Get the free Records Retention and Disposition Schedule MI-1

Show details

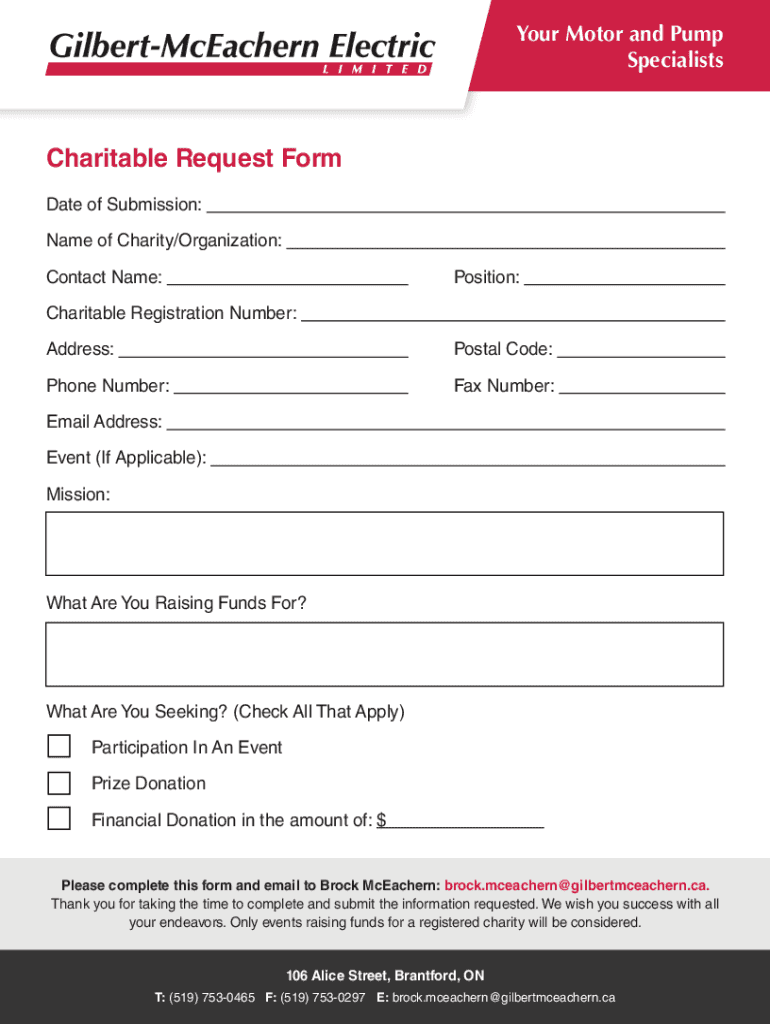

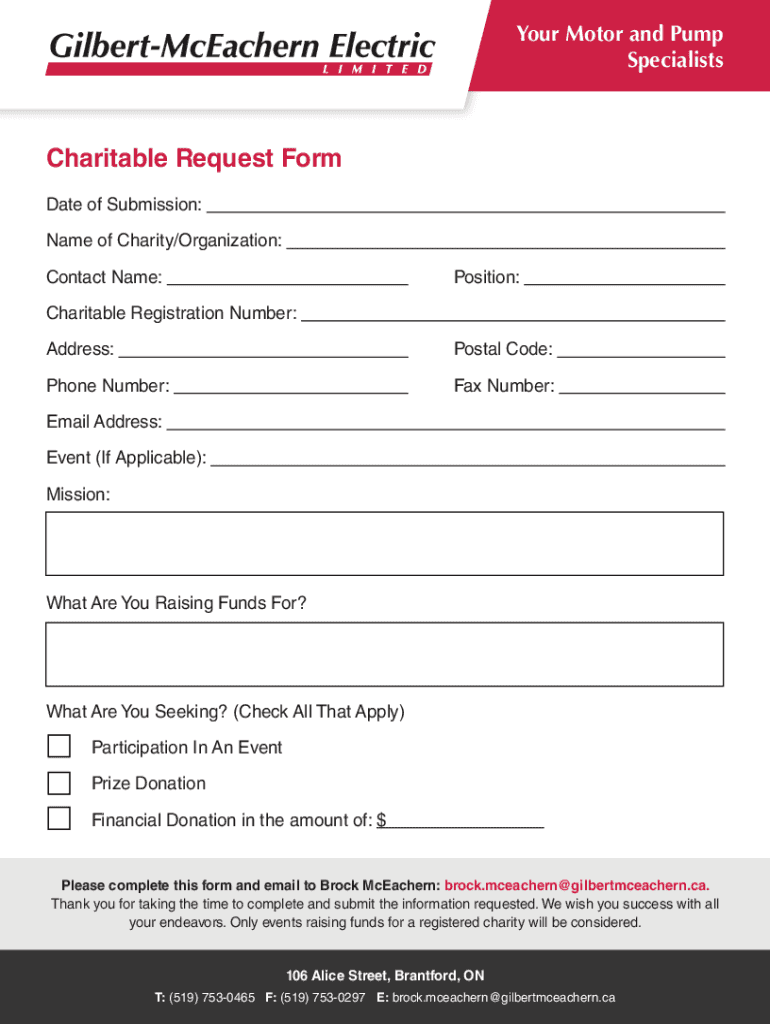

Your Motor and Pump SpecialistsCharitable Request Form Date of Submission:Name of Charity/Organization:Contact Name:Position:Charitable Registration Number:Address:Postal Code:Phone Number:Fax Number:Email

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign records retention and disposition

Edit your records retention and disposition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your records retention and disposition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit records retention and disposition online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit records retention and disposition. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out records retention and disposition

How to fill out records retention and disposition

01

To fill out records retention and disposition, follow the below steps:

02

Identify the types of records to be retained and disposed of.

03

Determine the appropriate retention periods for each type of record based on legal requirements, industry standards, and internal policies.

04

Create a comprehensive records retention schedule that lists each type of record along with its retention period.

05

Classify the records based on their level of sensitivity or confidentiality.

06

Establish a secure and organized storage system for the records, ensuring they are easily retrievable when needed.

07

Educate employees on the importance of proper records management and provide training on how to fill out the retention and disposition forms.

08

Develop a consistent process for regularly reviewing and updating the records retention and disposition schedule.

09

Monitor and enforce compliance with the retention and disposition policies and procedures.

10

Periodically review and dispose of records that have reached their designated retention periods in a secure and legally compliant manner.

11

Keep detailed documentation of the records retention and disposition process for auditing purposes.

Who needs records retention and disposition?

01

Any organization that generates and maintains records, regardless of its size or industry, needs records retention and disposition.

02

Government agencies, healthcare facilities, financial institutions, legal firms, educational institutions, and businesses in various sectors all require an effective records management system.

03

Compliance with legal and regulatory requirements, minimizing legal risks, operational efficiency, cost reduction, and ensuring data privacy and security are among the reasons why any organization would need records retention and disposition.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send records retention and disposition for eSignature?

To distribute your records retention and disposition, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an eSignature for the records retention and disposition in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your records retention and disposition right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit records retention and disposition on an Android device?

With the pdfFiller Android app, you can edit, sign, and share records retention and disposition on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is records retention and disposition?

Records retention and disposition refers to the policies and practices that govern how long records should be kept and when they should be destroyed or archived.

Who is required to file records retention and disposition?

Organizations and entities that create, manage, and maintain records are typically required to file records retention and disposition policies, including businesses, government agencies, and non-profits.

How to fill out records retention and disposition?

To fill out records retention and disposition, identify the types of records, determine the retention period, and complete the applicable forms detailing the record categories and their respective disposition dates.

What is the purpose of records retention and disposition?

The purpose of records retention and disposition is to ensure compliance with legal and regulatory requirements, manage records efficiently, and reduce risks associated with retaining unnecessary records.

What information must be reported on records retention and disposition?

The information required typically includes the type of record, retention period, legal or regulatory justification for retention, and disposition instructions.

Fill out your records retention and disposition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Records Retention And Disposition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.