Get the free Personal Cyber Protection Insurance Proposal Form - PCP-001

Show details

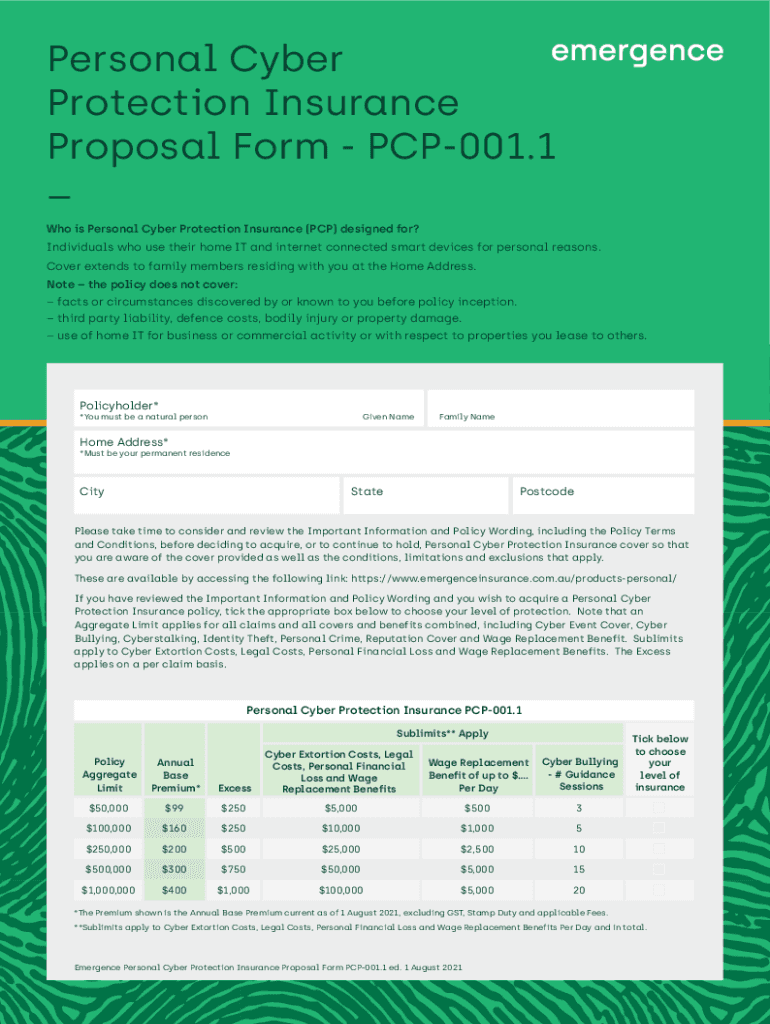

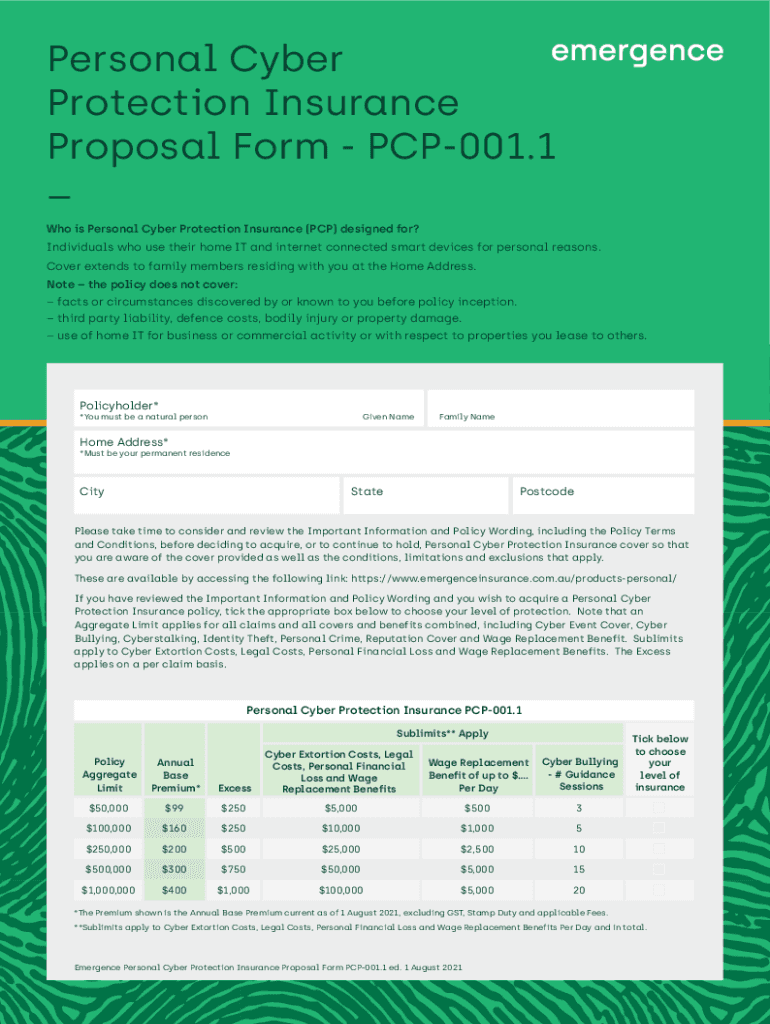

Personal Cyber Protection Insurance Proposal Form PCP001.1 Who is Personal Cyber Protection Insurance (PCP) designed for? Individuals who use their home IT and internet connected smart devices for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal cyber protection insurance

Edit your personal cyber protection insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal cyber protection insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal cyber protection insurance online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal cyber protection insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal cyber protection insurance

How to fill out personal cyber protection insurance

01

Start by gathering your personal information, such as your full name, contact details, and address.

02

Research and compare different insurance providers that offer personal cyber protection insurance.

03

Look for a policy that suits your needs and budget. Consider factors such as coverage limits, premium costs, and deductibles.

04

Fill out the application form provided by the chosen insurance provider. Provide accurate and detailed information.

05

If required, provide any additional documentation requested by the insurance provider, such as proof of identity or previous insurance history.

06

Review the application form and all the provided information carefully to ensure accuracy.

07

Make sure to understand the terms and conditions of the policy before signing or submitting the application.

08

Submit the completed application form and any additional documentation to the insurance provider.

09

Once the application is received, the insurance provider will review it and may contact you for any further clarification or information.

10

If your application is approved, you will receive a policy document outlining the coverage details, terms, and conditions.

11

Keep a copy of the policy document for your records and make sure to pay the premium as per the payment schedule.

12

In case of any claims or cybersecurity incidents, contact the insurance provider as soon as possible to initiate the claims process.

Who needs personal cyber protection insurance?

01

Personal cyber protection insurance is beneficial for individuals who want to safeguard their personal information and digital assets against cyber threats.

02

Anyone who uses the internet, owns digital devices, and engages in online transactions can benefit from personal cyber protection insurance.

03

This can include individuals who frequently use online banking or make online purchases, professionals who store sensitive client data, and those who use social media platforms extensively.

04

Additionally, individuals who have valuable digital assets such as cryptocurrencies, intellectual property, or personal documents stored in the cloud may also benefit from this insurance coverage.

05

Ultimately, anyone who values their privacy and wants financial protection in case of cyber attacks, identity theft, or online fraud should consider obtaining personal cyber protection insurance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my personal cyber protection insurance directly from Gmail?

personal cyber protection insurance and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit personal cyber protection insurance online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your personal cyber protection insurance and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out the personal cyber protection insurance form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign personal cyber protection insurance and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is personal cyber protection insurance?

Personal cyber protection insurance is a type of insurance policy that helps individuals cover financial losses due to cyber incidents, such as identity theft, data breaches, and cyber extortion.

Who is required to file personal cyber protection insurance?

Generally, individuals who have assets or financial interests that could be affected by cyber incidents may benefit from personal cyber protection insurance, but it is not mandatory for everyone.

How to fill out personal cyber protection insurance?

To fill out personal cyber protection insurance, applicants typically need to provide personal information, details about their digital assets, previous cyber incidents, and any precautionary measures they have taken to protect their data.

What is the purpose of personal cyber protection insurance?

The purpose of personal cyber protection insurance is to provide financial support and resources to individuals affected by cyber-related threats and to help them recover from losses associated with such incidents.

What information must be reported on personal cyber protection insurance?

Information that must be reported typically includes personal identification details, the extent of coverage desired, any prior claims, and personal risk factors related to cyber threats.

Fill out your personal cyber protection insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Cyber Protection Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.