Get the free OFFICE OF TAX APPEALS STATE OF CALIFORNIA EAST LA AUTO ...

Show details

DocuSign Envelope ID: 49BC96F7FCF046A7AF98148FB4AC98CFOFFICE OF TAX APPEALS

STATE OF CALIFORNIA

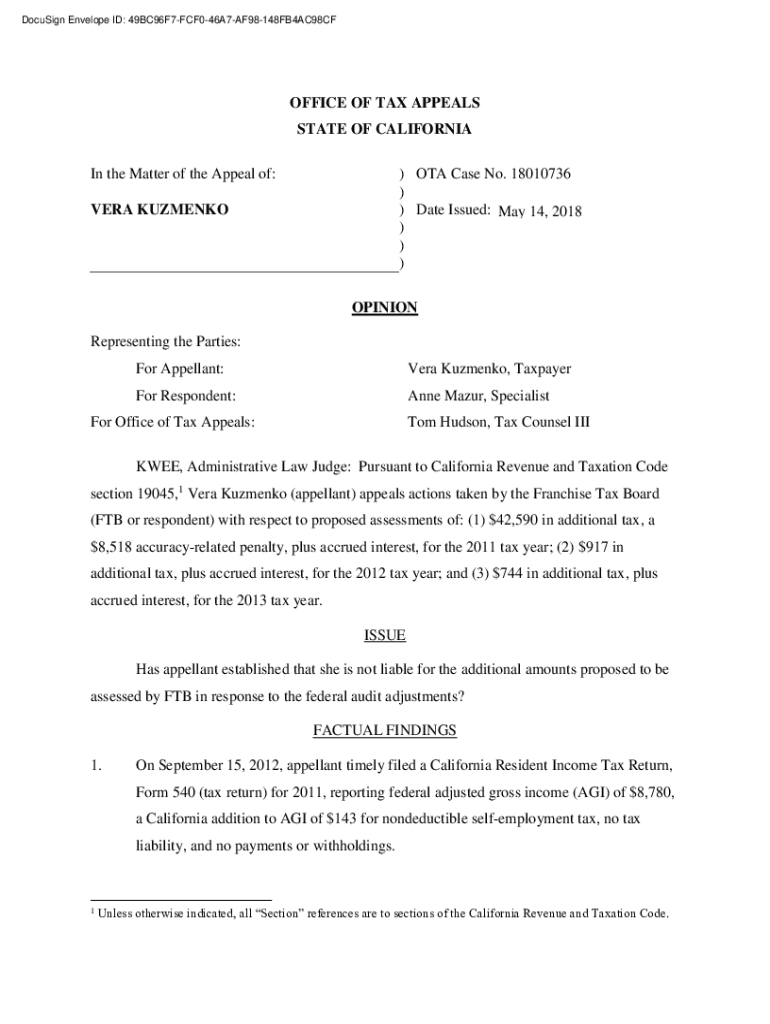

In the Matter of the Appeal of:) OTA Case No. 18010736)) Date Issued: May 14, 2018)))VERA KUZMENKOOPINION

Representing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign office of tax appeals

Edit your office of tax appeals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your office of tax appeals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing office of tax appeals online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit office of tax appeals. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out office of tax appeals

How to fill out office of tax appeals

01

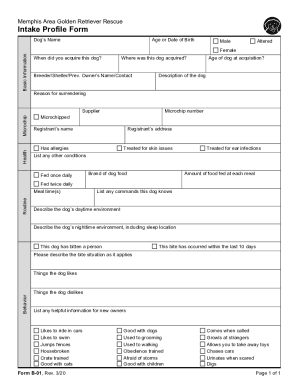

Gather all necessary tax and financial documents, including tax returns and supporting documents, relevant financial statements, and any other relevant paperwork.

02

Visit the website of the Office of Tax Appeals (OTA) and navigate to the appropriate forms section.

03

Download and print the required forms for filing an appeal with the OTA.

04

Carefully read and follow the instructions provided on the forms, ensuring all sections are completed accurately and all required information is included.

05

Include any supporting documentation or evidence that may strengthen your case, such as receipts, contracts, or financial records.

06

Compile all completed forms and supporting documents into a single package.

07

Make copies of all documents for your own records.

08

Submit the completed forms and supporting documents to the designated address provided on the OTA's website.

09

Keep track of the mailing date and any tracking or delivery confirmation information.

10

Wait for a response from the OTA regarding your appeal. It may take some time before a decision is reached.

11

If necessary, be prepared to provide additional information or attend hearings as requested by the OTA.

12

Follow any further instructions provided by the OTA and adhere to any deadlines or requirements given.

13

Await the final decision of the OTA and take appropriate action based on the outcome.

Who needs office of tax appeals?

01

Any individual or business entity that disagrees with a tax decision made by a California tax agency may need to file an appeal with the Office of Tax Appeals.

02

Taxpayers who have received a notice of action or determination from a California tax agency, such as the Franchise Tax Board or the California Department of Tax and Fee Administration, and wish to challenge the decision, may need to utilize the services of the Office of Tax Appeals.

03

Whether it's an individual taxpayer or a business entity, if there are disputes or disagreements related to tax matters in California, the Office of Tax Appeals provides a fair and impartial forum for resolution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get office of tax appeals?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific office of tax appeals and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my office of tax appeals in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your office of tax appeals right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit office of tax appeals straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing office of tax appeals, you need to install and log in to the app.

What is office of tax appeals?

The Office of Tax Appeals is an independent agency responsible for reviewing appeals of tax decisions made by the California Franchise Tax Board and the California Department of Tax and Fee Administration.

Who is required to file office of tax appeals?

Taxpayers who wish to appeal a decision made by the California Franchise Tax Board or the California Department of Tax and Fee Administration are required to file with the Office of Tax Appeals.

How to fill out office of tax appeals?

Taxpayers can fill out the necessary forms and submit their appeal online through the Office of Tax Appeals website, or by mail.

What is the purpose of office of tax appeals?

The purpose of the Office of Tax Appeals is to provide taxpayers with an impartial and efficient forum for resolving tax disputes.

What information must be reported on office of tax appeals?

Taxpayers must provide detailed information about the tax decision being appealed, as well as any supporting documentation.

Fill out your office of tax appeals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Office Of Tax Appeals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.