Get the free Corporate Giving Guidelines - Country Bank

Show details

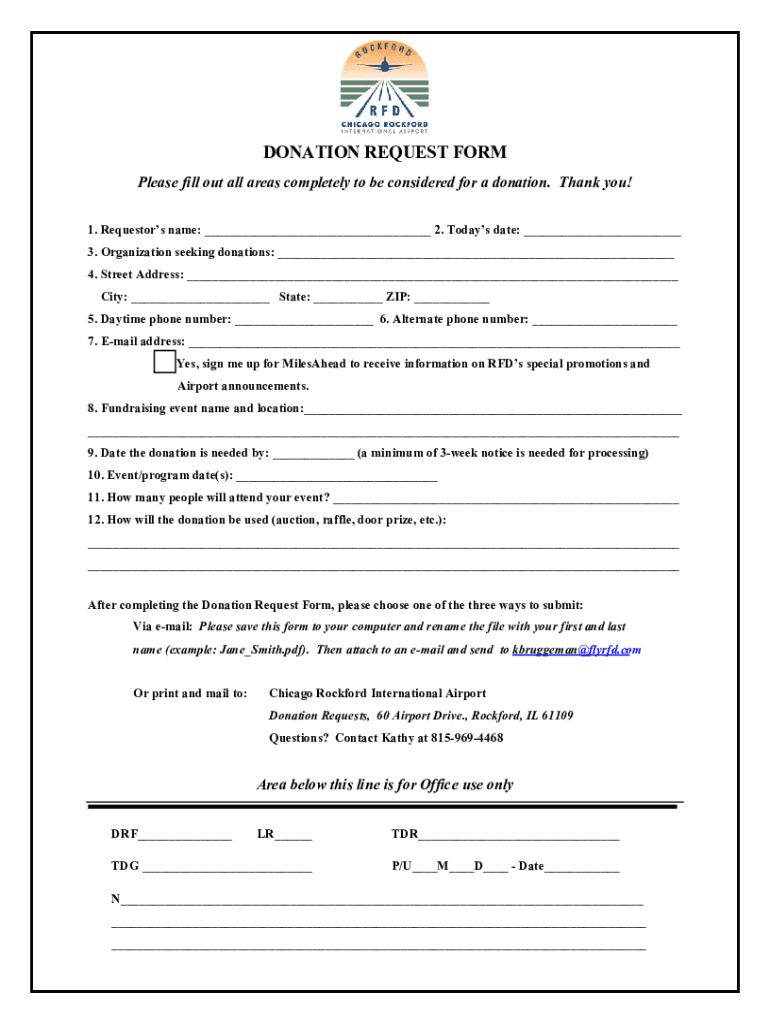

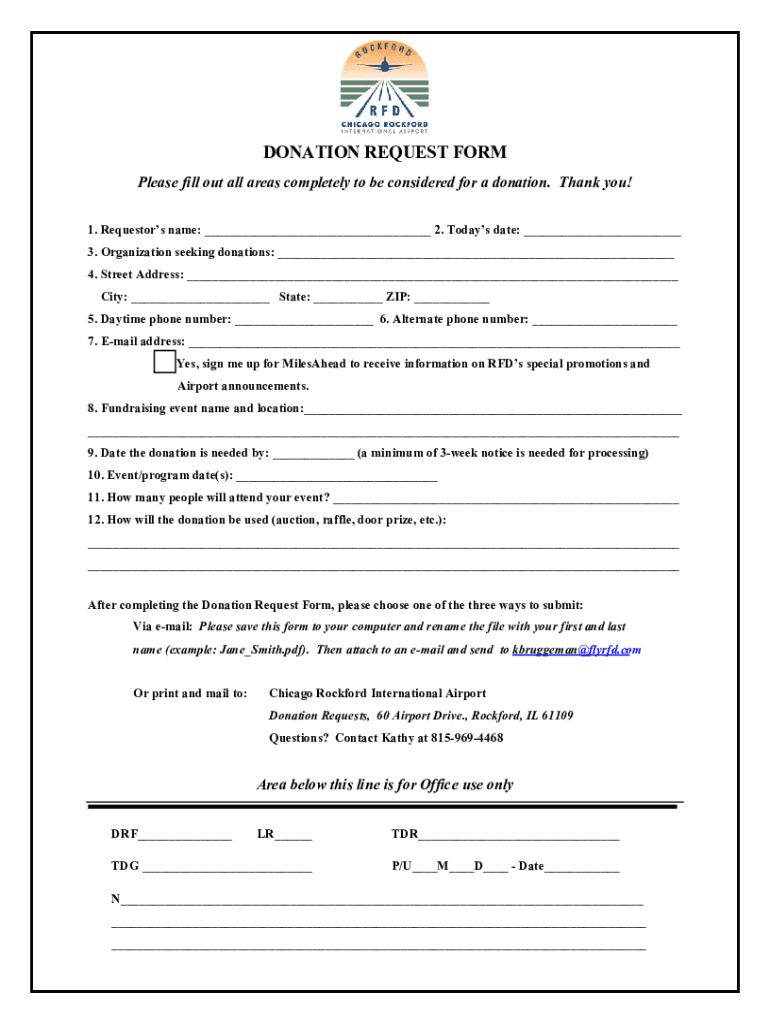

Greater Rockford Airport Authority Donation Request Guidelines Gift Baskets and/or Travel Certificates or Airiest Admission Tickets are donated, upon request, to the following types of nonprofit organizations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate giving guidelines

Edit your corporate giving guidelines form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate giving guidelines form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate giving guidelines online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit corporate giving guidelines. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate giving guidelines

How to fill out corporate giving guidelines

01

Start by gathering all the necessary information about your company's goals, mission, and areas of focus for corporate giving.

02

Identify the criteria and eligibility requirements for organizations that will be considered for corporate giving. This may include factors such as non-profit status, alignment with company values, and specific target populations or geographic areas served.

03

Create a clear and concise application or proposal form that organizations can use to submit their requests for corporate giving.

04

Develop a review and evaluation process to assess the submitted applications or proposals. This may involve forming a committee or panel to evaluate each request based on the established criteria.

05

Establish a timeline for reviewing and responding to corporate giving requests. This ensures that organizations receive timely feedback on their proposals.

06

Communicate the guidelines and application process to potential recipients of corporate giving. This can be done through your company's website, social media channels, or direct outreach to relevant organizations.

07

Evaluate the impact and effectiveness of corporate giving activities on a regular basis. This will help refine the guidelines and improve the overall giving strategy.

08

Finally, regularly update and revise the corporate giving guidelines as necessary to reflect changing company priorities or community needs.

Who needs corporate giving guidelines?

01

Corporate giving guidelines are needed by companies or organizations that engage in corporate philanthropy or social responsibility initiatives. These guidelines help establish a structured and transparent process for selecting and supporting non-profit organizations through financial contributions, grants, sponsorships, or in-kind donations. Companies of all sizes, from small businesses to large corporations, can benefit from having corporate giving guidelines in place to ensure their charitable efforts align with their mission, values, and strategic objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify corporate giving guidelines without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your corporate giving guidelines into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I edit corporate giving guidelines on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing corporate giving guidelines right away.

How do I fill out the corporate giving guidelines form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign corporate giving guidelines and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is corporate giving guidelines?

Corporate giving guidelines are a set of rules and criteria established by a company to guide their charitable donations and philanthropic efforts.

Who is required to file corporate giving guidelines?

Companies or organizations that engage in corporate social responsibility activities and charitable giving are required to have and follow corporate giving guidelines.

How to fill out corporate giving guidelines?

Corporate giving guidelines can be filled out by defining the company's charitable giving priorities, outlining the process for donation requests, and setting criteria for evaluating potential recipients.

What is the purpose of corporate giving guidelines?

The purpose of corporate giving guidelines is to provide a framework for companies to make informed decisions about their charitable giving, align donations with company values, and ensure transparency in their philanthropic activities.

What information must be reported on corporate giving guidelines?

Corporate giving guidelines typically include details on the company's mission and values, eligibility criteria for donation recipients, the application process for donation requests, and evaluation criteria for selecting recipients.

Fill out your corporate giving guidelines online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Giving Guidelines is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.