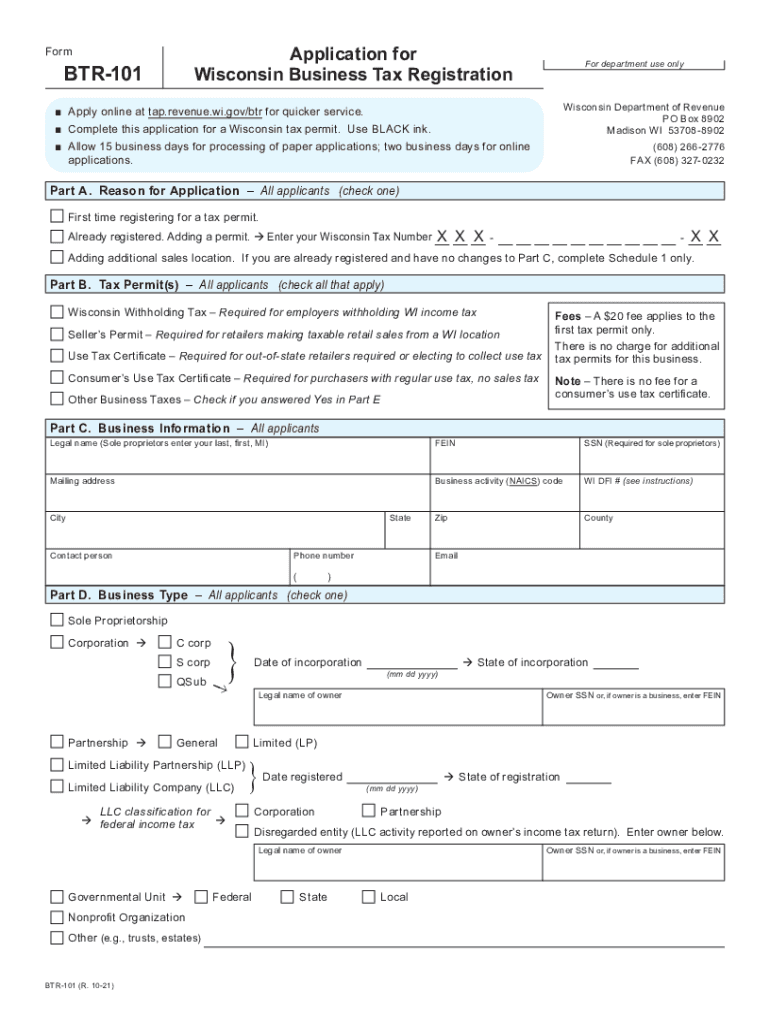

WI DoR BTR-101 2021-2025 free printable template

Get, Create, Make and Sign btr 101 instructions form

Editing btr wi online

Uncompromising security for your PDF editing and eSignature needs

WI DoR BTR-101 Form Versions

How to fill out wisconsin form btr 101

How to fill out WI DoR BTR-101

Who needs WI DoR BTR-101?

Video instructions and help with filling out and completing form btr 101

Instructions and Help about wisconsin form business registration

Good morning I'm Andrea I work at the Wisconsin Department of Revenue and this is Tax 101 Its tax filing season, so today here's an overview to help you accurately e-file and ensure timely processing of your return — ISAS easy as 1-2-3 First get all documents for your incomelike W-2s and 1099s If you claim deductions gather documents for; your property tax mortgage interest or charitable contributions Filing before you have all your documents may require you to amend your return later and will delay your refund Second go to the e-file page and save your tax form There's a helpful video and guide to help you decide which one is right for you Third enter accurate information and review it carefully Make sure you submit all required documents following the e-file instructions If you file Homestead or Earned Income credit make sure you attach all required documents Failing to provide documents or entering incorrect information will delay your refund Use direct deposit when you e-file By choosing direct deposit your refund goes directly into your account Verify bank routing and checking account numbers Visit our website revenuewigov and select Wisconsin e-file to get started We've also made it easy to check the status of your refund using Where's My Refund

People Also Ask about wisconsin business tax registration

How much does a Wisconsin business license cost?

What is Wisconsin BTR tax?

What are the types of business licenses?

How much does a business license cost in Wisconsin?

How do I get a tax registration certificate?

Does a Wisconsin sellers permit expire?

What is Wisconsin business tax?

How do I look up a resale certificate in Wisconsin?

What is a local business tax certificate?

How much do licenses and permits cost for small business?

What is a Wisconsin business tax registration certificate?

How much does it cost for a business license in Wisconsin?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify wi btr 101 without leaving Google Drive?

How do I edit wi form btr 101 straight from my smartphone?

How do I edit btr 101 wi online on an iOS device?

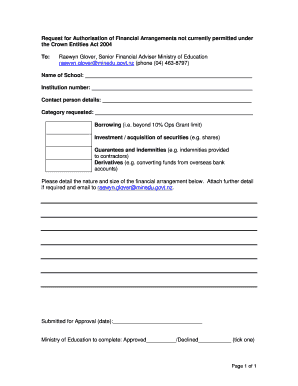

What is WI DoR BTR-101?

Who is required to file WI DoR BTR-101?

How to fill out WI DoR BTR-101?

What is the purpose of WI DoR BTR-101?

What information must be reported on WI DoR BTR-101?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.