Get the free Industrial Revitalization Tax Exemption Application Form

Show details

CITY OF ABBOTSFORD INDUSTRIAL REVITALIZATION TAX EXEMPTION APPLICATION A non-refundable application fee of $10.00 is required Please keep a copy of this application as it must be resubmitted upon

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign industrial revitalization tax exemption

Edit your industrial revitalization tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your industrial revitalization tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing industrial revitalization tax exemption online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit industrial revitalization tax exemption. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out industrial revitalization tax exemption

How to Fill out Industrial Revitalization Tax Exemption:

01

Obtain the necessary forms from your local tax authority or municipality.

02

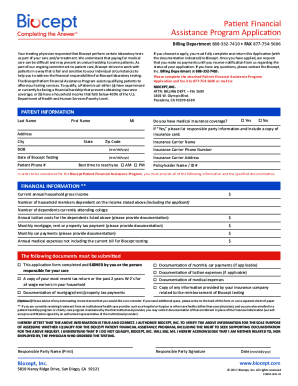

Fill out the required personal and business information accurately and completely.

03

Provide detailed information about the property or business that qualifies for the tax exemption. This may include the location, size, condition, and current use of the property.

04

Include any supporting documents or evidence that may be required, such as property appraisal reports, financial statements, or business plans.

05

Clearly state the reasons why you believe your property or business qualifies for the industrial revitalization tax exemption. This may include demonstrating that the property or business meets specific criteria set by the tax authority, such as being located in an economically distressed area or being engaged in qualifying industrial activities.

06

Review the completed application for any errors or omissions before submitting it.

07

Submit the application to the appropriate tax authority or municipality along with any required fees or additional documents.

08

Follow up with the tax authority or municipality to track the progress of your application and provide any additional information or clarification if requested.

Who Needs Industrial Revitalization Tax Exemption:

01

Property owners who have industrial or commercial properties located in economically distressed areas.

02

Businesses involved in qualifying industrial activities, such as manufacturing, energy production, or technology development.

03

Individuals or companies looking to invest in revitalizing deteriorated or underutilized properties within designated industrial zones.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is industrial revitalization tax exemption?

Industrial revitalization tax exemption is a tax incentive program that allows eligible properties to receive a reduction or exemption from property taxes for a certain period of time in order to encourage investment and development in designated areas.

Who is required to file industrial revitalization tax exemption?

Property owners or developers who own or plan to develop eligible properties in designated areas are required to file for industrial revitalization tax exemption.

How to fill out industrial revitalization tax exemption?

To fill out industrial revitalization tax exemption, property owners or developers must complete the necessary application forms and provide supporting documentation to demonstrate eligibility for the tax incentive program.

What is the purpose of industrial revitalization tax exemption?

The purpose of industrial revitalization tax exemption is to promote economic growth, create jobs, and revitalize communities by incentivizing investment in underdeveloped or blighted areas.

What information must be reported on industrial revitalization tax exemption?

Property owners or developers must report information such as property details, investment plans, and proof of eligibility criteria to demonstrate their need for the tax exemption.

How do I modify my industrial revitalization tax exemption in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your industrial revitalization tax exemption and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete industrial revitalization tax exemption online?

With pdfFiller, you may easily complete and sign industrial revitalization tax exemption online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the industrial revitalization tax exemption in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your industrial revitalization tax exemption in seconds.

Fill out your industrial revitalization tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Industrial Revitalization Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.