OK OTC 952 2022 free printable template

Show details

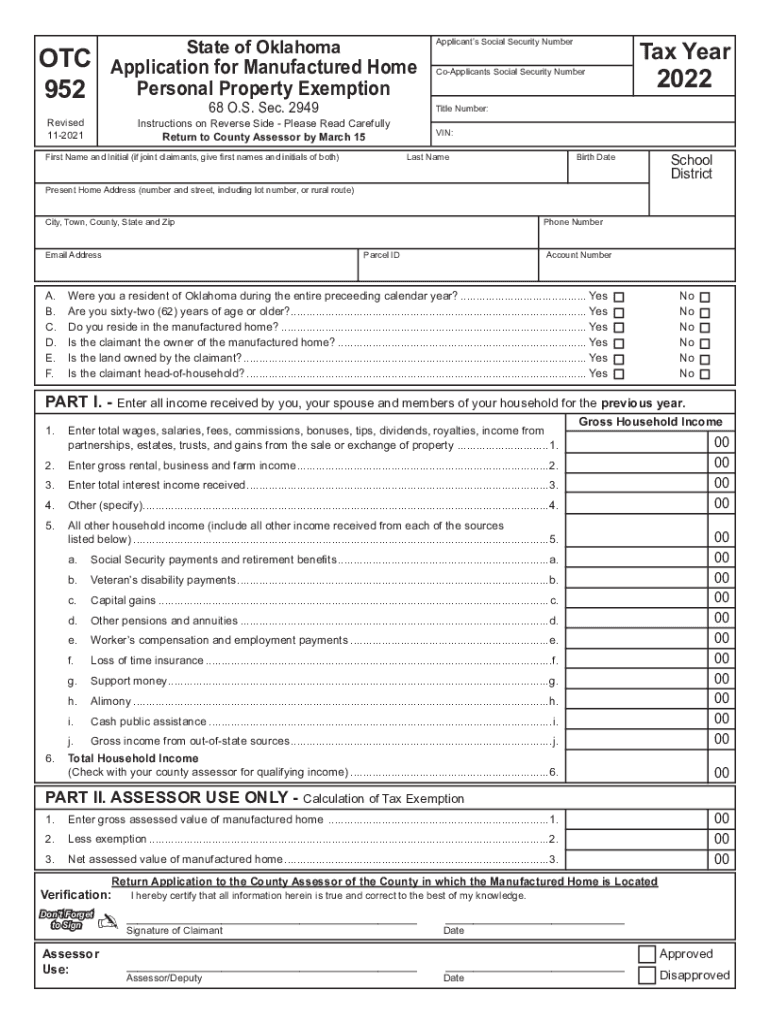

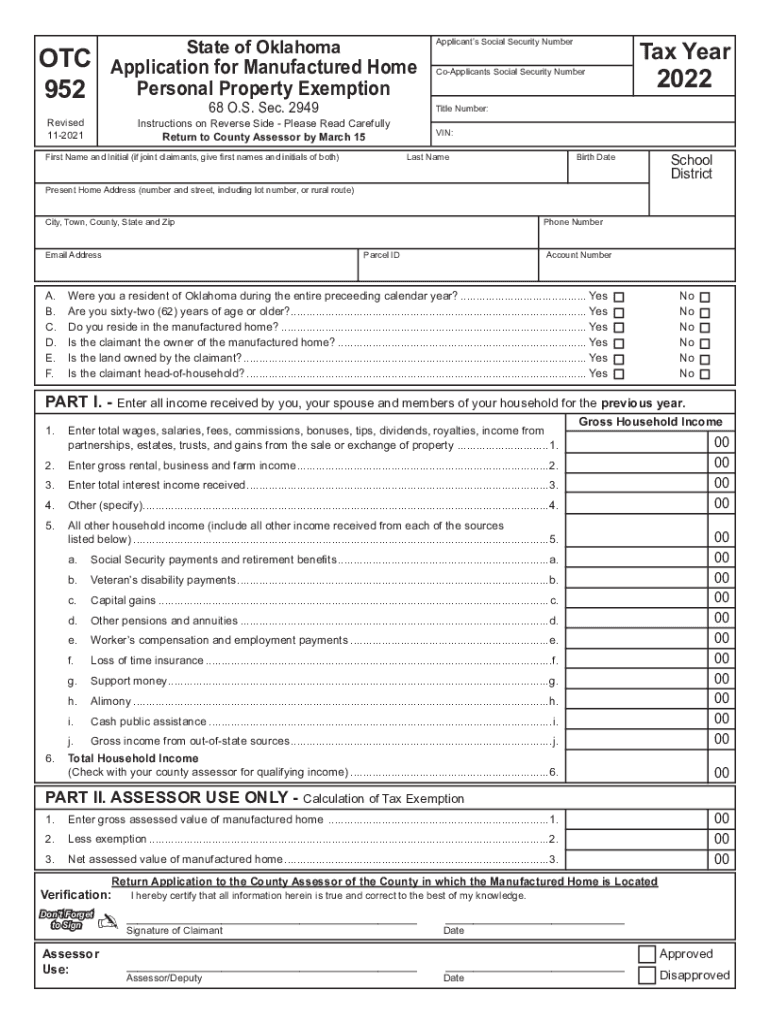

State of OklahomaApplicants Social Security Number OTC 952Application for Manufactured Home Personal Property ExemptionRevised 112021Instructions on Reverse Side Please Read Carefully Return to County

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK OTC 952

Edit your OK OTC 952 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK OTC 952 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK OTC 952 online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit OK OTC 952. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 952 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK OTC 952

How to fill out OK OTC 952

01

Step 1: Gather all required documentation and information related to the over-the-counter transaction.

02

Step 2: Fill out the top section of the form with your personal and contact information.

03

Step 3: Provide details of the transaction, including dates, amounts, and descriptions.

04

Step 4: Clearly state the reason for the transaction in the designated section.

05

Step 5: Review the completed form for any errors or missing information.

06

Step 6: Sign and date the form at the bottom.

07

Step 7: Submit the completed form to the appropriate agency or department.

Who needs OK OTC 952?

01

Individuals or entities engaging in over-the-counter financial transactions.

02

Businesses that require documentation for regulatory compliance.

03

Financial institutions processing OTC transactions on behalf of clients.

Fill

form

: Try Risk Free

People Also Ask about

What is form 511 Oklahoma?

File as Oklahoma married filing separate. The Oklahoma resident, filing a joint federal return with a nonresident civilian spouse, may file an Oklahoma return as married filing separate. The resident will file on Form 511 using the married filing separate rates and reporting only his/her income and deductions.

What are the residency requirements for tax purposes in Oklahoma?

An Oklahoma resident is a person domiciled in this state for the entire tax year. “Domicile” is the place established as a person's true, fixed, and permanent home. It is the place you intend to return to whenever you are away (as on vacation abroad, busi- ness assignment, educational leave or military assignment).

Who needs to file taxes in Oklahoma?

Oklahoma residents are required to file an Oklahoma income tax return when they have enough income that they must file a federal income tax return. Nonresidents are also required to file an Oklahoma income tax return if they have at least $1,000 of income from an Oklahoma employer or other source.

What is the POA form for Oklahoma taxes?

An Oklahoma tax power of attorney (Form BT-129), otherwise known as the Oklahoma Tax Commission Power of Attorney, is a form that provides you the opportunity to appoint a tax professional or other person to represent your interests in front of the tax commission.

Do I have to file an Oklahoma state tax return?

This prorated tax is the Oklahoma tax. standard deduction plus personal exemption is required to file an Oklahoma income tax return. resident. During the period of nonresidency, an Oklahoma return is also required if the Oklahoma part-year resident has gross income from Oklahoma sources of $1,000 or more.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute OK OTC 952 online?

With pdfFiller, you may easily complete and sign OK OTC 952 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the OK OTC 952 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out OK OTC 952 on an Android device?

Use the pdfFiller mobile app to complete your OK OTC 952 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is OK OTC 952?

OK OTC 952 is a specific form used for reporting certain tax-related information in the state of Oklahoma.

Who is required to file OK OTC 952?

Taxpayers who engage in certain types of transactions or activities as specified by the Oklahoma Tax Commission are required to file OK OTC 952.

How to fill out OK OTC 952?

To fill out OK OTC 952, you must provide the required information accurately, following the instructions outlined by the Oklahoma Tax Commission, and submit the form by the stipulated deadline.

What is the purpose of OK OTC 952?

The purpose of OK OTC 952 is to collect important tax-related information to ensure compliance with Oklahoma tax laws and regulations.

What information must be reported on OK OTC 952?

The information reported on OK OTC 952 typically includes details about the taxpayer's transactions, revenue, and any applicable deductions or credits, as specified in the filing instructions.

Fill out your OK OTC 952 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK OTC 952 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.