Get the free Single Individual Comprehensive Estate Plan

Show details

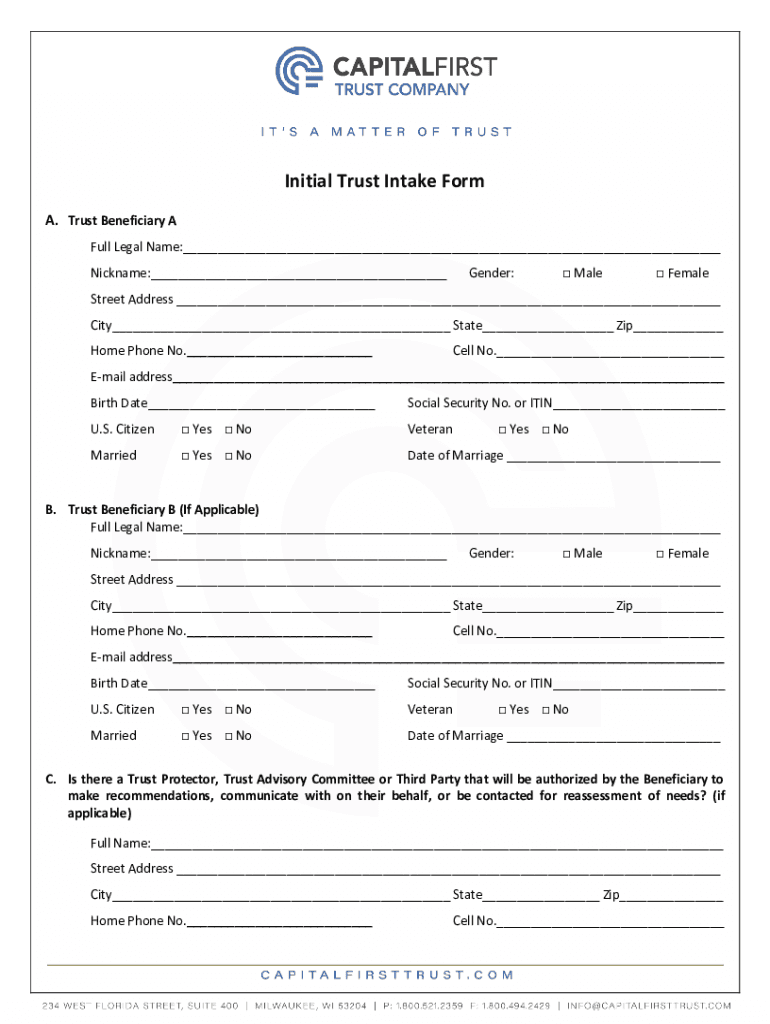

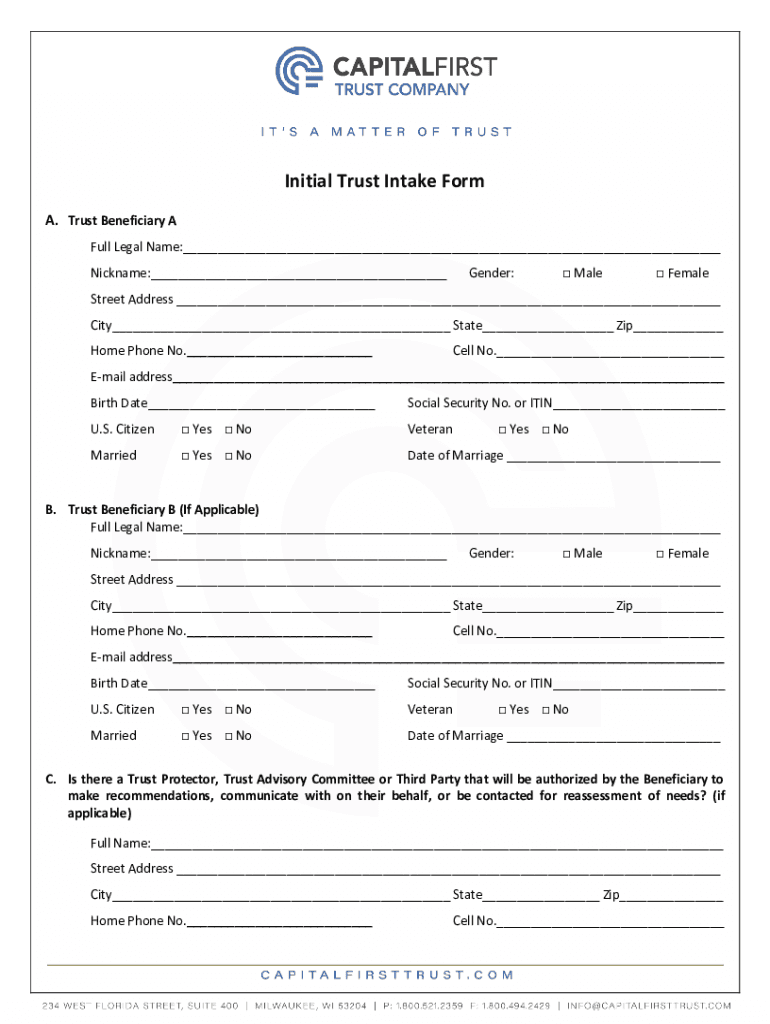

Initial Trust Intake Form A. Trust Beneficiary A Full Legal Name: Nickname: Gender: Male Beale Street Address City State Zip Home Phone No. Cell No. Email address Birth Date Social Security No. or

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign single individual comprehensive estate

Edit your single individual comprehensive estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your single individual comprehensive estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit single individual comprehensive estate online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit single individual comprehensive estate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out single individual comprehensive estate

How to fill out single individual comprehensive estate

01

Gather all necessary personal information about the individual whose estate you are filling out the form for, including their full legal name, date of birth, and Social Security number.

02

Determine the individual's assets, including real estate properties, bank accounts, investment accounts, vehicles, and personal belongings. Make sure to include information about the estimated value of each asset.

03

List any debts or liabilities that the individual had, such as mortgages, loans, credit card debts, or outstanding taxes.

04

Identify the individual's beneficiaries and include their contact information. This includes individuals who will inherit the assets mentioned earlier.

05

Provide information about the individual's preferred distribution of assets among the beneficiaries. This can include specific amounts or percentages for each beneficiary.

06

Make sure to include any additional wishes or instructions the individual may have regarding their estate, such as funeral arrangements or charitable donations.

07

Review the completed form carefully to ensure all information is accurate and complete.

08

Sign the form as the responsible party and make copies for your records and any involved parties.

09

Submit the completed form to the appropriate authority or attorney for further processing and legal validation.

Who needs single individual comprehensive estate?

01

Single individuals who have significant assets and want to ensure that their estate is properly distributed after their death.

02

Individuals who have specific preferences or wishes regarding the distribution of their assets.

03

Individuals who want to minimize conflicts or disputes among their potential beneficiaries and ensure a smooth transition of their estate.

04

Single individuals who want to have control over what happens to their estate and make sure that it goes to the right people or causes.

05

Individuals who want to minimize tax liabilities and maximize the value of their estate for their beneficiaries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit single individual comprehensive estate from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including single individual comprehensive estate, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send single individual comprehensive estate for eSignature?

Once your single individual comprehensive estate is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete single individual comprehensive estate online?

pdfFiller has made it simple to fill out and eSign single individual comprehensive estate. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

What is single individual comprehensive estate?

Single individual comprehensive estate is a detailed report of an individual's assets, liabilities, and net worth at a specific point in time.

Who is required to file single individual comprehensive estate?

Single individuals with significant assets and liabilities are required to file a single individual comprehensive estate.

How to fill out single individual comprehensive estate?

To fill out a single individual comprehensive estate, one must gather all financial information including assets, liabilities, and any relevant documentation.

What is the purpose of single individual comprehensive estate?

The purpose of a single individual comprehensive estate is to provide a clear snapshot of an individual's financial standing for assessment and planning purposes.

What information must be reported on single individual comprehensive estate?

On a single individual comprehensive estate, one must report assets such as property, investments, cash, and liabilities such as debts and mortgages.

Fill out your single individual comprehensive estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Single Individual Comprehensive Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.