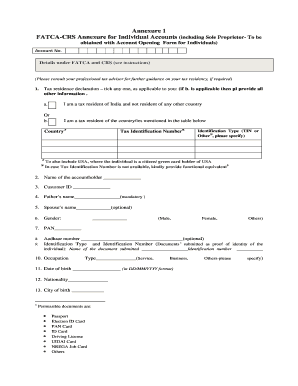

FATCA-CRS Annexure for Individual Accounts Annexure 1 2021-2025 free printable template

Get, Create, Make and Sign declaration of residency form

How to edit residency declaration online

Uncompromising security for your PDF editing and eSignature needs

FATCA-CRS Annexure for Individual Accounts Annexure 1 Form Versions

How to fill out annexure individual fillable form

How to fill out FATCA-CRS Annexure for Individual Accounts Annexure 1

Who needs FATCA-CRS Annexure for Individual Accounts Annexure 1?

Video instructions and help with filling out and completing 575765550

Instructions and Help about crs annexure individual

Goal so what are the implications of vodka and CRS individual investor I would like to give you a brief background of what exactly is factor and CRS to answer your question appropriately so internationally if you see the government's have been very concerned about money flowing out of their country into various other jurisdictions, and you know thus avoiding paying further tax on income and on those new assets which are flowing out of the country these governments have been signing treaties with each other, so that information can be exchanged and shared between the government's FATWA is a US law which requires the countries which are signing agreements with the U.S. to exchange information related to tax related to investments etcetera which binds the country which is signing that intergovernmental agreement to provide those details to the US government India has signed the intergovernmental agreement with the U.S. to share information related to investments financial assets' etcetera which pertain to US persons and u.s. persons are defined as US citizens or US residents this particular law also has a significant implication on various financial institutions elsewhere including in India what we are required to do is to collect information from investors individuals as well as non individuals and various details to be then exchanged between the governments if you see what we have done in Access mutual fund is we have you know got this particular form which a resident individual investor has to fill in or any individual investor who's investing into our funds has to fill in if you see the main contents of the form require an investor to tell whether he is a tax resident of any other country other than India or not if he is a tax resident of India actually and only India then things become very simple but if he is a tax resident of us then this information and the various other details that he fills in this particular form we have to submit it to the income tax department of India which in turn would provide these details to the IRS of us, so that is what is the requirement prescribed so if you see various things like you know place of birth of an investor what country of birth of an individual investor becomes very important similar to FATWA there is another arrangement called in a common reporting standard when we have signed an agreement which binds it to exchange this sort of information very similar to what we exchange with the US and the FATWA with close to a hundred odd countries we have to capture whether an investor is say from Australia and then exchange the detail with Australian government so this is something which FATWA has already come into existence from first November across the mutual fund industry this has been implemented and CRS comes into effect from 1st of January 2016 so that is broadly how it will have an implication on the individual investor he has to give these details these become mandatory from the dates I mentioned...

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find annexure individual add?

How do I make changes in annexure individual form?

How do I fill out fatca annexure text on an Android device?

What is FATCA-CRS Annexure for Individual Accounts Annexure 1?

Who is required to file FATCA-CRS Annexure for Individual Accounts Annexure 1?

How to fill out FATCA-CRS Annexure for Individual Accounts Annexure 1?

What is the purpose of FATCA-CRS Annexure for Individual Accounts Annexure 1?

What information must be reported on FATCA-CRS Annexure for Individual Accounts Annexure 1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.