Get the free Limited Liability Company (LLC) - IRS tax forms

Show details

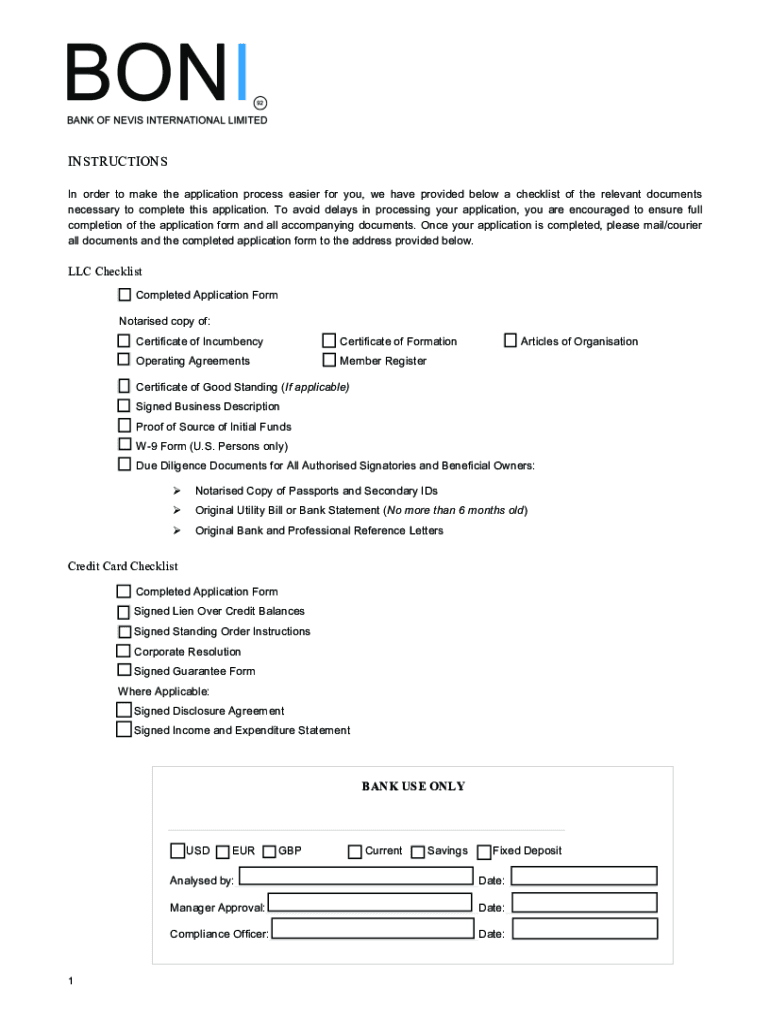

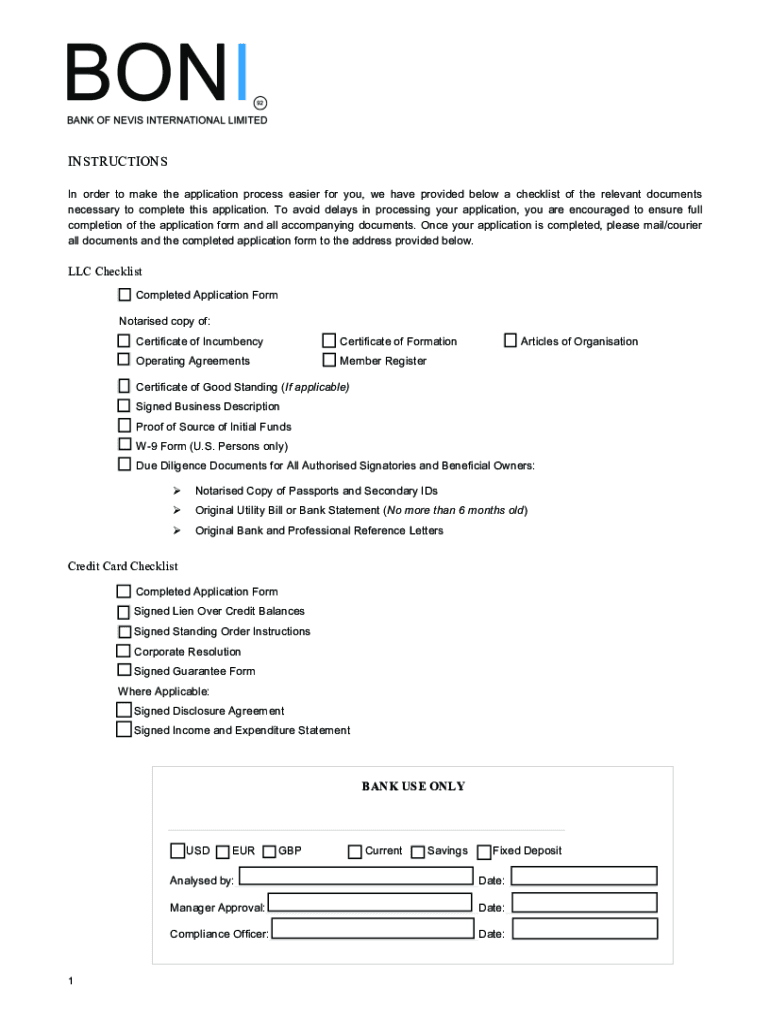

LLC ACCOUNT APPLICATION. O. Box 937, Nelson Spring St Thomas, Nevis, West. Indicate: 1869 469 0080/7770 Fax: 1869 469 5798info boiled .com www.boniltd.comINSTRUCTIONS In order to make the application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign limited liability company llc

Edit your limited liability company llc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your limited liability company llc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit limited liability company llc online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit limited liability company llc. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out limited liability company llc

How to fill out limited liability company llc

01

To fill out a limited liability company (LLC) form, follow these steps:

02

Research your state's requirements: Each state may have different requirements and forms for LLC registration. Make sure to gather information about the specific requirements and forms applicable in your state.

03

Choose a name for your LLC: Select a unique name that complies with your state's guidelines. Many states require the use of certain designators like 'LLC' or 'Limited Liability Company'.

04

File the Articles of Organization: Prepare and file the Articles of Organization form with the appropriate state agency. This form typically includes information such as the LLC's name, purpose, registered agent, and member details.

05

Draft an LLC operating agreement: Although not always required, it is highly recommended to have an LLC operating agreement. This document outlines how your LLC will be governed, including management structure, member responsibilities, and other important provisions.

06

Obtain necessary licenses and permits: Depending on your business activities, you may need to obtain specific licenses or permits at the state or local level. Research and apply for the required licenses and permits.

07

Apply for an Employer Identification Number (EIN): An EIN is issued by the IRS and is used for tax purposes. Most LLCs with more than one member are required to have an EIN. You can apply for an EIN online through the IRS website.

08

Register for state and local taxes: Determine your LLC's tax obligations and register for any necessary state and local taxes. This may include sales tax, employment tax, or other applicable taxes.

09

Comply with ongoing requirements: After forming your LLC, you will have ongoing obligations such as annual reports, tax filings, and maintaining proper records. Stay updated on these requirements and make sure to fulfill them in a timely manner.

Who needs limited liability company llc?

01

Limited Liability Company (LLC) is suitable for various individuals and businesses, including:

02

- Small businesses: LLCs provide liability protection to owners while offering flexibility in management and taxation.

03

- Real estate investors: LLCs are commonly used for property ownership to protect personal assets from potential liabilities.

04

- Professionals: Many professionals, such as doctors, lawyers, consultants, and freelancers, choose an LLC structure to protect personal assets and limit liability.

05

- Startups and entrepreneurs: LLCs can be a favorable option for startups and entrepreneurs due to their simplicity, liability protection, and potential tax advantages.

06

- Family businesses: LLCs enable families to operate businesses together while providing a clear structure for management and asset protection.

07

- Single-member businesses: Even individuals running a business on their own can benefit from the liability protection and flexibility offered by an LLC.

08

Ultimately, anyone who wants limited liability protection for their business or personal assets can consider forming an LLC.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my limited liability company llc directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your limited liability company llc and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in limited liability company llc?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your limited liability company llc to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for the limited liability company llc in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your limited liability company llc in minutes.

What is limited liability company llc?

A limited liability company (LLC) is a business structure that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.

Who is required to file limited liability company llc?

Anyone wishing to operate a business with limited liability protection may choose to form an LLC.

How to fill out limited liability company llc?

To form an LLC, you typically need to file articles of organization with the state and create an operating agreement.

What is the purpose of limited liability company llc?

The purpose of an LLC is to protect the personal assets of the owners from business debts and liabilities.

What information must be reported on limited liability company llc?

Information such as the LLC's name, address, registered agent, members or managers, and purpose must typically be reported.

Fill out your limited liability company llc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Limited Liability Company Llc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.