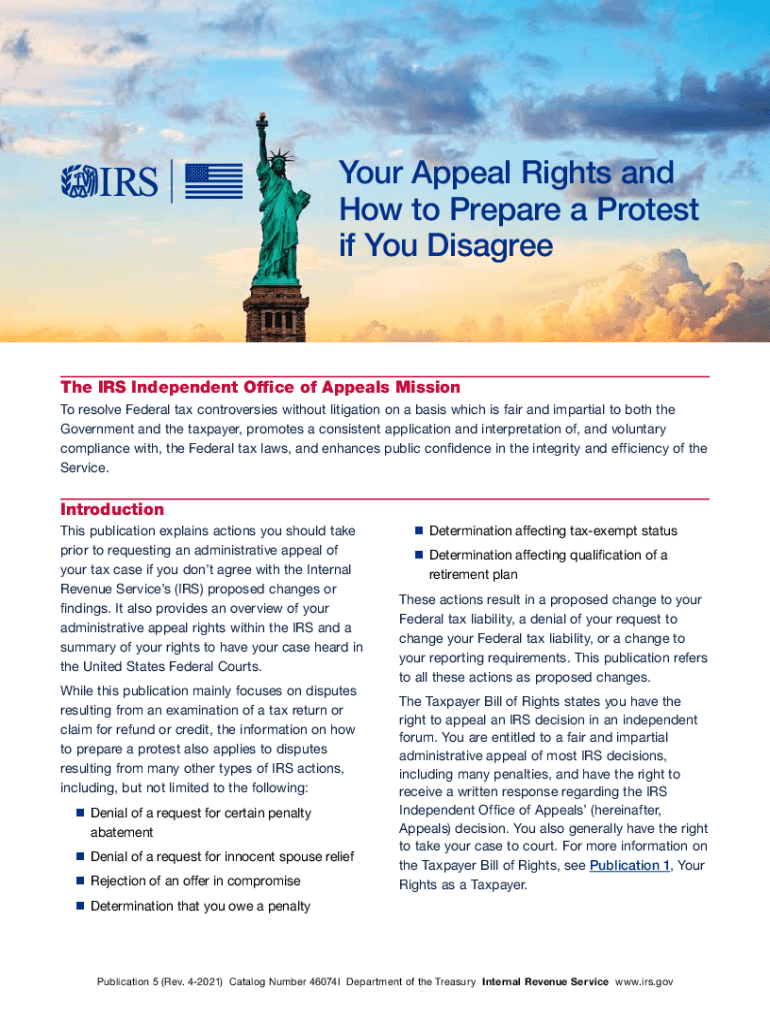

Your Appeal Rights and

How to Prepare a Protest

if You Disagree IRS Independent Office of Appeals Mission

To resolve Federal tax controversies without litigation on a basis which is fair and impartial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign refund and claims for

Edit your refund and claims for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your refund and claims for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing refund and claims for online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit refund and claims for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out refund and claims for

How to fill out refund and claims for

01

Gather all relevant information and supporting documents such as receipts, invoices, and proof of purchase.

02

Review the refund and claims form to understand the required information and documentation.

03

Fill out the refund and claims form accurately, providing all necessary details such as personal information, contact details, and specific reasons for the refund or claim.

04

Attach the supporting documents to the form, ensuring they are legible and clearly related to the refund or claim.

05

Double-check all the information filled out in the form and the attached documents for accuracy and completeness.

06

Submit the completed refund and claims form along with the supporting documents through the designated channel or to the appropriate department or organization responsible for processing refunds and claims.

07

Keep copies of the filled-out form and all attached documents for your records.

08

Follow up on the status of your refund or claim if necessary, through the provided contact information or by checking with the relevant department or organization.

09

Once approved, ensure to review the refund or claim amount and verify that it matches your expectations.

10

If any issues or discrepancies arise during the refund or claims process, seek clarification or assistance from the responsible department or organization.

Who needs refund and claims for?

01

Customers who have purchased a product or service that is faulty, damaged, or not as described are eligible for refund and claims.

02

Individuals who have experienced poor customer service or dissatisfaction with a company's products or services may require refund and claims to seek resolution or compensation.

03

Consumers who have been overcharged or billed incorrectly can utilize refund and claims processes to rectify the financial discrepancy.

04

In cases of lost or stolen items, individuals may need to file a refund or claims request to recover their lost funds or assets.

05

Businesses or organizations that have incurred financial losses or damages due to the actions or negligence of others may seek refund and claims for compensation.

06

Individuals with valid insurance policies may file refund and claims for reimbursement of eligible expenses or damages covered by their insurance.

07

Any individual or entity involved in contractual agreements or legal disputes that require financial settlements and compensations may utilize refund and claims processes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get refund and claims for?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific refund and claims for and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete refund and claims for online?

pdfFiller has made it easy to fill out and sign refund and claims for. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit refund and claims for in Chrome?

refund and claims for can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is refund and claims for?

Refund and claims refer to the process by which individuals or businesses can request the return of overpaid taxes or other fees from a government entity.

Who is required to file refund and claims for?

Any individual or business that believes they have overpaid taxes or fees is required to file refund claims.

How to fill out refund and claims for?

To fill out a refund claim, you typically need to provide personal or business information, details of the overpayment, and any supporting documentation, often using a specific form provided by the tax authority.

What is the purpose of refund and claims for?

The purpose of refund and claims is to allow taxpayers to recover money that they have overpaid in taxes or fees, ensuring that they are not unjustly penalized for errors in payments.

What information must be reported on refund and claims for?

Information that must be reported includes taxpayer identification, the amount being claimed, reason for the claim, and any relevant supporting documentation.

Fill out your refund and claims for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Refund And Claims For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.