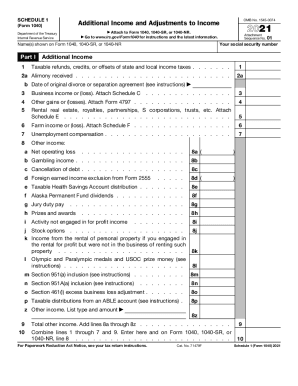

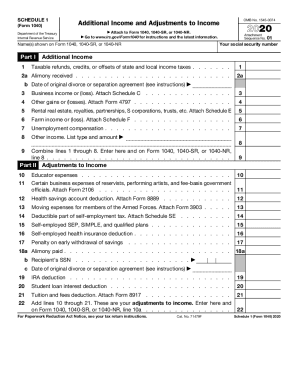

IRS 990 - Schedule I 2021 free printable template

Instructions and Help about IRS 990 - Schedule I

How to edit IRS 990 - Schedule I

How to fill out IRS 990 - Schedule I

About IRS 990 - Schedule I 2021 previous version

What is IRS 990 - Schedule I?

Who needs the form?

Components of the form

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

What information do you need when you file the form?

FAQ about IRS 990 - Schedule I

What should I do if I made errors on my submitted IRS 990 - Schedule I?

If you discover mistakes on your submitted IRS 990 - Schedule I, you can file an amended version to correct the errors. It's important to note the changes and ensure that you follow the guidelines for amending submissions to avoid further complications.

How can I verify the receipt of my e-filed IRS 990 - Schedule I?

To verify the receipt of your e-filed IRS 990 - Schedule I, check the IRS e-file system for confirmation. You will typically receive a notification of acceptance or rejection shortly after filing, which allows you to address any issues promptly.

What are the common errors to watch for when submitting the IRS 990 - Schedule I?

Common errors include incorrect payee identification and misreporting of financial information. To avoid these pitfalls, double-check all entries and ensure consistency with supporting documentation to maintain accuracy on your IRS 990 - Schedule I.

What should I do if my submission of IRS 990 - Schedule I gets rejected?

If your IRS 990 - Schedule I submission is rejected, review the e-file rejection codes provided by the IRS. Correct the identified issues, and resubmit the form promptly to avoid any potential penalties or delays.

Are there specific requirements for electronic signatures on the IRS 990 - Schedule I?

Yes, the IRS accepts electronic signatures on the IRS 990 - Schedule I under certain conditions. Ensure that you are familiar with the e-signature rules to confirm the validity of your submission and maintain compliance with IRS regulations.