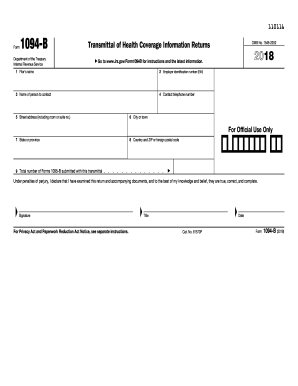

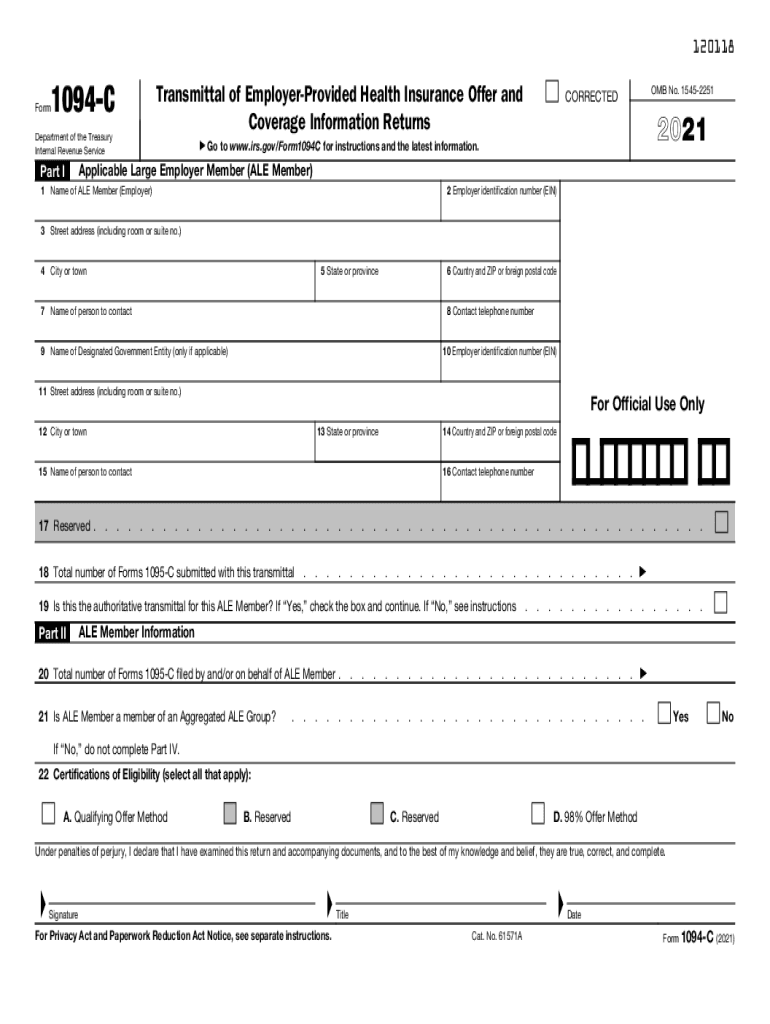

IRS 1094-C 2021 free printable template

Instructions and Help about IRS 1094-C

How to edit IRS 1094-C

How to fill out IRS 1094-C

About IRS 1094-C 2021 previous version

What is IRS 1094-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1094-C

How can I correct mistakes on my IRS 1094-C after submission?

To correct errors on your IRS 1094-C, you need to prepare and file an amended return. Clearly indicate which corrections are being made, and submit it as soon as the mistake is discovered to avoid penalties. This submission can be paper filed or electronically e-filed if you use approved software.

What should I do if I receive a notice regarding my filed IRS 1094-C?

If you receive a notice regarding your IRS 1094-C, carefully read the notice to understand the issue. Gather any requested documentation and respond promptly, addressing the specific concerns outlined in the notice to ensure compliance and avoid further complications.

What e-filing issues should I watch for when submitting my IRS 1094-C?

When e-filing your IRS 1094-C, be aware of common rejection codes such as issues with TINs or incorrect formatting. Regularly check the status of your submission through the e-filing portal and be prepared to make any necessary corrections based on feedback or rejections.

How long should I retain records related to my IRS 1094-C?

You should retain records related to your IRS 1094-C for at least three years from the due date of the form or the date it was filed, whichever is later. This retention is important for compliance and in case of audits or requests for documentation.