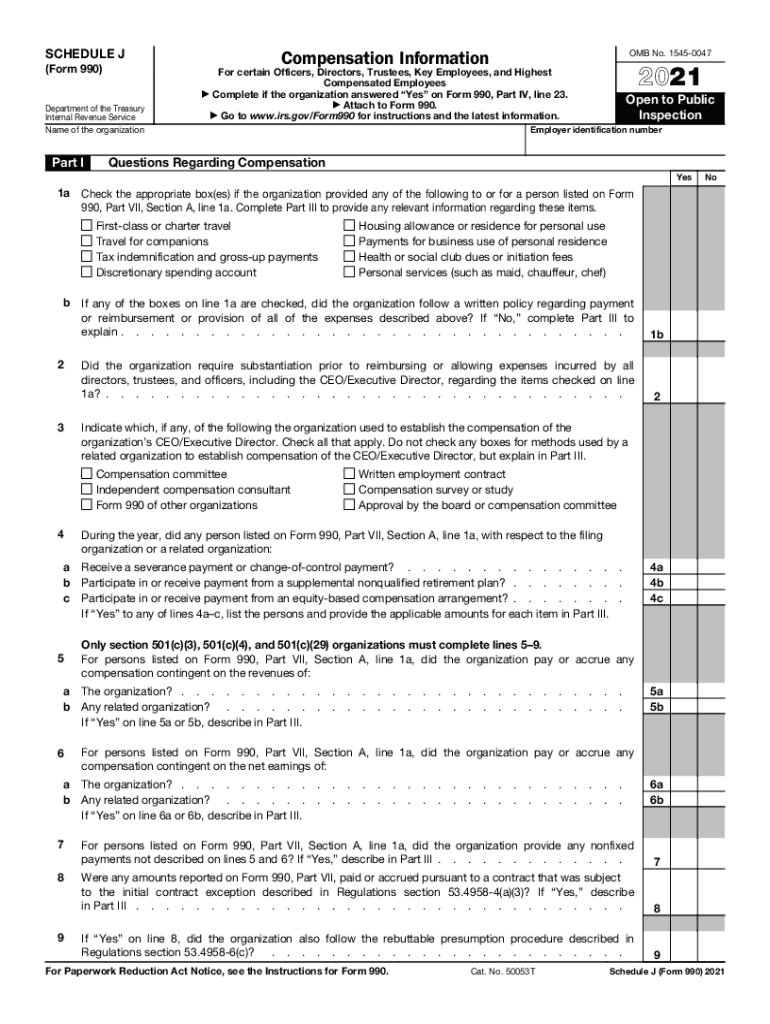

IRS 990 - Schedule J 2021 free printable template

Instructions and Help about IRS 990 - Schedule J

How to edit IRS 990 - Schedule J

How to fill out IRS 990 - Schedule J

About IRS 990 - Schedule J 2021 previous version

What is IRS 990 - Schedule J?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 990 - Schedule J

What should you do if you discover an error after filing the 990 schedule j?

If you find an error on your submitted 990 schedule j, you should file an amended form. This involves clearly marking it as an amended return and providing the corrected information. Make sure to address the specific errors to avoid further complications.

How can you verify the status of your 990 schedule j after submission?

To verify the status of your 990 schedule j, you can contact the IRS directly or use their online tools for tracking your submission. Be aware of common e-file rejection codes that may indicate issues.

What should you consider regarding data security when filing your 990 schedule j electronically?

When e-filing your 990 schedule j, ensure that you are using secure software that complies with IRS requirements. Additionally, maintain privacy by using encrypted connections and safeguarding any sensitive data during the filing process.

What common mistakes should be avoided when completing the 990 schedule j?

Common errors when completing the 990 schedule j include incorrect taxpayer identification numbers, mismatched financial figures, and failing to include necessary attachments. Double-check your entries to minimize these issues.

How should you respond if you receive an IRS notice regarding your 990 schedule j?

If you receive an IRS notice about your 990 schedule j, carefully review the content to understand the issue. Gather relevant documentation and respond promptly, providing any requested information to facilitate resolution.