Get the free A professional tax and accounting firm in Naples, Florida: Blog

Show details

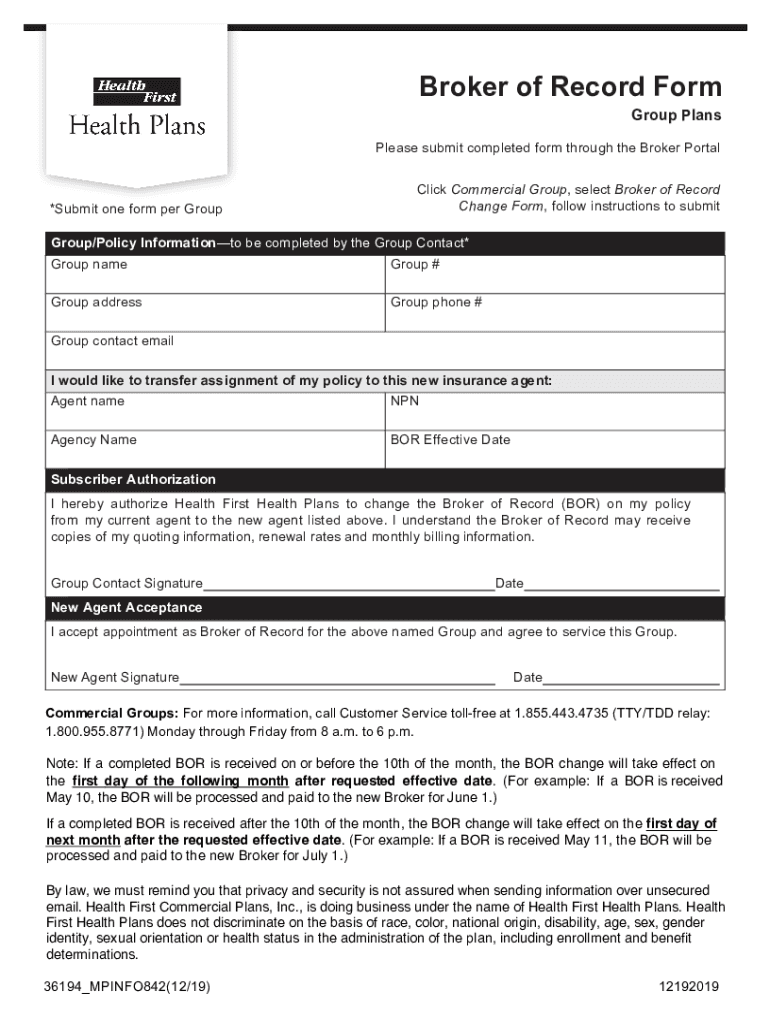

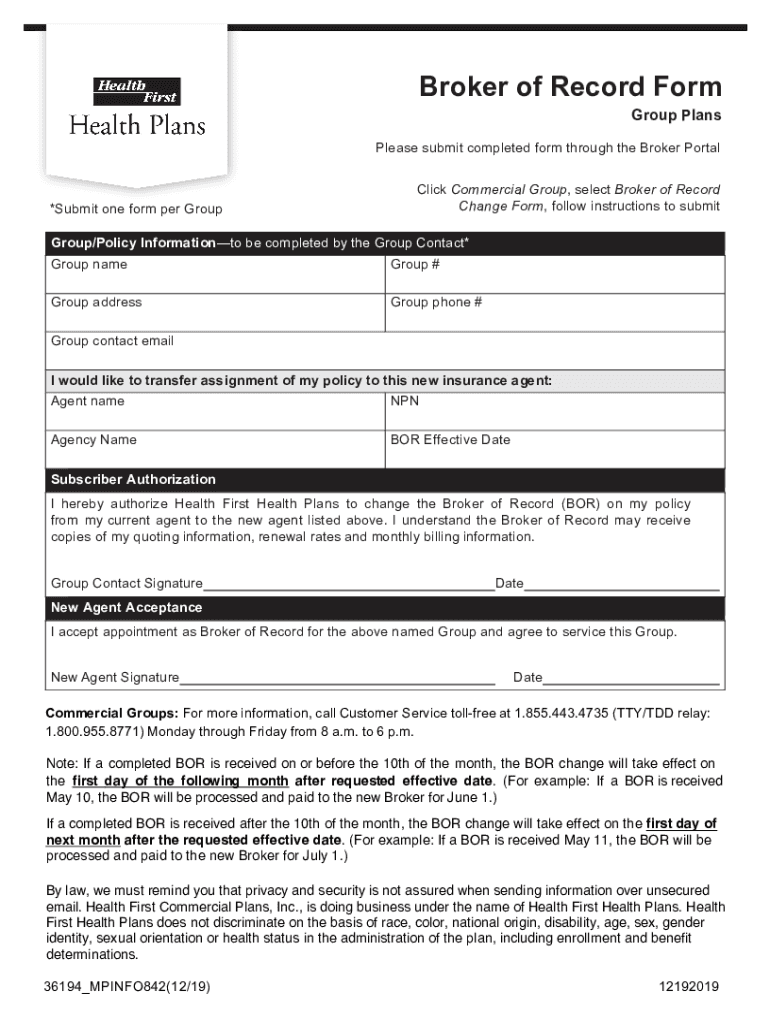

Broker of Record Form Group PlansPlease submit completed form through the Broker Portal×Submit one form per Groupthink Commercial Group, select Broker of Record Change Form, follow instructions to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a professional tax and

Edit your a professional tax and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a professional tax and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit a professional tax and online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit a professional tax and. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a professional tax and

How to fill out a professional tax and

01

To fill out a professional tax, follow these steps:

02

Gather all the necessary documents, such as your income statements, expense records, and receipts.

03

Determine your professional income, which includes income from your profession or business.

04

Calculate your taxable income by deducting any allowable expenses from your professional income.

05

Understand the various tax deductions and exemptions available for professionals.

06

Fill out the appropriate tax forms accurately, providing all the required information.

07

Double-check your calculations and ensure all the information is correct.

08

Attach relevant documents and supporting evidence, if required.

09

Submit the completed tax return to the appropriate tax authority by the deadline.

10

Keep copies of your tax return and supporting documents for future reference.

Who needs a professional tax and?

01

Anyone who earns income from a profession or business needs to pay professional tax.

02

This includes self-employed individuals, freelancers, consultants, and owners of small businesses or partnerships.

03

Professional tax is typically applicable to individuals practicing certain licensed professions, such as doctors, lawyers, accountants, engineers, architects, etc.

04

The specific requirements for professional tax vary by jurisdiction, so it is important to consult the local tax authority or a tax professional for accurate information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the a professional tax and electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your a professional tax and in minutes.

Can I create an electronic signature for signing my a professional tax and in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your a professional tax and directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete a professional tax and on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your a professional tax and. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is a professional tax?

A professional tax is a tax levied by the state or local government on individuals engaged in professions, trades, or employment. It is typically based on income levels and is aimed at generating revenue for local infrastructure and services.

Who is required to file a professional tax?

Individuals who earn an income through their profession, trade, or employment, such as salaried employees, freelancers, and self-employed individuals, are required to file a professional tax, depending on the regulations of the state or locality.

How to fill out a professional tax?

To fill out a professional tax, individuals typically need to obtain the specific forms provided by their local government or tax authority, provide necessary income details, calculate the applicable tax based on their earnings, and submit the form along with any payment by the deadline.

What is the purpose of a professional tax?

The purpose of a professional tax is to generate revenue for local governments to fund public services, infrastructure, and community development projects while ensuring that those who earn income through professions contribute fairly to the community.

What information must be reported on a professional tax?

Individuals must generally report their total annual income, profession or trade details, and any deductions applicable according to local tax laws on the professional tax forms.

Fill out your a professional tax and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Professional Tax And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.