Get the free Deducting Cleaning and Repair Costs From a Security Deposit

Show details

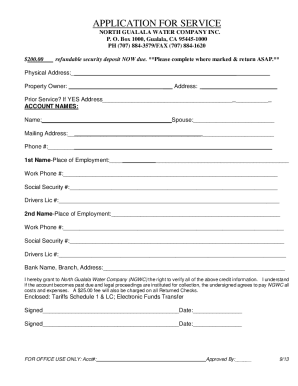

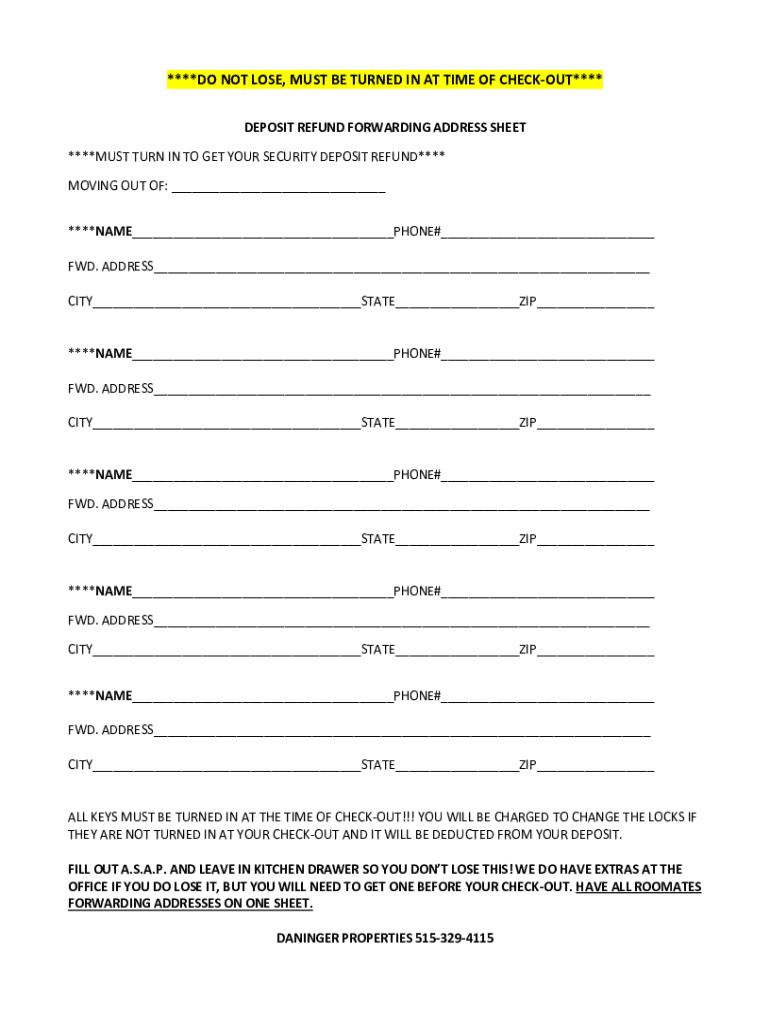

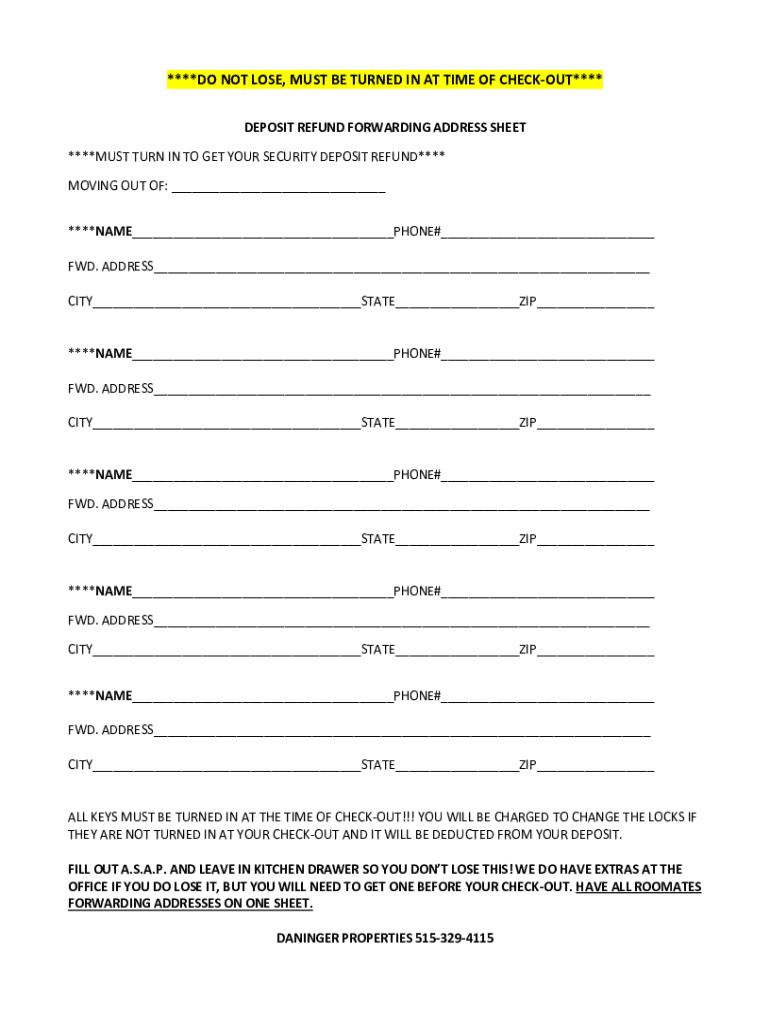

****DO NOT LOSE, MUST BE TURNED IN AT TIME OF CHECKOUT**** DEPOSIT REFUND FORWARDING ADDRESS SHEET ****MUST TURN IN TO GET YOUR SECURITY DEPOSIT REFUND**** MOVING OUT OF: ****NAME PHONE# FWD. ADDRESS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deducting cleaning and repair

Edit your deducting cleaning and repair form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deducting cleaning and repair form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deducting cleaning and repair online

Follow the steps below to take advantage of the professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit deducting cleaning and repair. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deducting cleaning and repair

How to fill out deducting cleaning and repair

01

Start by reviewing your lease agreement to understand the terms and conditions related to deducting cleaning and repair expenses.

02

Create a checklist of all the areas that require cleaning and repair, such as walls, floors, appliances, and fixtures.

03

Take photographs of the areas that need cleaning and repair as evidence before beginning the process.

04

Gather the necessary cleaning supplies and tools, such as brooms, mops, vacuum cleaners, and cleaning solutions.

05

Begin by cleaning the premises thoroughly, including dusting, sweeping, mopping, and scrubbing the surfaces.

06

Repair any damages found, such as broken windows, chipped paint, or damaged fixtures. You may need to hire professionals for some repairs.

07

Document all the cleaning and repair expenses, including receipts and invoices.

08

Communicate with your landlord or property management company to notify them about the completed cleaning and repair work.

09

Submit the documentation of expenses along with the evidence of the cleaning and repair work done.

10

Follow up with the landlord or property management company to ensure the deductions are acknowledged and processed accordingly.

Who needs deducting cleaning and repair?

01

Anyone who is renting a property and wishes to get their security deposit back.

02

Landlords or property management companies who want to deduct cleaning and repair expenses from the security deposit of a tenant who did not fulfill their contractual obligations regarding maintenance and cleanliness.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my deducting cleaning and repair directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your deducting cleaning and repair and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify deducting cleaning and repair without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including deducting cleaning and repair. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send deducting cleaning and repair to be eSigned by others?

When you're ready to share your deducting cleaning and repair, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

What is deducting cleaning and repair?

Deducting cleaning and repair refers to the process of deducting expenses related to cleaning and repairing from taxable income.

Who is required to file deducting cleaning and repair?

Individuals or businesses who have incurred expenses for cleaning and repairing property are required to file deducting cleaning and repair.

How to fill out deducting cleaning and repair?

To fill out deducting cleaning and repair, you need to gather documentation of the expenses, calculate the total amount, and report it accurately on the appropriate tax form.

What is the purpose of deducting cleaning and repair?

The purpose of deducting cleaning and repair is to reduce taxable income by deducting legitimate expenses incurred for maintaining and improving property.

What information must be reported on deducting cleaning and repair?

The information that must be reported on deducting cleaning and repair includes the total amount of expenses incurred for cleaning and repairing property.

Fill out your deducting cleaning and repair online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deducting Cleaning And Repair is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.