MN CDS Medical Expense Flex & HRA Reimbursement Request Form 2019-2025 free printable template

Show details

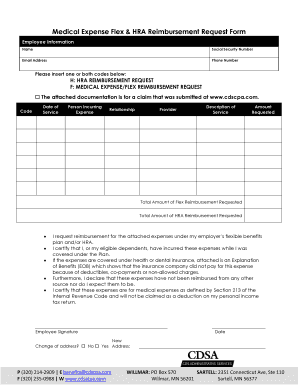

Medical Expense Flex & HRA Reimbursement Request Form

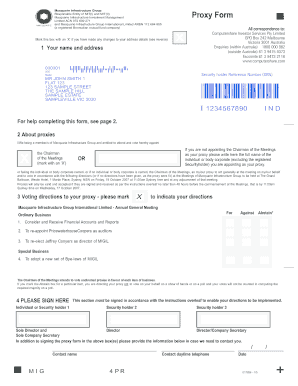

Employee Information

Asocial Security NumberEmail AddressPhone Numberless insert one or both codes below:H: HRA REIMBURSEMENT REQUEST

F: MEDICAL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN CDS Medical Expense Flex HRA

Edit your MN CDS Medical Expense Flex HRA form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN CDS Medical Expense Flex HRA form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MN CDS Medical Expense Flex HRA online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MN CDS Medical Expense Flex HRA. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN CDS Medical Expense Flex & HRA Reimbursement Request Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN CDS Medical Expense Flex HRA

How to fill out MN CDS Medical Expense Flex & HRA

01

Obtain the MN CDS Medical Expense Flex & HRA form from your employer or the benefits administrator.

02

Fill in your personal information, including your name, address, and employee ID.

03

Detail your medical expenses in the required sections, providing dates, descriptions, and amounts.

04

Attach any necessary receipts or documentation to support your claims.

05

Review your form for accuracy and completeness before submission.

06

Submit the completed form to the designated department or online portal as instructed.

Who needs MN CDS Medical Expense Flex & HRA?

01

Employees participating in employer-sponsored health plans.

02

Individuals with qualified medical expenses that are not covered by insurance.

03

Those looking to utilize pre-tax benefits for eligible medical expenses.

04

Employees interested in managing out-of-pocket healthcare costs efficiently.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if something is FSA eligible?

Check out IRS Publication 502 or our FSA eligibility list to understand what is covered. In order for something to be considered a “qualified" medical expense, it must be for the primary purpose of diagnosing, treating, curing, mitigating, or preventing a medical condition.

What does a flex card pay for?

Facts about Flexible Spending Accounts (FSA) You can use funds in your FSA to pay for certain medical and dental expenses for you, your spouse if you're married, and your dependents. You can spend FSA funds to pay deductibles and copayments, but not for insurance premiums.

Is a medical flexible spending account the same as a health savings account?

HSAs and FSAs both help you save for qualified medical expenses. HSAs may offer higher contribution limits and allow you to carry funds forward, but you're only eligible if you're enrolled in a HSA-eligible health plan. FSAs have lower contribution limits and generally you can't carry over funds.

Can I use my Flex card anywhere?

Where Can I Use the Flex Card? IRS regulations allow you to use your Flex Cards in participating local or mail-order pharmacies, discount stores, and supermarkets that can identify FSA/HRA-eligible items at checkout and accept benefit pre- paid cards.

Where can I use my Flex benefits card?

The card can be used at any qualified service provider that accepts MasterCard, and funds are automatically transferred from the benefit account directly to qualified providers. There are no out-of-pocket costs to you and no need to file a claim for reimbursement.

What is a flex expense?

In personal budgeting, a flexible expense is a non-essential expense that can be cut back or eliminated. Flexible expenses stand in contrast to fixed expenses, also known as inflexible expenses.

What kind of food can I buy with my Flex card?

No, you can't use your Flexible Spending Account (FSA) or Health Savings Account (HSA) for straight food purchases like meat, produce and dairy. But you can use them for some nutrition-related products and services. To review, tax-advantaged accounts have regulatory restrictions on eligible products and services.

Where can I use my Flex spending card?

For the most part, your FSA card should work where it makes sense: at locations like pharmacies, vision centers, doctor and dentist offices, and so on. But if you try to use your card at a restaurant or bike shop, even if that bike shop happens to sell FSA eligible bandages, chances are your card won't work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MN CDS Medical Expense Flex HRA?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific MN CDS Medical Expense Flex HRA and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out the MN CDS Medical Expense Flex HRA form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign MN CDS Medical Expense Flex HRA. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit MN CDS Medical Expense Flex HRA on an Android device?

With the pdfFiller Android app, you can edit, sign, and share MN CDS Medical Expense Flex HRA on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is MN CDS Medical Expense Flex & HRA?

MN CDS Medical Expense Flex & HRA is a state-specific health reimbursement arrangement that allows employees to use pre-tax dollars for qualified medical expenses, promoting healthcare affordability.

Who is required to file MN CDS Medical Expense Flex & HRA?

Individuals who participate in the MN CDS Medical Expense Flex & HRA program and wish to claim reimbursement for qualified medical expenses are required to file the form.

How to fill out MN CDS Medical Expense Flex & HRA?

To fill out the MN CDS Medical Expense Flex & HRA, you need to provide personal information, details of the medical expenses incurred, and any supporting documentation required by the program.

What is the purpose of MN CDS Medical Expense Flex & HRA?

The purpose of MN CDS Medical Expense Flex & HRA is to provide a tax-advantaged way for employees to pay for out-of-pocket medical expenses, thereby improving access to necessary healthcare services.

What information must be reported on MN CDS Medical Expense Flex & HRA?

The information that must be reported includes the participant's name, social security number, type of medical expenses, the amount claimed, and any accompanying receipts or documents to validate the claims.

Fill out your MN CDS Medical Expense Flex HRA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN CDS Medical Expense Flex HRA is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.