Get the free Claim for Reassessment Exclusion for ... - lakecountyca.gov

Show details

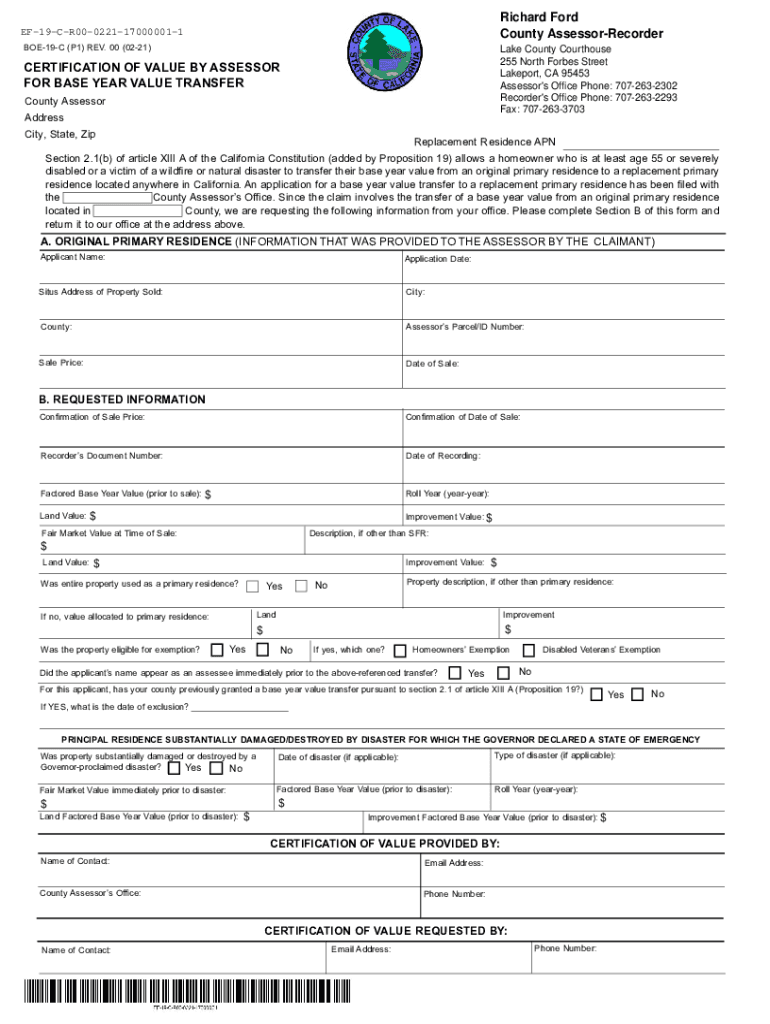

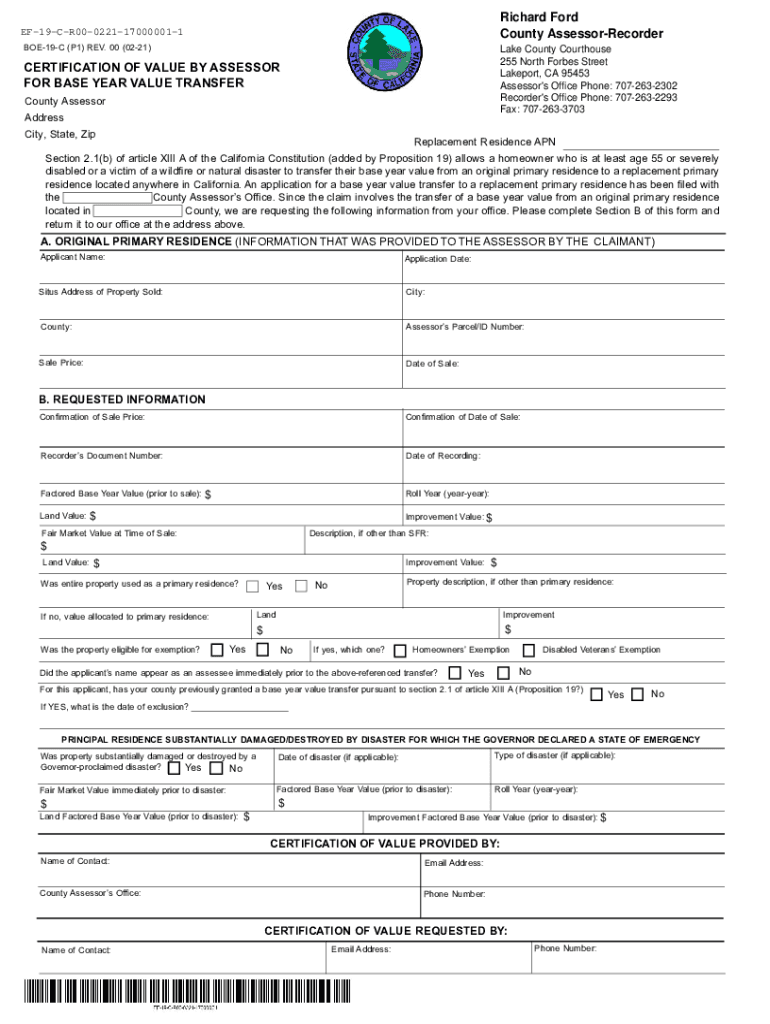

Richard Ford County AssessorRecorderEF19CR000221170000011 BOE19C (P1) REV. 00 (0221)Lake County Courthouse 255 North Forbes Street Lake port, CA 95453 Assessor\'s Office Phone: 7072632302 Recorder\'s

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for reassessment exclusion

Edit your claim for reassessment exclusion form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for reassessment exclusion form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for reassessment exclusion online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit claim for reassessment exclusion. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for reassessment exclusion

How to fill out claim for reassessment exclusion

01

To fill out a claim for reassessment exclusion, follow these steps:

02

Obtain the claim form from the relevant tax authority or download it from their website.

03

Read the instructions carefully to understand the eligibility criteria and required documentation.

04

Provide your personal information, including your name, address, and contact details.

05

Clearly state the reason for requesting reassessment exclusion.

06

Attach any supporting documents or evidence to strengthen your claim.

07

Double-check the completed form for accuracy and completeness.

08

Submit the claim form along with the required documents to the designated tax office.

09

Keep a copy of the submitted claim for your records.

10

Follow up with the tax authority if necessary to ensure the progress of your claim.

11

Await the decision on your reassessment exclusion claim and respond accordingly.

12

Remember to consult with a tax advisor or seek professional assistance if you have any doubts or complex tax situations.

Who needs claim for reassessment exclusion?

01

A claim for reassessment exclusion is needed by individuals or businesses who believe they should be exempted from a tax reassessment.

02

This may include individuals who have valid reasons, such as substantial changes in circumstances or new evidence that can influence their tax assessment.

03

Businesses might also need to submit this claim if they have undergone mergers, acquisitions, or other significant events that could impact their tax liability.

04

It is essential to review the specific eligibility criteria set by the tax authority to determine if a reassessment exclusion claim is necessary for your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify claim for reassessment exclusion without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your claim for reassessment exclusion into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit claim for reassessment exclusion in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing claim for reassessment exclusion and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for the claim for reassessment exclusion in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your claim for reassessment exclusion in minutes.

What is claim for reassessment exclusion?

A claim for reassessment exclusion is a request made by a property owner to exclude certain improvements from reassessment for property tax purposes.

Who is required to file claim for reassessment exclusion?

Property owners who have made specific improvements to their property may be required to file a claim for reassessment exclusion.

How to fill out claim for reassessment exclusion?

To fill out a claim for reassessment exclusion, property owners must provide detailed information about the improvements made to the property and submit the claim to the appropriate tax authority.

What is the purpose of claim for reassessment exclusion?

The purpose of a claim for reassessment exclusion is to potentially lower the property tax burden on the owner by excluding certain improvements from reassessment.

What information must be reported on claim for reassessment exclusion?

Property owners must report detailed information about the improvements made to the property, including the cost of the improvements and the date they were completed.

Fill out your claim for reassessment exclusion online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Reassessment Exclusion is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.