Get the free Could you Borrow Against an IRA? Preciselywhat Are Your ...

Show details

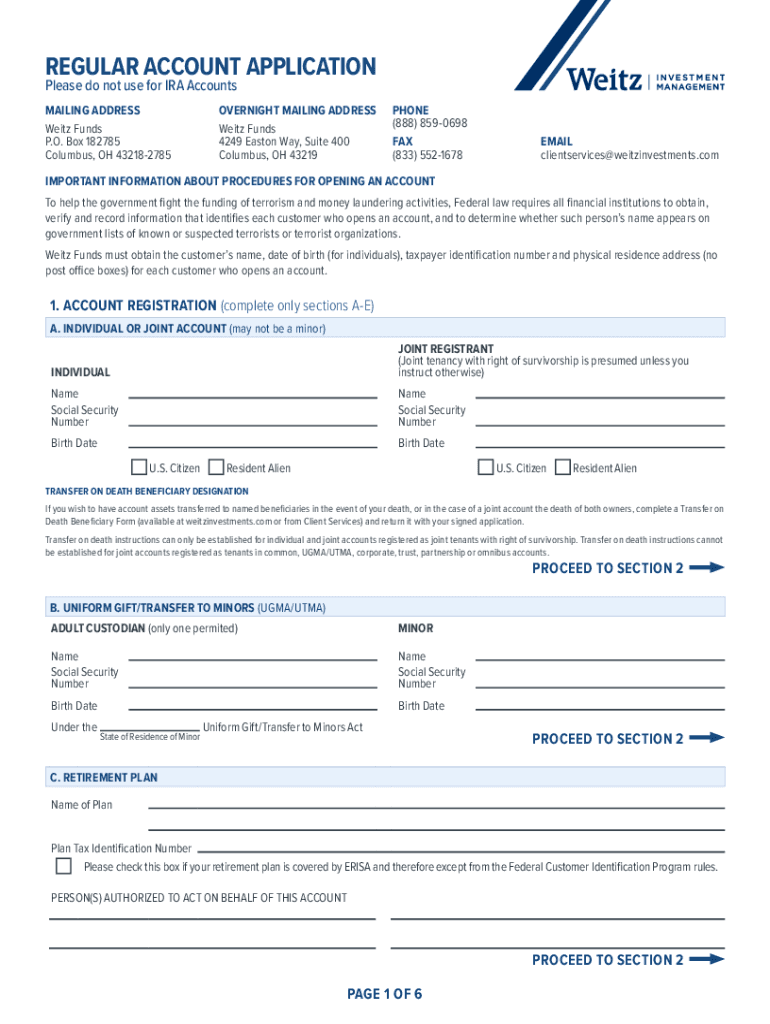

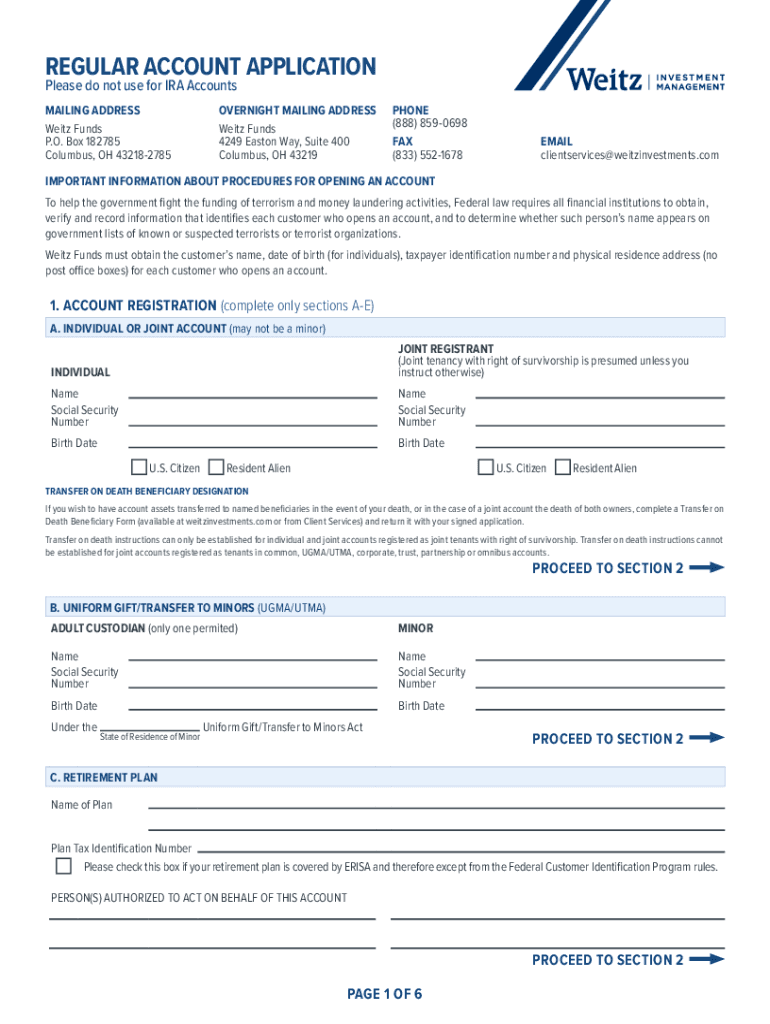

REGULAR ACCOUNT APPLICATION Please do not use for IRA Accounts MAILING ADDRESS Watt Funds P.O. Box 182785 Columbus, OH 432182785OVERNIGHT MAILING ADDRESS Watt Funds 4249 Easton Way, Suite 400 Columbus,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign could you borrow against

Edit your could you borrow against form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your could you borrow against form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit could you borrow against online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit could you borrow against. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out could you borrow against

How to fill out could you borrow against

01

To fill out a 'could you borrow against' form, follow these steps:

02

Start by gathering all the required information such as your personal details, income details, employment details, and current financial situation.

03

Understand the purpose of borrowing against something and the potential risks and benefits associated with it.

04

Research different financial institutions or lenders that offer borrowing options against various assets such as property, vehicles, or investments.

05

Compare the borrowing terms, interest rates, and eligibility criteria of different lenders to find the most suitable option for your needs.

06

Once you have chosen a lender, visit their website or physical branch to obtain the 'could you borrow against' form.

07

Read the form carefully and ensure you understand all the terms and conditions mentioned in it.

08

Provide accurate and truthful information in the form, ensuring all the required fields are filled correctly.

09

Attach any supporting documents or proofs required by the lender to verify your eligibility for borrowing against the asset.

10

Double-check all the information provided in the form before submitting it to the lender.

11

Submit the form along with any necessary fees or charges as mentioned by the lender.

12

Wait for the lender to review your application and communicate their decision to you.

13

If approved, carefully review the loan agreement and ensure you understand all the obligations and repayment terms outlined in it.

14

If satisfied with the terms, sign the agreement and complete any additional formalities required by the lender.

15

Upon completion, the borrowed funds will be disbursed to you as per the agreed terms.

16

Ensure timely repayment of the borrowed amount to avoid any penalties or negative impacts on your credit score.

Who needs could you borrow against?

01

Anyone who requires immediate funds and owns valuable assets that can be used as collateral may consider borrowing against them.

02

Some potential scenarios where borrowing against could be beneficial include:

03

- Individuals who need to cover unexpected expenses, such as medical bills or home repairs.

04

- Entrepreneurs looking for capital to start a business or expand their existing one.

05

- Homeowners who wish to undertake renovation projects to increase the value of their property.

06

- People seeking to consolidate their debts and obtain a lower interest rate.

07

- Individuals facing financial emergencies or temporary cash flow issues.

08

It's important to note that borrowing against an asset comes with risks, and the decision should be made after careful consideration of one's financial situation and ability to repay the loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my could you borrow against directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your could you borrow against as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I edit could you borrow against from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your could you borrow against into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit could you borrow against straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing could you borrow against.

What is could you borrow against?

You could borrow against your assets such as your home, car, or savings.

Who is required to file could you borrow against?

Individuals who are in need of a loan or seeking financial assistance may file for borrowing against their assets.

How to fill out could you borrow against?

To fill out a borrowing against your assets, you need to provide information about the asset you want to borrow against, the amount you wish to borrow, and your financial situation.

What is the purpose of could you borrow against?

The purpose of borrowing against your assets is to access funds or financial assistance when needed without selling the asset.

What information must be reported on could you borrow against?

You must report details about the asset you are borrowing against, the loan amount, and your financial status.

Fill out your could you borrow against online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Could You Borrow Against is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.